Exclusive Interviews | Jan 05,2020

Regulators at the National Bank of Ethiopia (NBE) have issued a stern warning to the President and Vice-president of Debub Global Bank over what they say was "negligence" during the managment of letters of credit (LCs).

Alarmed by the mismanagement of forex and letters of credit at Debub Global, the central bank has conducted an assessment on Debub Global's forex approval process and reprimanded its executives for engaging "in activities that compromise the financial health of the Bank and tarnish its reputation."

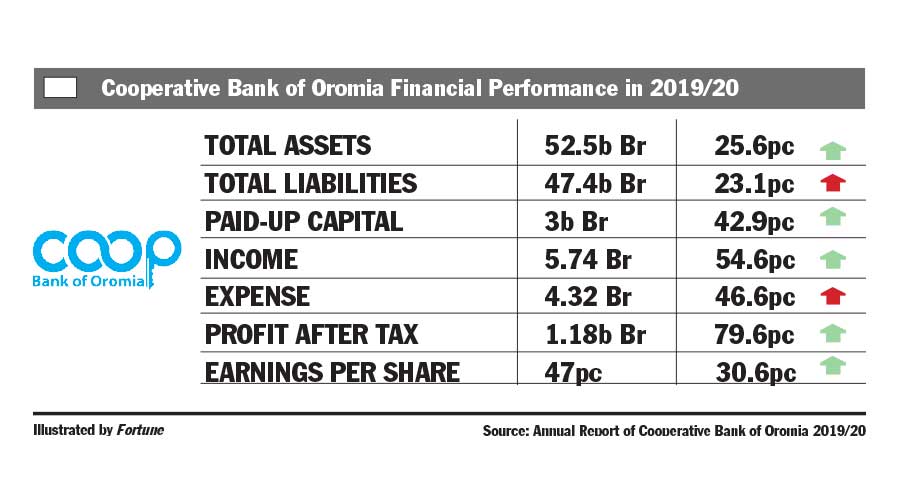

Debub Global is not the first bank to find itself in the midst of a quandary because of controversy over the letters of credit management after executives of the Cooperative Bank of Oromia were suspended six years ago.

Signed by Solomon Desta, vice governor of the NBE, the letters have been separately addressed to both Tesfaye Boru (PhD), president of Debub Global Bank, and his deputy, Fekadu Shigute. The central bank held them liable for the Bank's failure to settle foreign currency bills with overseas clients of importers after approving letters of credit requests beyond the Bank's forex position.

The regulatory body says it has found 197 defaults in letters of credit commitment after October 5, 2020, imposing a 985,000 dollar penalty on the Bank. It has also put a one million Birr fine on Debub Global for an additional 104 defaults that occurred prior to that. While the former has to be deposited in the central bank account with Citibank in New York, the fine must be paid in local currency within the next four months.

A rare measure by authorities at the central bank, this has resulted in disappointment for the Bank's shareholders, whose dividends have been suspended for the same reason.

Authorities at the central bank believe Debub Global has yet to settle its forex liabilities, incurring additional expenses due to fluctuations of the exchange rate. This, however, remains undisclosed, according to a letter written by the NBE on May 14, 2021.

According to the central bank, this has led to the misrepresentation of the Bank's profits on its latest annual financial reports, and the regulatory body holds both Tesfaye and his deputy, Fekadu, responsible for the act.

"This is unacceptable," said a shareholder of the nine-year-old Bank. "It should be understood that the fine would be paid from the gross profit – thereby reducing our returns."

Debub netted 292.4 million Br in profits over the last operating year, showing a 38.7pc annual growth, while its earnings per share expanded by 7.4pc to 347 Br during the same period. However, the figure was found to be in contrast to reality, according to the NBE, which has suspended dividend payments, citing that letters of credit that the Bank has previously approved may result in a loss.

This is a foreseeable event that resulted from the foreign currency shortage in the country, Tesfaye, who denied that there was an act of concealing losses, told Fortune.

"It's no surprise," said the President, while pointing his finger at Debub Global's previous managment under Addisu Habba, former president of the Bank. "This happened four years ago during the tenure of the ex-president. The incumbent management inherited the historical mismatches in asset and liability. The Bank has been following such an approach from the onset, and there was no policy change by the new management."

Addisu declined to comment on the matter when approached by Fortune.

Executives of Debub Global have attributed the overexposure to forex commitments to the difficulties of settling the already accumulated liabilities of the Bank. Had the Bank stopped approving letters of credit, it would have lost its potential customers and been unable to meet forex liabilities, according to Tesfaye.

"The management had to make decisions to provide import services and gradually reduce its exposure from the export earnings it collected," Tesfaye said, who justified his decision as "a wise approach".

If the Bank stopped providing services to importers, getting foreign currency from them would be difficult as most are unwilling to work with banks without such offers.

The Chairperson of Debub Global, Nuredin Awol, and the Vice President, Fekadu, have declined to comment on this story, despite repeated calls from Fortune.

PUBLISHED ON

[ VOL

, NO

]

Exclusive Interviews | Jan 05,2020

Obituary | May 21,2022

Radar | Feb 19,2022

Commentaries | Apr 06,2024

Radar | Oct 09,2021

Fortune News | Feb 27,2021

Radar | Jun 15,2024

Agenda | Jan 01,2022

Fortune News | Mar 28,2020

Fortune News | Jul 13,2020

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...