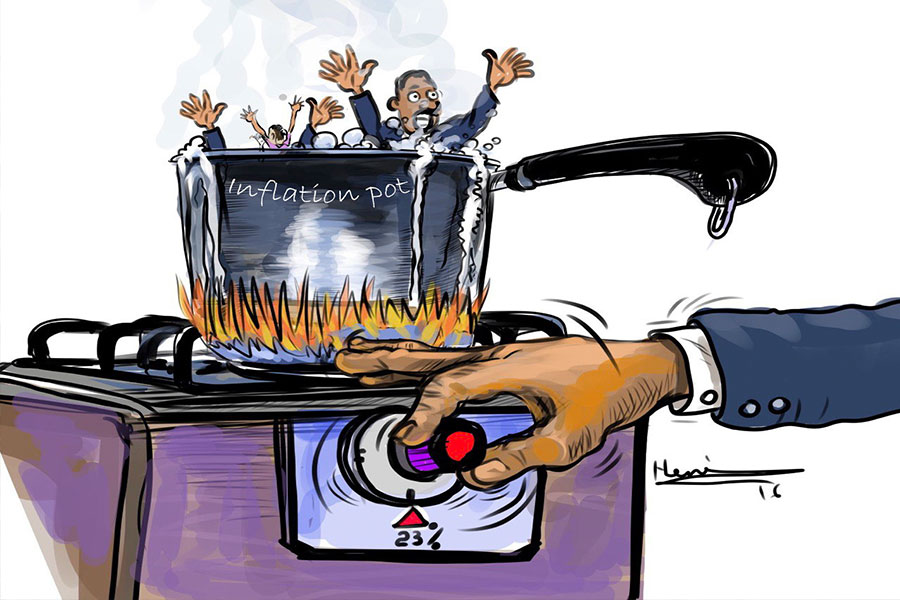

Headline Inflation, an indicator of the cost of living, ticked down slightly last month to 18.7pc, according to the latest report from the Central Statistical Agency (CSA).

Headline inflation, which is gauged by the Consumer Price Index (CPI) that measures the average change in prices that consumers pay for a basket of goods and services, has shown a 1.3-percentage-point dip compared to the previous month.

The growth of food inflation stood at 21.2pc, drawing a 0.8-percentage-point drop from the previous month. The rate of non-food inflation also depicts a two-point decline, reaching 15.5pc. The growth rate reported a decline despite the holidays that were celebrated in September.

"Most cereal prices continued to rise, which largely tends to drive up food inflation," reads the report from the Agency.

However, vegetables, potatoes and some pulse types registered a decrease in price. At the same time, the price of red pepper continued to hike last month following the previous trend, according to the report.

The rise in non-food inflation was caused mainly by a surge in the prices of alcohol and tobacco, khat, housing repair and maintenance, energy, medical care and jewellery (mainly gold), the report indicates.

The report also stated that the cost of transport declined last month. After the onset of the Novel Coronavirus (COVID-19) pandemic, the government has ordered transport service providers to load passengers at half of their capacity and charge double the normal rate. This restriction was lifted last month.

It is hard to believe the report, according to Alemayehu Geda (Prof.), a macroeconomist and a lecturer at the Faculty of Business & Economics at Addis Abeba University.

September is a month of higher spending of consumers, because it has two major holidays and parents send their kids back to school, according to Alemayehu. He also says that the ongoing banknote changeover is also one factor that can potentially push the inflation rate higher. People are currently rushing to change their cash into an asset by buying items that have a good store of value such as rebar and gold, according to Alemayehu.

"These issues put the credibility of the report in question," he said.

There should be an independent peer review of the report by statistical economists before it is released, according to Alemayehu.

"Most importantly the Agency has to directly report to the parliament, switching from the existing executive organ," he said.

The rise of the cost of living has been the major challenge of the administration, which targeted to confine the headline inflation rate to the single digits at 9.8pc during the current fiscal year. The rate has been edging into double digits for the past decade and a half, marking an average of 15.5pc.

Last fiscal year’s average headline inflation rate stood at 19.9pc, mainly driven by the growth of food inflation that registered a 23.3pc rate, while non-food inflation stood at 15.8pc.

It is crucial to control the inflationary pressure to maintain the macroeconomy's stability and save it from further collapse, according to President Sahle-Worq Zewde, while addressing the joint session of the parliament and the House of Federation last Monday. She also added that the macroeconomic situation has been recovering.

“To drag the rate down," she said, "the government will continue employing strict fiscal and monetary policies."

"Even though the tight fiscal and monetary policies can achieve many positive changes," said Sahle-Worq, "the policies couldn't bring meaningful changes when it comes to inflation."

Thus, to decrease headline inflation mainly to keep it in a single-digit rate, both policies are fundamental, according to the president.

"To attain the target," she said, "the government will employ these policies but blend them with other economic policies."

PUBLISHED ON

Oct 11,2020 [ VOL

21 , NO

1067]

Editorial | May 25,2024

Editorial | Jul 24,2021

Agenda | May 20,2023

Commentaries | Aug 12,2023

Agenda | Aug 18,2024

Verbatim | May 03,2025

Featured | Sep 28,2019

Fortune News | Sep 02,2023

Commentaries | Jun 15,2024

Commentaries | Feb 13,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...