Jun 24 , 2023

By Remi Marechaux

The post-war international financial architecture is no longer sufficiently adapted to deal with the growing inequalities, climate change, biodiversity erosion, and public health challenges prevalent in the 21st Century. The international community’s responses are currently fragmented, partial and insufficient.

Concessional resources provided by development institutions are not delivering their full potential in terms of impact, co-finance and alignment with needs. Neither is the expansion of finance conditions and rise in debt encouraging investment in developing countries nor provides them with means to address the challenges they face.

Yet international solidarity has never been more critical amid a growing number of crises that are weakening the poorest and most vulnerable countries to an even greater extent. To help the most exposed countries exit the COVID crisis, deal with the consequences of Russian aggression in Ukraine on their food and energy security, and cover the very high cost of climate transition and consequences of extreme climate events, it is necessary to scale up finance.

The global financial system inherited from Bretton Woods has reached its limits at a time when we are facing two major threats to the future of our planet.

The first is insufficient support for development and for the protection of our global public goods due to a lack of resources. The second, which is even more crucial, is the risk of geopolitical fragmentation, at a time when we need effective multilateralism and enhanced cooperation more than ever.

A number of G7 and G20 countries, organizations and associations share this observation with France and wish to promote the same conviction: we have to act fast and join efforts to correct the imbalances and injustices generated by these divides.

We are therefore now calling for a review of our software and for a shake-up of finance. We must together drive change in our global financial system to make it more responsive, just and inclusive, fight inequalities, finance the climate transition and biodiversity protection, and move closer to achieving the United Nations Sustainable Development Goals (SDGs).

This is the objective of the Summit for a New Global Financing Pact, held on 22 and 23 June in Paris. This Summit intended to be inclusive, with every country, every opinion and every proposal being able to be expressed.

The Summit was part of a positive momentum.

The launch of reform by the World Bank, the G20 Presidency of India and that of Brazil right after, the SDG mid-term review and commitments made at COP are all reasons for hope to build on this momentum. Tangible solutions have already been initiated: the Paris Club and the G20 launched an initiative for debt treatment. France plays a pivotal role in implementing coordinated solutions under the Common Framework.

We have proposed and obtained the issuance of 100 billion dollars in IMF Special Drawing Rights (SDR) for the most vulnerable countries. All countries in a position to do so must take part in this effort. Several multilateral development banks have begun to respond to the G20’s requests and have implemented initial measures to optimize capital to increase their lending capacity.

But we must now go even further, following the example of the Bridgetown Initiative, a set of innovative solutions spearheaded by Barbados to address climate vulnerability affecting many middle-income developing countries.

We will promote a reform agenda for development banks and the IMF to provide more finance to countries in the most need as well as global challenges. It is an agenda that aims to improve existing instruments and capital and to promote innovative approaches and instruments to support the poorest and most vulnerable countries.

It also aims to mobilize more private finance using risk-sharing and guarantee mechanisms to redirect financial flows towards these countries to support the local private sector and durable infrastructure. This requires stepping up the use of our instruments and public and private innovative and new financing mechanisms.

To be more effective, our international financial institutions should be able to do more than they are currently doing to work better together, while better mobilizing private savings. To be more inclusive, we must above all give a greater voice to the most vulnerable countries in international fora.

The Summit for a New Global Financing Pact highlighted global finance challenges and the many leaders participating gave the impetus needed to carry out the transformations our system requires.

We do not have to choose between fighting poverty, tackling climate change and its impact and protecting biodiversity. A just transition is the only answer.

PUBLISHED ON

Jun 24,2023 [ VOL

24 , NO

1208]

Fortune News | Mar 02,2024

Viewpoints | Jun 07,2025

Fortune News | Apr 20,2019

Editorial | Oct 20,2024

Fortune News | Jul 21,2024

Agenda | May 17,2025

Commentaries | Sep 10,2023

Fortune News | Sep 01,2024

Sunday with Eden | Jun 14,2025

Radar | Feb 17,2024

My Opinion | 131673 Views | Aug 14,2021

My Opinion | 128039 Views | Aug 21,2021

My Opinion | 126001 Views | Sep 10,2021

My Opinion | 123622 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

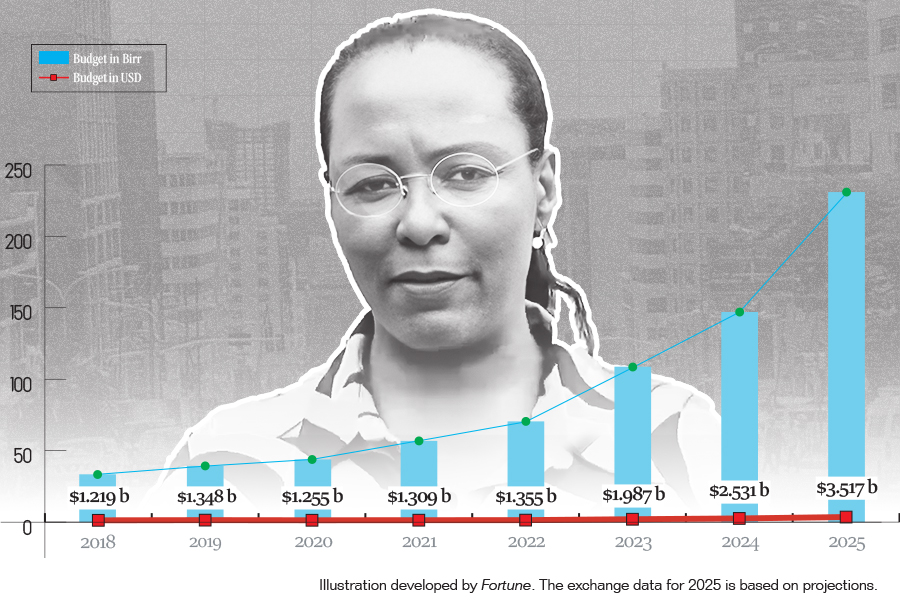

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...