Apr 20 , 2019.

The International Monetary Fund (IMF) has lowered its growth projection for the global economy to its lowest level since the financial crisis, 3.3pc, and 70pc of all the countries in the world are expected to see slower economic growth this year. During a recent ‘Spring Meeting’ of the IMF and the World Bank held early this month in Washington DC, there was an apprehensiveness concerning the state of the world economy. The buzz words were rather “uncertain,” “delicate” and “precarious.”

Not so much for Ethiopia, still a star performer as far as GDP is concerned. And this is despite a myriad of macroeconomic challenges the country faces. Represented at the meeting by Ahmed Shide, its finance minister, Ethiopia was the light at the end of the tunnel - partly due to the opening up of the economy by Prime Minister Abiy Ahmed (PhD).

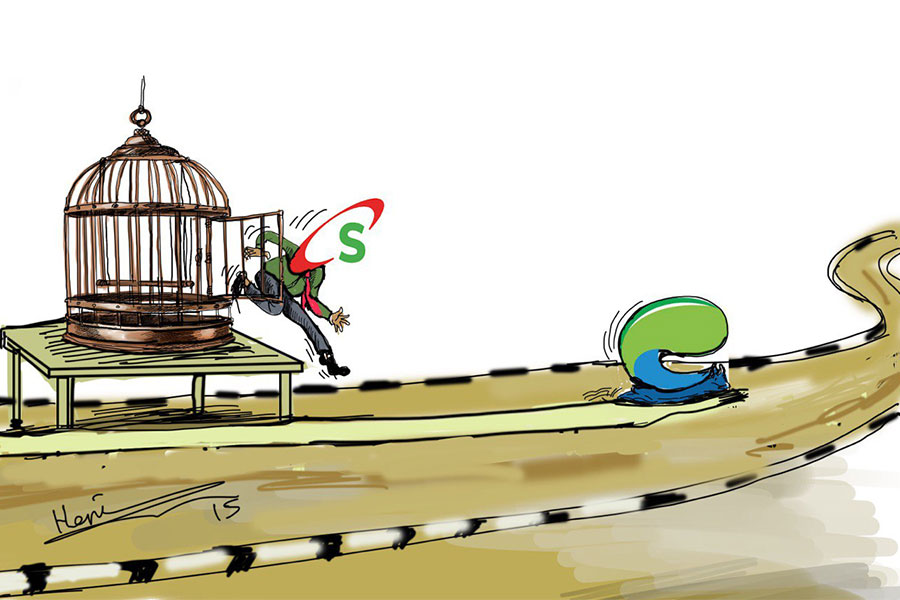

Unlike the predictions of the critics of this administration, the government has not gone wild with a wholesale privatisation of state assets or embarked on deregulation that could be considered suicidal. But a series of steps are being taken by the government, an indication where the economy is headed.

Recently, a request of information (RFI) was released for interested parties to participate in the privatisation of 13 operational and under-construction state-owned sugar corporations. In addition, Yinager Dessie (PhD), governor of the National Bank of Ethiopia (NBE), recently announced a study on opening the financial sector for foreign investment.

Add to this the ratification of the African Continental Free Trade Agreement (ACFTA) by parliament, reforms dealing with foreign currency trade, and easing requirements for the establishment and operation of businesses in the country - significant steps leading to a wider space for the private sector to thrive.

The pace of reform has been steady and there have been sincere efforts to ensure transparency, especially with regard to the partial privatisation of major state enterprises.

But these measures alone will not ensure a steady ship once government’s role switches from being the driver of the economy to the overseer of the economy. It is a task that requires a great deal of subtlety, sophistication and balance to nurture free market forces to prevail, safeguarding consumers, protecting the environment, upholding workers’ rights and ensuring that domestic sources of revenue do not suffer.

Gnawing at the heels of a messy liberalisation will be economic and political instability. Countries that have taken policy reforms but failed to heed advice on an orderly transfer of the reins of the economy to the private sector have witnessed rampant inequality, capital flight and greater macroeconomic fluctuations. Russia, under Boris Yelsin’s privatisation debacle, remains an instructive lesson to the rest of the world.

Even the West, long a hallmark of a liberal economic order, is beginning to shy away from laissez-faire capitalism given some of the negative effects of unregulated markets. Fewer regulations have meant that consumers fall prey to substandard products and services; employers overwhelm workers’ rights; companies ignore rules on fair competition and environmental regulations; and brazen risks are taken by private financial institutions leaving the debris of their failures to be picked up by taxpayers.

In the face of such potential adverse risks, the advantages that can be gained from economic liberalisation remain elusive. Abiy’s administration needs a grand strategy on how economic liberalisation can be achieved without creating short-term instability. The design should consider how potential capital flight and shortfalls in government revenue can be avoided while ensuring long-term sustainability.

This requires a clear understanding of the domestic and global political and economic fundamentals that operate, especially in the context of greater international integration and opening of the political space at home.

The future may face depressed global trade, especially as trade tensions between two of the world’s biggest economies - the United States and China - worsen. This would be the case as the Asian country gobbles up more of the global economic pie at the expense of the United States.

Global debt, driven by a long period of low interest rates, affects the economic wellbeing of Ethiopia. In addition, the importance of the service sector, primarily due to the miracles of the digital age, will leave more of its effects on the country as liberalisation takes root.

At home, the economy is faced with declining capital inflow from bilateral partners, especially China, and a population explosion. The latter entails that any dip in government revenue will have significant social and political implications. The fact that even newly graduated medical doctors are unable to find employment in a nation bereft of adequate medical services only goes to show the extent of the economic and social challenges Ethiopia faces.

The most pressing concern for the stability of the economy is political instability. An economy driven by the private sector is heavily dependent upon the general condition of the peace in a society that directly relates to the confidence level of investors and consumers. The lack of confidence will choke dynamism of the investment environment leading to capital flight and the proliferation of an informal market.

It is crucial that policies are formulated to ensure that economic liberalisation does not end up as a burden that worsens the prevailing economic problems. Such policies should be designed to create jobs, improve government revenue, improve the confidence of investors and protect against external shocks.

The government has a duty to safeguard and protect the lives and property of citizens as well as institutions and investors. The fundamental requirement for economic growth is the enforcement of the rule of law, followed by creating independent and capable institutions that can regulate the private sector without suffocating it.

True liberalisation will entail an independent central bank whose chief task is dedicated to keeping a sustainable macroeconomic environment; a competent tax enforcement agency that administers the law without prejudice; enactment of policies that facilitate the expansion of the economic pie; and curtailing government entities from competing against the private sector.

Reforms based on competent policies, the rule of law and fairness will guarantee that privatisation is not merely a short-term agenda to assuage a current foreign currency shortage, but a policy that charts a durable path for a stable macroeconomic environment.

Without reforms in the rule of law, creation of independent and capable institutions, and a meaningful regulatory capacity that culminates in a grand plan, the very sincere effort of Abiy’s administration to liberalise the economy may create more havoc than it fixes.

PUBLISHED ON

Apr 20,2019 [ VOL

20 , NO

990]

Editorial | Oct 15,2022

Commentaries | Jun 07,2025

Commentaries | Jun 24,2023

Commentaries | Apr 06,2019

View From Arada | Jan 27,2024

Editorial | Dec 07,2024

Life Matters | Oct 24,2020

Commentaries | Jun 03,2023

Editorial | Mar 16,2019

Viewpoints | Dec 15,2024

Photo Gallery | 177955 Views | May 06,2019

Photo Gallery | 168165 Views | Apr 26,2019

Photo Gallery | 158903 Views | Oct 06,2021

My Opinion | 137029 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 27 , 2025

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...