Commentaries | Nov 02,2024

May 27 , 2023

By Kidist Yidnekachew

I was standing next to a lady at one of our neighbourhood shops. She was arguing with a shopkeeper to get credit, saying she had been a regular customer for years.

They kept going back and forth, and he decided to give her credit no longer unless she settled her previous debt. I was surprised by her entitlement.

The lady recalled the time she had spent close to 4000 Br and paid for it through mobile banking. She tried to reason that she had a good credit score through the years and was running late with her monthly payment.

She promised to close her account completely in a few days, but it had not been a few days yet. However, the shopkeeper remained firm on his decision. He did not have enough money at hand to restock, as he had given credit to others.

She was furious and threatened to take her spending elsewhere. She claimed other shops nearby have given her and people she knows more credit, pointing out that a business without a customer is nothing.

It got me wondering if it gives customers the right to demand credit. I debated with myself whether the shopkeeper did the right thing by not giving the lady more credit. He could have given her the requested items, considering she had been paying her debts before. But at the same time, he was not obliged in any way to give her credit, even if it meant it would cost him his business.

As inflation hits hard and prices increase exponentially, it is becoming hard for many people to get from one paycheck to the next without taking loans.

The price of commodities doubles overnight, sometimes turning things that were once affordable into luxury items. But people struggle to let go of the items they consider basic, although it becomes inevitable at some point.

Giving out credit is trending in corporate service providers, with prominent corporates such as Ethiotelecom requiring customers to have a history of recharging their balance to be eligible for credit, while a small percent is returned as interest.

But shops do not work like that. The neighbourhood shops are places where people get credit without interest rates.

It all depends on the judgement.

I believe the slogan plastered at most shops that translates as "no credit today; come back tomorrow" should be redefined. The principle of giving credit should not be the problem but how it is done.

Providing credit to trustworthy customers with good scores is a smart move. The rule of thumb must be those eligible must be reliable and regular customers. This will help small businesses thrive and foster a sense of trust and reliability between customers and businesses.

Customers must pay their outstanding debt before asking for another credit. Their behaviour, in turn, shapes shop keeper’s credit-giving behaviour.

Failure to pay debts can significantly impact small businesses' financial stability and can even lead to their closure. It is crucial to understand the importance of fulfilling their financial obligations- prioritising financial responsibilities which support the growth of businesses and the sustainability of the economy.

PUBLISHED ON

May 27,2023 [ VOL

24 , NO

1204]

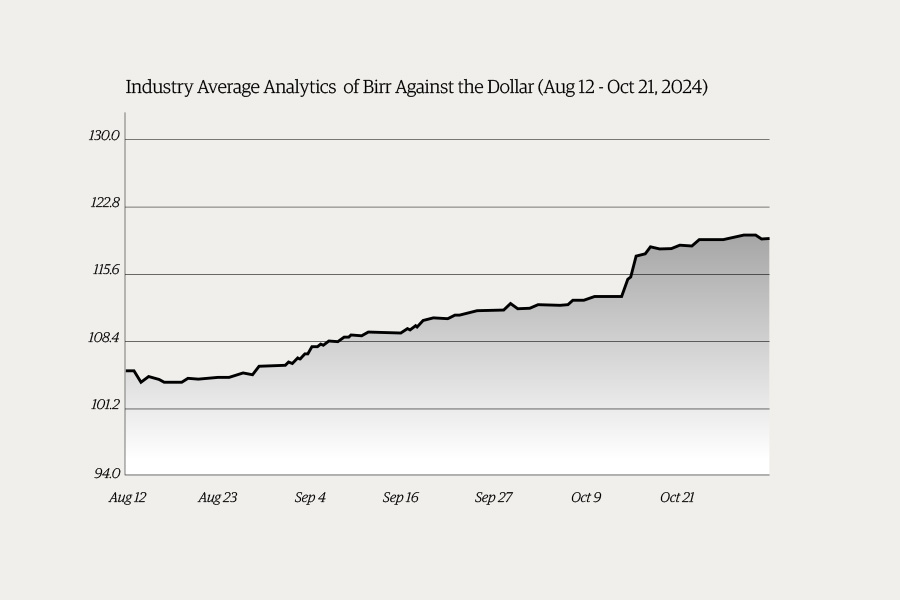

Money Market Watch | Nov 03,2024

Advertorials | Jun 05,2023

Fortune News | Jul 28,2024

Delicate Number | Jul 17,2022

Radar | May 31,2025

Photo Gallery | 178816 Views | May 06,2019

Photo Gallery | 169014 Views | Apr 26,2019

Photo Gallery | 159864 Views | Oct 06,2021

My Opinion | 137117 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...