Radar | Dec 24,2022

Jul 3 , 2021

By HAWI DADHI

Several bank accounts opened in Tigray Regional State were frozen a day after the federal government declared a humanitarian unilateral ceasefire, and authorities in Addis Abeba said they withdrew federal forces from the region on June 28, 2021. However, authorities at the central bank left the decision to the banks' discretion, cautioning them to manage risks while the regional state is cut off from the rest of the country.

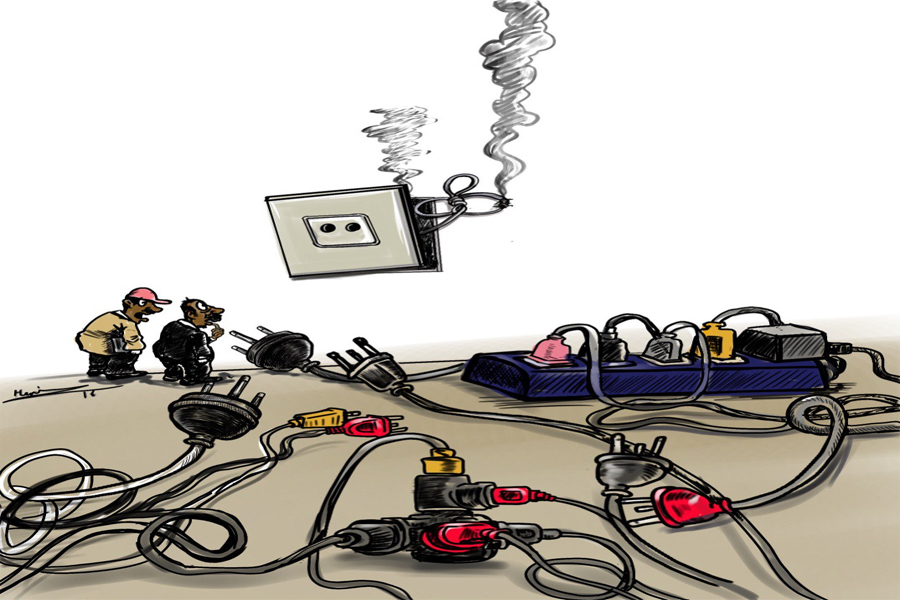

This was followed by the takeover of Meqelle, the seat of the regional administration, by Tigray Defense Forces (TDF), cheerfully welcomed by thousands of residents. Subsequently, electricity to the region was cut off, telecommunications services interrupted, and air and surface transport from and to the regional state blockaded.

Last week, clients with accounts in the regional state were unable to deposit or withdraw cash – an experience many are suffering for the second time since November last year.

A medical professional who opened an account with the Commercial Bank of Ethiopia (CBE) in Hawzen, a town located in eastern Tigray, discovered on Tuesday morning his account was frozen. He pleaded before the employees of a CBE branch in the Bole neighbourhood but he was told accounts opened in Tigray have been frozen.

Authorities at the National Bank of Ethiopia (NBE) have cautioned banks to manage risk associated with loss of communication and given the choice to freeze accounts if needed, confirmed Solomon Desta, vice governor for financial institutions supervision at the central bank.

Account-holders confirmed that CBE, Lion and Hibret banks have frozen accounts opened in Tigray. There were over 600 bank branches active in Tigray up until last week.

"We don't have central access to branches in the region," Melaku Kebede, CEO of United Bank, told Fortune.

All accounts opened in any of the 23 branches United Bank operates in Tigray remain deactivated beginning June 29.

However, the Bank serves customers who request to use their accounts outside of Tigray applying the Know Your Customer (KYC) rules, Melaku told Fortune. Customers' recent transactions are reviewed before a new transaction is allowed, according to Melaku.

"If an account has been inactive for a long time, it would be difficult for the Bank to consent," he said.

Banks implement a contingency plan to ensure deposit collection and withdrawal continues when the internet connection is lost. However, the development in Tigray makes it difficult to send information about customers from the banks' central database.

Another bank that has received a caution from the central bank and is looking into dealing with the situation is the Cooperative Bank of Oromia.

"We haven't decided whether to freeze all accounts," said Deribe Asfaw, CEO of the Bank.

Leaving the matter to the discretion of the banks instead of following a blanket approach is a wise move, according to Abdulmenan Mohammed, a finance expert with over a decade of experience.

"The banks know their customers better," said Abdulmenan. "The central bank or Financial Intelligence Centre can conduct a random check on the banks."

PUBLISHED ON

Jul 03,2021 [ VOL

22 , NO

1105]

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

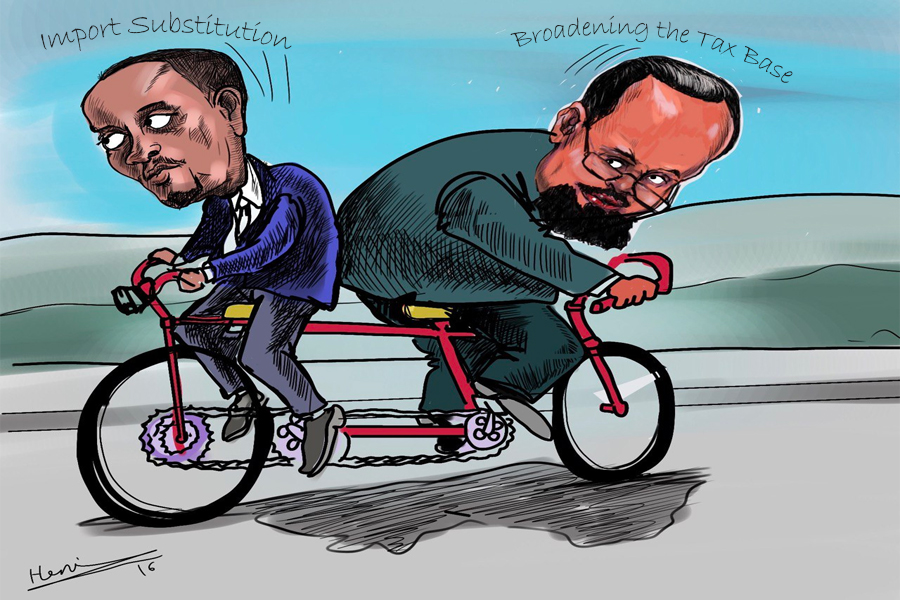

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...