Apr 9 , 2022

By Asseged G. Medhin

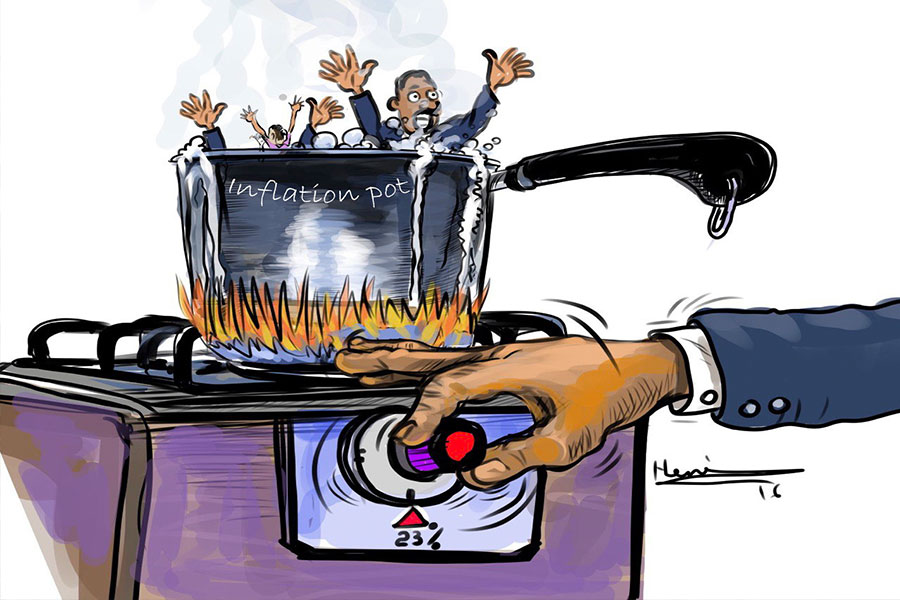

Several reforms in the economic front have been employed over the past three years. They range from liberalisation efforts to tax reform and monetary policy reorientation. However, none have shielded the economy from internal and external variables. The latter has been the impacts of COVID-19, global supply chain disruptions and commodity price volatilities. Internal failures have been resistance to reform and conflict that consumed a chunk of government spending.

Household incomes are not rising as rapidly as they should, leading to low national savings and consequently only limited capital to be deployed as investments. At the same time, tax revenues are only enough to meet the country’s needs, with little left over to finance development. Under these circumstances, deficit financing may appear to be an easy method of providing finance to expand investment and hence to be an easy way of obtaining capital for a more rapid expansion of output. If a government can persuade the central bank to create money to finance a development programme, or if the banking system freely makes loans to private investors for the finance of physical investment, the problem of expanding the country’s real assets may appear to be easily solvable.

There is no doubt that, on occasion, a monetary expansion greater than the increase in real output will introduce an element of flexibility in an economy, releasing resources for development. However, there are strict limits to the amount of development that may be fostered without creating hyper-inflation.

The less inflation there would be going forward, the moment the government pulls out from the money markets – ceasing borrowing from commercial banks through the treasury markets and the central bank. If inflation is lower, so would be consumption and more money can go into investments. More production will help the economy use its competitive land and labour advantage, more than any other in the region. The government should look for other workable strategies that will increase production and individual income of the nation.

In any economy, the monetary system operates on the assumption that a currency serves as a satisfactory medium of exchange, store of value and unit of account. If prices are stable or rising imperceptibly, citizens will find the currency less acceptable. The Birr is facing pressure as it loses its value due to the effects of low savings, weak export, deficit financing and devaluation. If we are not careful in measuring the impact and providing proper intervention, it could sweep away any wealth held by households. The increasing cost of living and the fall of household’s disposable income is shrinking by the day. These threats could mean a financial apocalypse from which many any active participant will not recover.

The impact of inflation on the daily earning capacity of citizens should be the government’s priority. Individual units of investment financed by bank credit are indeed likely to be created even in inflationary conditions. It is not the immediate products of monetary expansion that are in question; rather, it is the overall effect on the supply of money in the market where the real purchasing power of money is significantly discounted by the marginal rate of inflation over interest rate. Such a trend, at some point, will create financial crises since the real value of assets might drop as a result of latent economic growth.

As long as prices keep rising, the real value of any increase in money holdings will be eroded. This fall in the real value of money may be considered a tax on money holders. Inflationary policies, or policies which lead a government to be weak in resisting inflationary pressures, may be assessed by criteria similar to those used in assessing alternative taxation proposals. We need a wise, long-sighted and effective price adjustment intervention for our economy before the rate of inflation surpasses the capacity of absorbing shocks. The economic misalignment needs to be addressed before it creates a financial storm that bankrupts the country.

PUBLISHED ON

Apr 09,2022 [ VOL

23 , NO

1145]

Commentaries | Jan 28,2023

Agenda | Jul 18,2021

Fortune News | Mar 30,2022

Commentaries | Dec 19,2021

News Analysis | May 25,2024

Editorial | May 25,2024

Commentaries | Oct 01,2022

My Opinion | Jun 07,2025

Fortune News | Oct 05,2019

Radar | Oct 05,2024

Photo Gallery | 176648 Views | May 06,2019

Photo Gallery | 166859 Views | Apr 26,2019

Photo Gallery | 157401 Views | Oct 06,2021

My Opinion | 136927 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...