Radar | Nov 20,2021

Oct 23 , 2021

By HAWI DADHI

The central bank has instructed commercial banks to reinvest returns from bonds maturing next year and onwards on treasury bills.

The banks bought the bonds for eight years after a directive from the National Bank of Ethiopia (NBE) was issued in 2011. It was a controversial decision that forced private banks to invest 27pc of loans and advances in five-year government bonds. Part of the funds from these bonds were directed towards the Development Bank of Ethiopia (DBE) at a low interest rate of three percent, which was adjusted to five percent in 2018.

The mandatory rule was lifted soon after Prime Minister Abiy Ahmed's (PhD) administration took the helm of office following years of pressure from executives of commercial banks. Over the years since its introduction, private banks had spent 116 billion Br in buying the bonds. The returns on these bonds for the next three months beginning October have already been paid, people familiar with the issue disclosed. Those maturing between January and June 2022 will also be paid to the banks.

Central bank authorities have told banks to spend returns from bonds maturing beginning July next year and subsequently bonds with maturity dates beginning in December 2023.

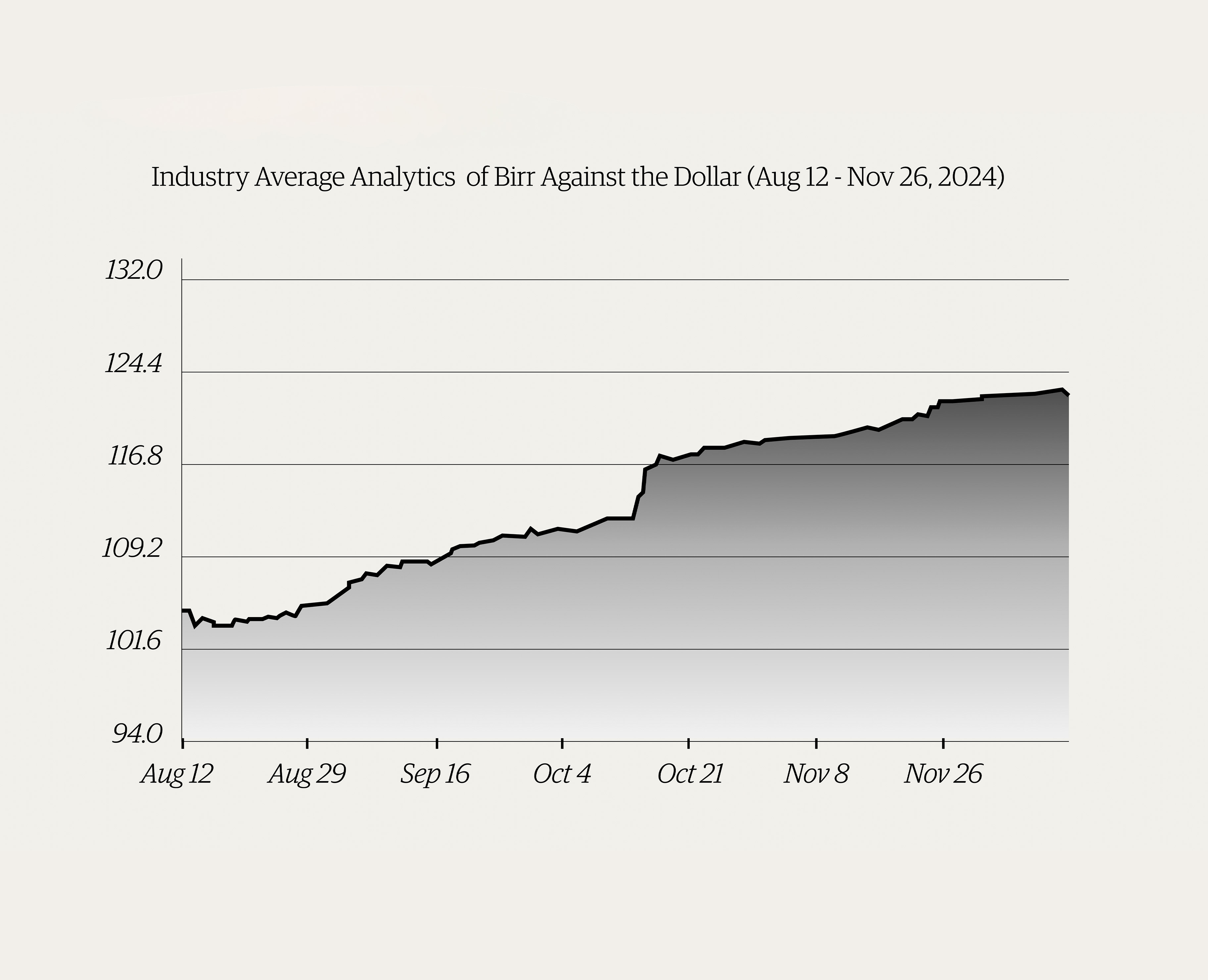

The central bank has already started making the conversion though the bonds are yet to mature, a measure leading to the oversubscription of treasury bills during the latest auction on October 6. The regulatory body accepted offers of 32.6 billion Br, though a total of five billion Birr worth of 365-day bills were brought to the auction. This has reversed an all-time low interest in treasury bills seen recently.

In two consecutive auctions held last month for 60 billion Br worth of T-bills, offers made were for less than 12 billion Br. Liquidity crunch was attributed to the central bank's directive issued in September this year to increase their reserve ratio to 10pc, double the previous threshold.

"It's been difficult to meet these requirements, let alone invest in T-bills," a senior bank executive, who asked to remain anonymous due to the sensitivity of the issue, told Fortune.

Banks were benefitting from the returns paid monthly on maturing bonds, according to this executive. He believes the timing could not be more wrong for the central bank to force the banks to reinvest the returns in treasury bills, considering the liquidity issues.

Officials at the central bank declined to comment.

Experts have their own opinions, however.

Abdulmenan Mohammed, a financial analyst based in London, sees an administration trying to secure the sale of long-maturing T-bills to raise funds for the government with agreed-upon interest rates, lower than the recent averages. In the past few auctions, the average yield of 365-day maturity treasury bills was about 9.3pc, a much-discounted rate of 15pc market average.

While some banks are unhappy to be submitting their proceeds, others have welcomed it.

Among the latter is Wegagen Bank, which netted 831 million Br in profits in the 2019/20 operation year. Aklilu Wubet, its acting president, is contented with the central bank`s offering T-bills with a one year maturity period. The interest rate earned from the T-bills is higher than what banks earned when they bought NBE bills years back.

“The central bank did a good thing,” he said.

The expert disagrees.

"The banks shouldn't invest in the treasury bills unless they are forced to," said Abdulmenan.

He believes banks' priority should be building up their reserve, then improving their liquidity level to deal with day-to-day operations.

"If they have extra funds, they can invest in a financial instrument that they deem suitable," he said.

PUBLISHED ON

Oct 23,2021 [ VOL

22 , NO

1121]

Radar | Nov 20,2021

Fortune News | Oct 27,2024

Money Market Watch | Apr 13,2025

Fortune News | Jul 03,2021

Editorial | May 27,2023

Radar | Jun 11,2022

Radar | Nov 24,2024

Fortune News | Jun 11,2024

Money Market Watch | Dec 15,2024

Fortune News | Nov 14,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...