Mar 19 , 2022

By Abdulmenan M. Hamza

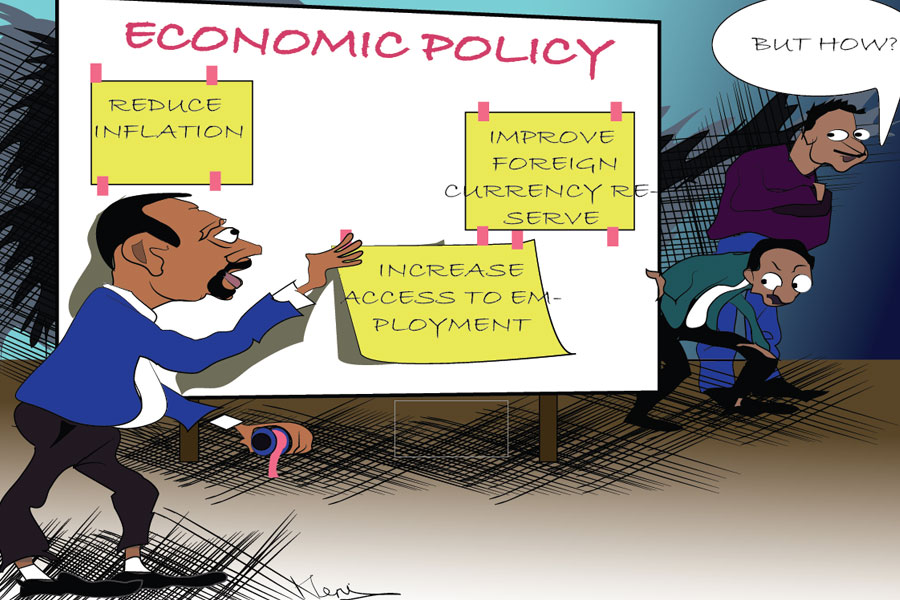

The ruling party's defining economic tenets are implementation of some of the Homegrown elements, selective interventions, ad hoc interventions, vanity projects and office renovations. They have been a muddle that created an economic calamity, writes Abdulmenan Mohemmed (abham2010@yahoo.co.uk), a financial analyst with two decades of experience.

For any curious observer of Ethiopia's economy, there has not been any time as the past few years during which the ruling party's economic policies have been in a muddle. The policy chaos has been caused by an effort to distance from the predecessors' policies, the sluggish progress of its reform agenda, and the inclusion of novel elements during the implementation.

The most notable reform package is Homegrown Economic Reform Plan. The Homegrown plan, although its content is not homegrown as claimed, is aimed at addressing the imbalances caused by the economic policies of the previous decade and bridging the private sector to the front seat of the economy. But the past few years’ experiences have shown that not only the implementation has been in disarray, but new factors have also been added.

Besides implementing some of the Homegrown package elements, selective interventions (for instance, the support provided to bread and cooking oil manufacturing), ad hoc interventions by supplying consumers goods, vanity projects and office renovations have become the defining characteristics of the policy sphere.

When the impacts of COVID-19, political instability and the conflict in the north have been added to the economic policy disorientation, the country found itself in a mess unobserved in decades: violent inflation, severe foreign exchange shortages, a slowdown in economic growth, increasing poverty, debt build-up and economic uncertainties.

The economic policy muddle has continued in the face of such worsening economic realities. The ruling party has come up with the basic outlines of its economic policies, among others, ahead of its first party congress. Its economic direction focuses on economic justice, the poor and intervention.

From the brief outline released recently, it is difficult to discern aim from policies. Keeping aside this confusion, it is vital to discuss interventionist policies, why they have failed before and the lessons to be taken.

Interventionist policies are not innovations of the Prosperity Party. The EPRDF used a range of interventionist policies under the auspice of developmentalism. The interventions range from cheap credit and tax privileges to direct investment. The direct investments include chemical plants, sugar projects and retail. Strikingly, there was a time when for every market woe, direct investments were prescribed.

The EPRDF reasoned the economic interventions on the grounds of market failures. This means there are investment areas that cannot be addressed by the working of markets as the private returns are less than the social returns, warranting state intervention.

If the rationale of interventionism sounds plausible, its implementation track record has been fraught with failures, proving the classic government foundering. And the costs of the losses have been enormous: from Ale Bejimla to sugar projects, from the Metals & Engineering Corporation (MetEC) to fertiliser plants, from the enormous bad loans of the Development Bank of Ethiopia (DBE) to the enormous guaranteed loans of the Commercial Bank of Ethiopia (CBE). The list goes on.

At the heart of interventionism failures, we find mainly two culprits. Firstly, lack of clarity about where, how, and how much to intervene. Secondly, absence of autonomous, capable, and effective state economic apparatus to implement the interventionist policies.

Despite not having addressed these problems, the prevailing ruling party went ahead with interventionism. Strikingly, apart from a few reforms, the whole body of interventionist policies, which should be rectified, is still in place.

Of course, any government intervenes in the economy in one or another form. It can be through regulation, influencing pricing and resource allocation mechanisms, and direct investment.

Now, the government, on the one hand, is charged with regulatory tasks. The past few years have shown that the government has failed in its regulatory roles (good examples are on cement and cooking oil). On the other hand, it extensively intervenes in the economy and will continue to do as such.

There are good track records of interventionist economies, particularly in East Asia. Their defining characteristics are autonomy, a capable state apparatus, particularly in the economic sphere, and market-friendly policies.

To carry on the extensive interventionist policies in a context where the state and party apparatus are mingled and priority to loyalty over merit and professionalism is a recipe for failure, as witnessed before. This entails a complete overhaul of the state apparatus to set boundaries between party, state, and markets. This should be complemented by a policy that clearly outlines where, how and to what extent to intervene. The policy should keep the costs and distortionary nature of the interventions at a minimum, set strong monitoring and evaluation mechanisms and provide an exit strategy.

PUBLISHED ON

Mar 19,2022 [ VOL

22 , NO

1142]

Fortune News | Sep 23,2023

Fortune News | Nov 09,2024

Fortune News | Feb 09,2019

My Opinion | Feb 23,2019

Editorial | Jan 26,2019

Fortune News | Oct 30,2021

Viewpoints | Dec 04,2020

Commentaries | Apr 13, 2025

Fortune News | Nov 18,2023

My Opinion | 131674 Views | Aug 14,2021

My Opinion | 128041 Views | Aug 21,2021

My Opinion | 126002 Views | Sep 10,2021

My Opinion | 123625 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...