Radar | Dec 17,2022

Feb 4 , 2023

By Carolyn Kissane

Inspired by the stories of business people who started small, I have been on the quest to decode the custom-made recipe of wealth for the past few weeks. These entrepreneurs had very small businesses that bloomed and blossomed into empires, and I was curious to learn how.

Businesses that did not show any progress over the years; the people running them also have not changed much. On the contrary, there are individuals who started with scantly anything and are now at the top. I found such interviews inspiring and motivating. The difference between successful and less progressive business people is the created self-doubt, that there must be something these people are not telling.

I started asking the modern guru, a.k.a. the internet, and what appeared on my search result repeatedly was saving early to have more money for compound growth. Saving late is difficult, especially for someone with no financial discipline. I agree starting early is a golden idea lest the worry about rent and food that parents provide. By adulthood, at least there will be a decent amount of money saved up to start a business.

As beautiful as it sounds, saving does not always come easy. With the declining value of money and losing its purchasing power, the idea is not wise to entertain. For the majority, saving is not even practical. Besides limiting the desire to get expensive groceries, clothing and household items, one has to watch the transport costs and even skip meals.

Leading a low-key life in order to save a substantial amount could take a decade, and by the time the target figure is reached, inflation has picked up, and what was once affordable is not within reach anymore. A few years ago, a million Birr could buy a house. Now it cannot even buy cars on the lower curve of the market price. Although I am grateful to live in the era of technology and accessibility, I often envy older people who say they usually bought a quintal of Teff or a gallon of butter for 30 cents. The price of bread has hiked up from 50 cents to six Birr in my lifetime.

On the contrary, I wonder how regulars at the raw meat eateries and bars with sharp dressing pull it off. It amazes me how extravagant people are while others are trying to keep their heads above water. In an ideal world, if resources are shared, and people care about each other, everyone would enjoy a decent and stress-free life. Not everyone can be rich, as there must be a group of people below the mark serving others. Yes, there is a possibility of passing before enjoying the fruits of saving. But I do not believe the solution is to be spendthrift.

Investing in an asset seems like a great idea for someone with capital or seed money. In cases with no capital, borrowing from an individual or institution willing to lend is another choice. Some people would rather wait for a monthly paycheck as it requires no risk. Yes, starting a business is risky. There is a chance it might fail, but it would pass as a lesson learned for the next great idea that may lead to financial freedom.

Many motivational speakers affirm by visualization or manifestation. There are stories of some of the greatest people in history and how they used this technique to change their dreams into reality. It might work for some, but I cannot visualise sleeping in a yacht when I am cold and hungry, lying on a small excuse of a bed. Our thoughts have power, and we become what we often think of. But it takes character and determination to start from scratch and become wealthy; not everyone is equipped with those traits.

Dreams come true, but it takes time, dedication, hard work and also luck. Whenever hearing big shots about how they made it, do not immediately buy it. Rather swallow it with a pinch of salt, as there is more to the story than meets the eye. It may not necessarily be anything shady but the general ups and downs and untold stories.

PUBLISHED ON

Feb 04,2023 [ VOL

23 , NO

1188]

Radar | Dec 17,2022

Sunday with Eden | Mar 16,2024

Featured | Jan 05,2020

Editorial | Dec 19,2020

Commentaries | Aug 17,2019

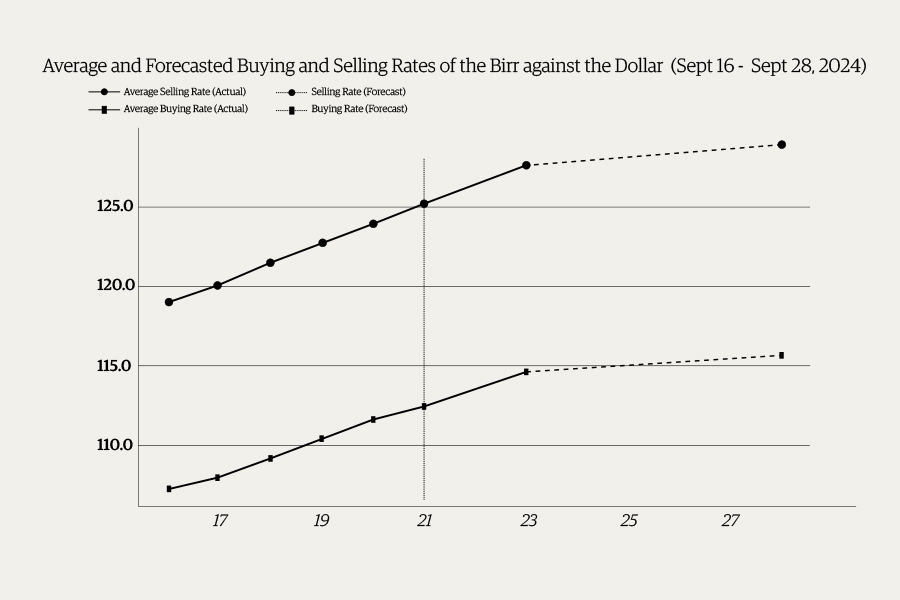

Money Market Watch | Sep 22,2024

Life Matters | May 14,2022

View From Arada | Jun 07,2025

View From Arada | Apr 25,2020

Radar | Mar 11,2024

My Opinion | 131584 Views | Aug 14,2021

My Opinion | 127940 Views | Aug 21,2021

My Opinion | 125915 Views | Sep 10,2021

My Opinion | 123539 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...