Fortune News | May 08,2021

Oct 30 , 2021.

Central banks are prone to conspiracy theories. It should be no surprise, for they are notorious for secrecy. The complexity of monetary policymaking makes decisions made incomprehensible for the general public. The latitude central bankers enjoy to keep these processes discretionary makes their work highly sceptical in the eyes of the market. This is the case even in developed economies with mature democracies.

The peculiarity of the National Bank of Ethiopia (NBE) is even more remarkable. Recently, it has been on steroids. Bouncing from one policy direction to another for the past few years, it has been confusing economic actors who are more disoriented by the COVID-19 pandemic and the ongoing civil war. If monetary policy tools and effective use of communications are central banks' forte, the NBE`s scorecard should be the most embarrassing.

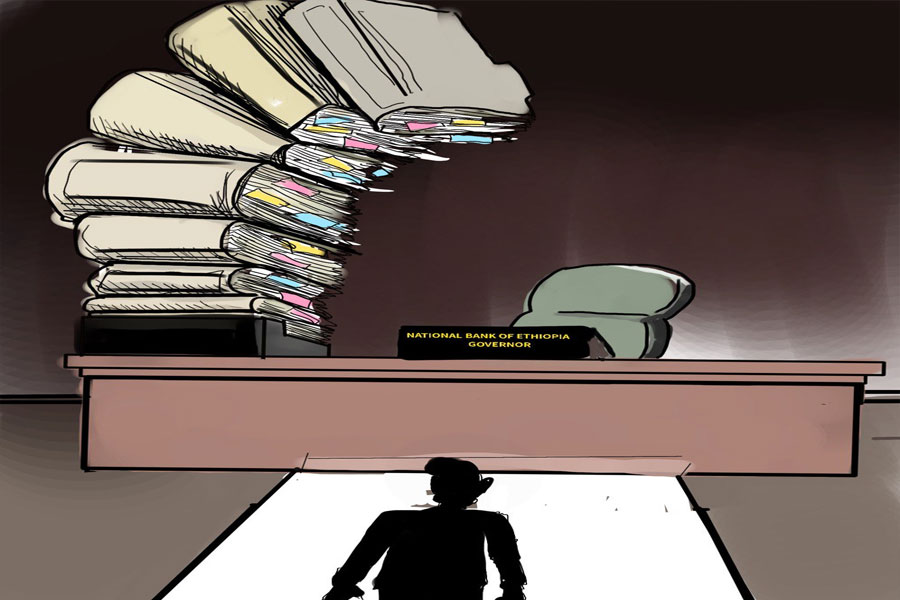

When was the last time the Governor, Yinager Dessie (PhD), made a public statement on any subject of importance to the economy?

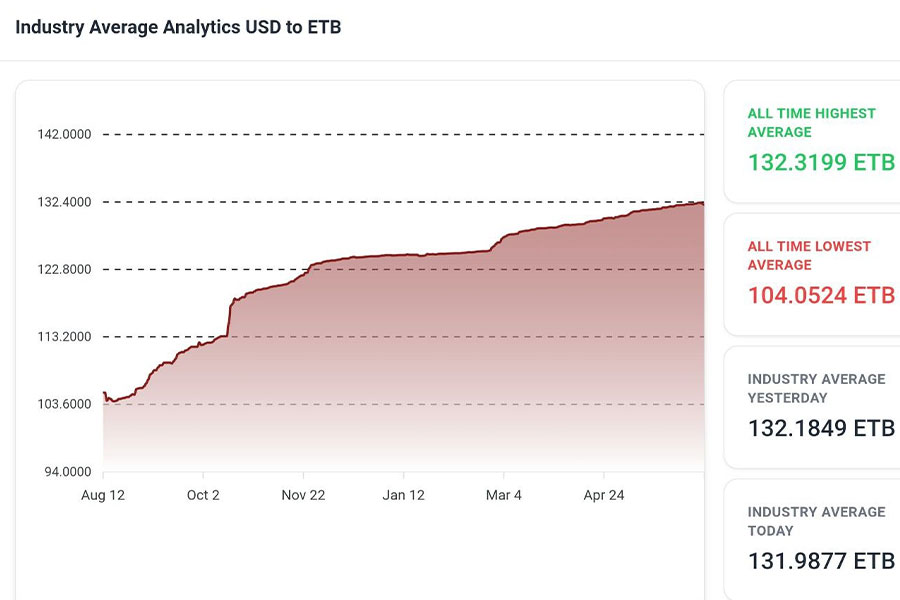

Confirmed as a governor in June 2018, a few months after Abiy Ahmed took the helm of government, Yinager hardly speaks in public whether rain or storm hitting the economy. He may appear visible attending occasional inaugural events; however, he has not addressed the public since his last question time since April 2021. The economy remains besieged by galloping inflation, massive loss of productivity due to the war, erosions of the exchange rate, and a high risk of external debt default.

Governor Yinager has an impressive academic background, having studied economics in Ethiopia, the Netherlands and Austria. He has had educational exposures from Harvard to Yale and the London School of Economics (LSE). His last job before becoming a governor was as a commissioner of Planning, and he continued to serve in the macroeconomic policy team chaired by the Prime Minister. If there was anyone the market should look up to to get a sense of direction during such times of confusion and alarm, it is no one but Yinager.

Alas! The Governor is nowhere seen providing insight, hope and leadership.

From the chamber of his obscurity, the central bank does policy back-pedalling telling banks to do a whole list of things and restricting depositors in managing their savings.

The latest policy shot is forcing banks to re-invest in treasury bills of their returns from bonds. For eight years since 2011, the central bank had forced banks to buy bonds worth a third of loans and advances they made. A policy footprint of Meles Zenawi`s era, it was a deliberate move in the state`s determination to collect rent from the private sector and redistribute it to economic sectors of its preferences. It was an unpopular decision, for the non-market interest rate of three, and later, five percent the bonds yield in a country where the headline inflation is rarely in the single digits.

It was a policy bitterly resented for crowding out the private sector.

The central bank lifted the mandatory bond purchases two years ago with plaudits, freeing more credit to the private sector. But gradually, the decision is rolled back, and banks are forced to chip in more to the state’s coffers as their interest in the T-bill market waned. Governor Yinager and his policy team have also compelled insurance firms to invest no less than 40pc of the deposits they would park in checking, time and savings deposits into T-bills.

There are those in the high office of the administration who credit Yinager for successfully seeing through the demonetisation of the Birr back in September last year. It may have been the case, for demonetisation is a milestone a central bank can make. Nonetheless, subversion of an idea to create a financial sector that could be as fair to private creditors as it is to the state all in the name of propping up an unprofitable T-bill market will remain to be Governor Yinager`s legacy.

No less disorienting is the constant back and forth on forex account retention rules. In about a year, the central bank altered the retention regime where exporters were allowed to use 70pc of their foreign currency earnings to import to 31.5pc. Yinager and his team have not stopped there. Recently, they upped the regulatory uncertainty to the highest volume with a blanket freeze on asset-based loans, pulling the rug from under the feet of the economy. The Governor was nowhere to explain the rationale for such a bizarre decision affecting an entire market or when it will be removed. More importantly, he was reluctant to address the public if the central bank was even prepared to make policies that are not stopgaps to bandaging the economy.

Perhaps the best indication of the uncertainty is the informality with which the NBE communicated its decision to the executives of the commercial banks. The instructions to cease loans or the order to re-invest bonds on T-bills are not directives. The former was communicated through text messaging to heads of banks.

It is possible to sympathise with the Governor’s dilemma. Much of what is putting the economy in a trainwreck is beyond his control.

Ethiopia is nearly a failed state and cannot have its economy regulated like most countries worldwide. As a patient with a terminal disease, it is no longer at the point where it can be expected to optimise. The best policymakers could administer is less traumatising and painful prescriptions, sad as it may sound for its young and hopeful.

Policymaking at the central bank cannot be business as usual. Opening up the economy to more investments and strengthening the private sector are ambitions too lofty for a country going through a destructive civil war. A bare minimum level of social trust on the ground needed for economic activities to take off is fast eroding. The governor and his team could prioritise having a central bank focused on cushioning the fall. Opting to freeze loans instead of risk a foreign currency run on the black market could indicate that they partially understand this.

Sound macroeconomic policymaking requires a state that functions in a state of normalcy. The Ethiopian state has to restore peace and stability; there will be no way around that. Unwilling to enter into negotiated settlements to end insurgencies and civil wars, it is regrettable to see much tragedy befall Ethiopians. They will get ever poorer, even by the low standards of sub-Saharan Africa. The era of insecurity may be protracted for years, if not decades. The central bank needs to act having in mind an economic space besieged by uncertainty and insecurity.

Cushioning the impact of the fall, at the very least, demands developing a consistent monetary policy that makes it possible for fledgling businesses and savers to be able to make rational decisions. Regulatory uncertainty could lead to the economy going further underground, in turn making policymaking inept. Whatever policy the Governor settles on would be less destructive than something inconsistent and amplifies uncertainty for the ailing business environment.

This may require two things to happen. The central bank has to improve its risk management and projection capabilities. It needs to have a Governor bold, courageous and passionate about communicating policies designed to maintain confidence in the Birr and ensure the financial system's stability. The latter is critical to allow the regular dose of glucose drips to the economy before its total implosion.

Ethiopia is credited for the wisdom, "You may well have two legs, but you still can't climb two trees at the same time." Governor Yingaer has to choose in doing one. He cannot be in the service of funding a war effort as well as sustainably growing the economy. These are nearly mutually exclusive goals. One needs to be sacrificed in the service of the other.

PUBLISHED ON

Oct 30,2021 [ VOL

22 , NO

1122]

Fortune News | May 08,2021

News Analysis | Mar 23,2024

Money Market Watch | Jun 15,2025

Editorial | Jan 28,2023

Radar | Oct 20,2024

Radar | Aug 14,2021

Viewpoints | Aug 03,2025

Fortune News | Nov 27,2021

Radar | Jun 07,2020

Photo Gallery | 175367 Views | May 06,2019

Photo Gallery | 165587 Views | Apr 26,2019

Photo Gallery | 155917 Views | Oct 06,2021

My Opinion | 136814 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

Oct 18 , 2025 . By BEZAWIT HULUAGER

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...