Viewpoints | Nov 12,2022

Oct 5 , 2024

By Yehualashet Tamiru

For over two decades, Ethiopians have clung to an optimistic belief that tomorrow will bring better economic prospects. Yet the realisation of this hope seems farther down the road than many anticipated. As economist Ralph George Hawtrey aptly noted, returning to currency stability after inflation is a painful and laborious process, much like the headache that follows overindulgence.

While many are captivated by the recent currency unification, the policy is only one facet of a broader suite of macroeconomic reforms. The authorities devalued the currency after shifting from a pegged to a floating exchange-rate regime, a key demand by the International Monetary Fund (IMF) to secure much-needed loans. The economy is transitioning from a government-led to a market-driven one, seeking to depoliticise economic activities and reestablish a clear divide between politics and the marketplace. However, these reforms are expected to contract the market in the short term, forcing many enterprises out of business.

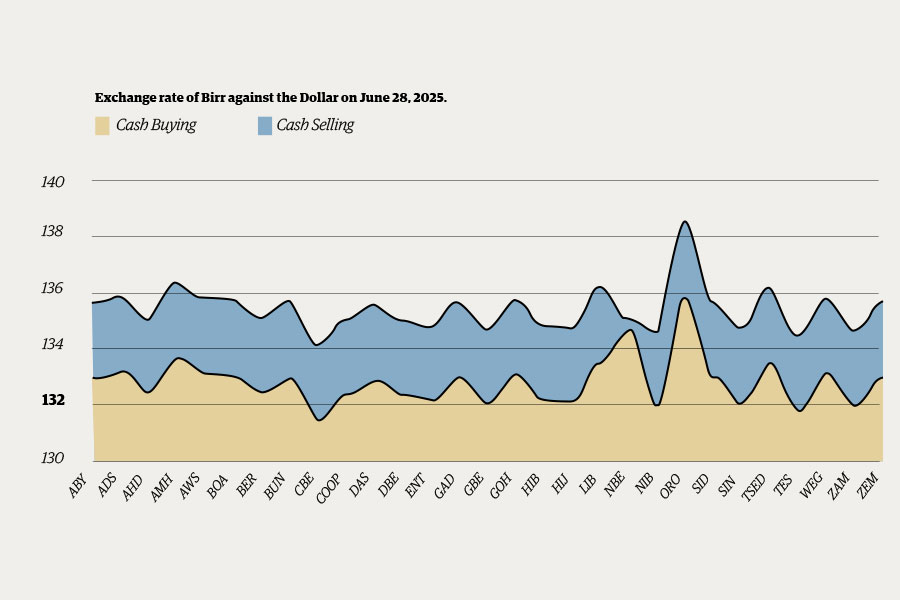

A pillar of this transformation is the devaluation of the Birr against the US Dollar. This increases the country's external debt burden, elevates domestic prices, and slows economic activities due to insufficient imports.

As part of the agreement with the IMF, the federal government committed to cutting its expenditure and enhancing domestic revenue, reducing its active role in the economy. The government is expanding the tax regime and increasing tax rates, effectively signalling to the public that fiscal resources are constrained. Though not labelled explicitly as such, austerity measures — budget cuts, privatisation, and wage repression — are being implemented across the economy.

Austerity employs two primary tools: fiscal and monetary policies.

Fiscal policy, in turn, has two aspects: expenditure and revenues. On the expenditure side, austerity involves cutting public funds, particularly budgets for social spending like education, infrastructure, and healthcare. Governments are urged to reduce welfare and social expenses, avoid price controls on primary goods, eliminate unemployment benefits, and cease other activities that increase public expenditures and interfere with the market. The main goal of these budget cuts is to redirect funds toward servicing debts held by national or international creditors.

On the revenue side, the government is enhancing taxation mechanisms. For instance, it has amended the Value Added Tax (VAT) law and is planning to introduce property and environmental levies. These measures target boosting government revenue in line with austerity's objective to "save more, consume less."

The second tool of austerity, often referred to as "dear money" policy, increases interest rates and reducing the money supply in circulation. The immediate impact of higher interest rates is that borrowing becomes more expensive for everyone, including the government. This affects public expenditure on essential sectors like education and healthcare. For individuals, increased interest rates mean higher loan costs, leading to consumption dropping as disposable incomes shrink.

Consider the real estate sector. Many Ethiopians bought homes through bank loans. As interest rates climb, their loan repayments increase, leaving less money for other expenditures. On the flip side, higher interest rates encourage people to save more, which can increase the purchasing power of money as cash becomes scarcer in the market.

These policies also have long-term implications. Expensive borrowing discourages investment, increasing unemployment rates as businesses scale back or shut down. As private and public investments decline, the economy contracts. Reduced investment can lead to a decline in imports, helping to correct the balance of payments. To prevent capital flight and encourage investment, the government may reduce corporate income taxes and offer incentives to surviving businesses, often larger enterprises capable of weathering the economic storm.

While austerity is not inherently detrimental, it frequently results in short-term hardships for the public and businesses when governments cut public benefits and seek to increase revenues.

Another major reform is adopting an interest-based monetary policy, where market forces rather than government mandates determine rates. As interest rates rise, traders are dissuaded from borrowing, reducing the money circulating in the economy and helping to respond to inflation. However, reduced expenditures also lead to a decline in production and a slowdown in economic growth.

Perhaps one of the most transformative changes is reintroducing a capital market. Ethiopia briefly had a share trading market during the imperial regime before it was abolished after the 1974 revolution and the rise of the Derg regime, which adopted a command economy. Establishing a capital market is expected to increase the use of debentures - a form of debt financing - in the private sector, providing new avenues for raising capital or investing excess liquidity.

Companies can finance themselves not only through equity, by issuing shares in exchange for contributions, but also through debt financing. Large companies with established reputations and resources can find new ways to finance their core businesses in this system. Conversely, small and medium enterprises may struggle due to a lack of means or insufficient creditworthiness to attract public investment. This could lead to SMEs disappearing or merging with larger companies.

Prime Minister Abiy Ahmed (PhD) addressed this issue directly when speaking to Parliament. He noted that most banks should merge to compete with incoming foreign banks as the financial sector opens up. He made his administration's position clear that it would not want to see domestic banks fail because of the new financial reforms. His suggestion implies a consolidation to perhaps five or six robust banks.

Similarly, SMEs should consider merging to survive this challenging period and remain competitive against established large enterprises.

PUBLISHED ON

Oct 05,2024 [ VOL

25 , NO

1275]

Viewpoints | Nov 12,2022

Fortune News | May 17,2025

Featured | Aug 24,2019

Commentaries | Jul 31,2021

Agenda | Sep 21,2025

Agenda | Sep 22,2024

Editorial | Jul 20,2024

Life Matters | May 27,2023

Money Market Watch | Jun 29,2025

Featured | Jan 15,2022

Photo Gallery | 177565 Views | May 06,2019

Photo Gallery | 167772 Views | Apr 26,2019

Photo Gallery | 158440 Views | Oct 06,2021

My Opinion | 136988 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...