Commentaries | Sep 21,2024

Nov 6 , 2021

By Carlos Lopes , Ricardo Soares de Oliveira

The Pandora Papers revealed a wealth of information about the inner workings of offshore finance, leading to calls for international action to combat tax avoidance and evasion. This has been a longstanding problem in Africa, yet organisations on the continent are not leading the push for reform, writes Carlos Lopes, professor at the Nelson Mandela School of Public Governance at the University of Cape Town, and Ricardo Soares de Oliveira, professor of the International Politics of Africa at the University of Oxford.

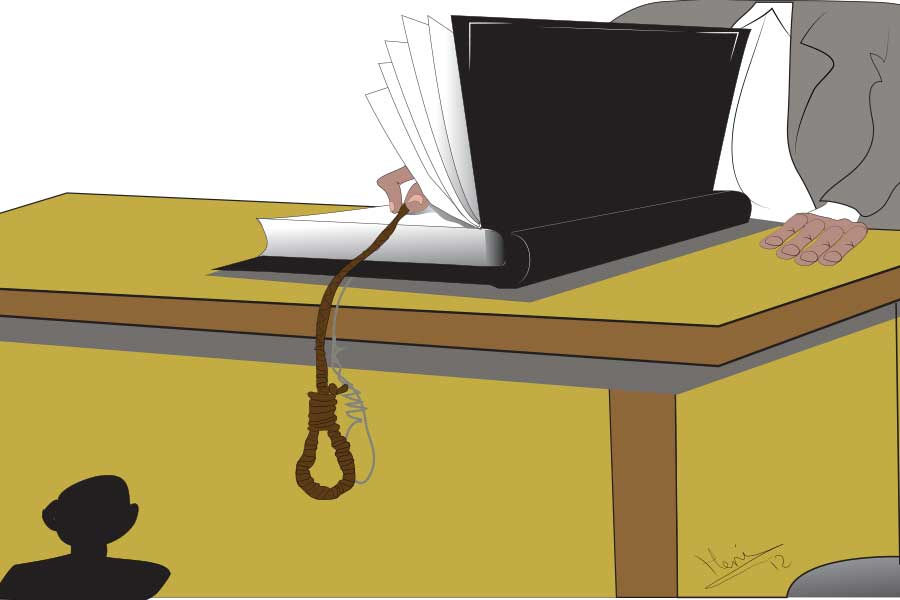

The Pandora Papers, the largest investigative effort yet to shed light on the world of offshore finance, show just how serious the challenge of illicit financial flows is for Africa. The papers reveal that many prominent Africans hold assets in major financial centres abroad with the help of professional enablers who provide them with secrecy, ensure asset protection, and secure tax exemptions.

The investigation also demonstrated that such offshore services are not limited to the best-known tax havens. International standard-setters like the United States and the United Kingdom (directly and through its overseas territories) were shown to be major offshore financial players, illustrating the hypocrisy underlying discussions of reform for the past decade. And the Pandora Papers include further evidence that Asian financial centers also have become significant offshore players, underscoring the global nature of the problem.

Some African initiatives demonstrated early leadership in assessing the issue and developing potential solutions. The African Tax Administration Forum, which was created in 2008 and includes 38 African states, has been a noteworthy actor on tax reform issues. The High-Level Panel on Illicit Financial Flows from Africa, a joint effort of the African Union and the United Nations Economic Commission for Africa, first convened in 2012 and produced a much-discussed report on the subject in 2015. At that time, it seemed offshore finance would be a regular part of African Union discussions. Unfortunately, it is disappearing from the agenda.

In the past few years, leadership in the fight against tax evasion and avoidance seems to have migrated to international organizations such as the United Nations Conference on Trade and Development and the OECD, which launched its program on tax transparency in Africa in 2014. On the continent itself, independent media are taking a larger role: the Pandora Papers involved 53 African journalists working in 18 countries, often under extremely difficult conditions. Civil-society organizations such as Tax Justice Network Africa also are active in this domain. But African governments and Africa-based international organizations have refrained from major initiatives.

As a result, there is no multilateral African body leading the way on the problem, and the African organizations that were working on it actively five years ago have assumed what can only be described as a low profile. It is hard to avoid the sense that many of the continent’s rich and powerful have little incentive to compromise arrangements that have enabled them to move, hide, and protect their assets. Moreover, their lawyers and financial advisers point out that many such practices are not only legal, but common among multinationals active in Africa, especially in the extractive industries. According to this logic, there is no reason Africans should not avail themselves of strategies that are widespread in the global financial system.

This lack of concern by African states over illicit finance is bolstered by the perception that in most countries, most of the time, tax evasion is not a matter that registers with public opinion. At best, leaders assume that any effect the issue has on public trust can be managed. They are certainly wrong, especially regarding younger voters, but this view shapes their non-committal approach.

The role of external organisations and African civil-society actors in combating offshore tax evasion and avoidance is welcome. But African governments’ lack of initiative on the issue is regrettable. Worryingly, the absence of a robust, collective African response invites outsiders to shape the reform process in ways that will most likely continue to favor leading industrial powers. This trend already is visible in the way the naming and shaming of tax havens invariably targets microstates and ignores important enablers of illicit financial flows such as the US and the UK.

While some African states will never be at the forefront of reform efforts in this area, those that have been victimized by such flows must raise their voices and work together to push for global action. Current efforts include the African Parliamentary Network on Illicit Financial Flows and Taxation, which has representatives from 11 countries. Other organizations that played an important role earlier, like the African Union and the UN Economic Commission for Africa, also could reinvigorate their commitment. Multilateral endeavors such as the African Continental Free Trade Area, which currently is being shaped with strong inter-governmental support, could be used as vehicles to standardize tax rules and avoid a race-to-the-bottom competition to attract foreign direct investment.

Illicit financial flows rob governments of the resources they need to provide the public goods – education, health care, and trade and communications infrastructure – that are vital for long-term economic growth and prosperity. Africa’s interest in curbing the problem is as obvious as the need for African leadership to get it done.

PUBLISHED ON

Nov 06,2021 [ VOL

22 , NO

1123]

Commentaries | Sep 21,2024

Viewpoints | Sep 21,2019

Viewpoints | Aug 05,2023

My Opinion | Mar 09,2024

Fortune News | Sep 26,2021

Radar | Feb 17,2024

Radar | Jan 19,2024

Fortune News | Apr 22,2023

Editorial | Oct 26,2019

Radar | Nov 27,2023

My Opinion | 131590 Views | Aug 14,2021

My Opinion | 127946 Views | Aug 21,2021

My Opinion | 125921 Views | Sep 10,2021

My Opinion | 123545 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...