Radar | Aug 04,2024

Jul 13 , 2024.

Policymakers are walking a tightrope, struggling to generate growth and create millions of jobs while tackling budget deficits, trade imbalances, debt servicing, and runaway inflation. These are problems compounded by the economy's ongoing structural transformation from agriculture to services and manufacturing, leading to a shift from rural to urban settings. Crafting effective social, economic, and political policies in such a volatile environment is no small feat.

The urgent need to silence the guns in Ethiopia's mountains, gorges, and valleys is at the heart of its economic woes. Negotiated political settlements between adversarial forces are indispensable for long-term stability and growth. Subsequently, reorienting the economy towards productivity, particularly in the industrial sector, is imperative.

Despite years of impressive growth, averaging more than nine percent in the 17 years beginning in 2000, the economy is reeling from the legacy of the COVID-19 pandemic, a raging civil war, and the global fallout from Russia's war in Ukraine. These crises have slowed growth and exacerbated existing macroeconomic vulnerabilities. Inflation has soared to double digits, and fiscal and current account deficits have widened. Foreign exchange reserves are depleted, and the public debt-to-GDP ratio for the fiscal year 2022/23 was approximately 38.8pc, down from 56.1pc in 2018/19 and 51.1pc in 2021/22.

These macroeconomic headwinds, coupled with a compressed fiscal space due to increased defence and debt servicing expenditures, have strained the economy.

The crux of policymakers' trouble lies in transforming economic growth into inclusive and job-rich development. The impressive growth recorded for two decades beginning in the mid-2000s has not been accompanied by structural changes or job creation. The manufacturing sector, in particular, has underperformed, failing to generate employment for the young and rapidly growing population. The sector remains nascent, contributing only 4.6pc to GDP and five percent to total employment in 2023. It is dominated by small firms, many of which struggle to scale up and diversify their products.

Industrial parks, introduced as part of a strategy to attract foreign direct investment (FDI) and boost manufacturing, have yielded mixed results. These parks attracted 740 million dollars in FDI and created over 150,000 jobs a few years ago. However, security issues, logistical inefficiencies, and foreign exchange shortages have undermined their ability to deliver on their much-touted promises. But the suspension of the Africa Growth & Opportunity Act (AGOA), due to ongoing conflicts, has led to an exodus of foreign firms and underutilisation of industrial capacities.

Despite these obstacles, Ethiopia's potential as a manufacturing powerhouse remains immense. With the right mix of policies, reforms, and investments, the economy could transform its manufacturing sector, create quality jobs, and achieve sustainable and inclusive growth.

For now, though, Prosperitians seem fixated on the magic wand of import substitution. However, regulatory burdens and policy unpredictability are unravelling the domestic manufacturing sector.

Last week, factories received letters from the Revenue Bureau warning that their water and electricity would be cut off if they failed to make payments before the fiscal year ends. An amendment to the 48-year-old "Wall & Roof" tax, abruptly imposed by Mayor Adanech Abebie’s Administration, has presented a formidable problem for manufacturers in the capital. The levies, predicated on the size of the property, among other factors, meant more extensive obligations for bigger factories. While broadening the tax base could be ushelpful forncreasing government revenue to narrow the budget deficit, it should not undermine long-term economic development. Tax policies should help meet strategic targets rather than short-term fiscal goals.

While the manufacturing sector could help ease foreign currency shortages, high urban unemployment, and diminishing purchasing power, it has remained largely stagnant. Many factories operate below capacity, leading to a 1.5pc decline in the sector's GDP contribution.

Contradictory policy orientations also make effective implementation unlikely and shake the foundations on which they are predicated. This issue holds more weight given the Prime Minister's prognosis that the industrial sector will grow by 10pc next fiscal year.

Nevertheless, access to finance remains the top challenge for the sector in achieving this target, with many firms relying on personal savings or informal sources of finance due to the stringent collateral requirements and high interest rates of banks. The shortage of foreign exchange further limits firms' ability to import essential inputs and repatriate profits. Already battling security concerns, the sector's lack of raw materials, basic utility shortages, and bureaucratic red tape add to the burden of expanding to post the growth promised.

Policy prescriptions thus far have given little consideration to the possibility of taxing businesses out of existence. The simultaneous introduction of newer tax types over the past few years and the drop in the tax-to-GDP ratio to around seven percent should prompt reflection from policymakers.

Instead of a one-size-fits-all property tax, policymakers could consider a tiered system based on production capacity. Tax breaks and incentives tied to reinvestments in infrastructure and skills development could also optimise net gains. Of course, all of this must be intimately tied to increasing tax authorities' operational capacities. Policymakers are better off reconciling their economic policies and prioritising nurturing the domestic manufacturing sector.

Benjamin Franklin once quipped, "Nothing can be said to be certain in this world, except death and taxes." While the statement remains true, it would be wise to acknowledge that dead businesses or individuals do not pay taxes either. The federal government should carefully consider how its plans to increase tax revenue by 23pc to 502 billion Br could impact all other economic actors.

Several key reforms are essential for the federal government to realise manufacturing potential. It should carefully calibrate its policies to ensure immediate fiscal goals do not undermine long-term economic development. The stakes are high, but with thoughtful and consistent policies, Ethiopia can emerge as a robust and resilient economy.

Addressing the fragmentation of the domestic market is essential. Improving coordination between federal and regional governments on land issues, taxation, and investment facilitation is more critical now than ever before. Reducing the cost of finance and improving access to credit for manufacturing firms can help spur growth. This can be achieved through financial sector reforms, increased competition, and innovative credit-scoring methods.

Ensuring sustained peace and stability is paramount. Conflict and insecurity are known deterrents to domestic and foreign investments. Building broad-based support for economic reforms, enhancing institutional independence, and promoting a robust public-private dialogue are also crucial. Policy clarity and predictability will help build investor confidence and drive manufacturing growth.

Investing in human capital is no less vital. Strengthening the education and health sectors, particularly at the foundational level, can improve the quality of the workforce. Technical and vocational training programs should be aligned with the needs of the private sector to ensure that the skills being developed are relevant to the industries and in demand.

Addressing sector-specific constraints through a strategic and targeted industrial policy can help boost manufacturing.

The concept of industrial policy, as measures to boost manufacturing and productive sectors, has evolved since the Industrial Revolution. Today, it includes all state interventions targeting economic structural transformation to achieve public goals. These interventions range from subsidies and tax incentives to public procurement. Most economic policies aim to improve the economic structure or achieve social goals, indirectly benefiting specific industries, sectors, or firms.

In countries like Ethiopia, with limited fiscal space, social programs can alter the economic structure by increasing public debt and posing financial stability risks, disproportionately affecting certain groups in society. Separating vertical industrial policy's effects - such as banking on import substitution as a panacea for all the ills - from broad macroeconomic or regulatory policies could be unrealistic. Both policies have wide-ranging repercussions, whether direct effects on other sectors or indirect opportunity costs for various economic agents.

The right blend of reforms and policies could unleash the economy's potential, transform it into a manufacturing hub, and achieve inclusive, sustainable growth. The rewards of successful transformation are substantial. Ethiopia has the ingredients for such success with its young demography, strategic location, and abundant natural resources. The task now is to mix these ingredients wisely.

PUBLISHED ON

Jul 13,2024 [ VOL

25 , NO

1263]

Radar | Aug 04,2024

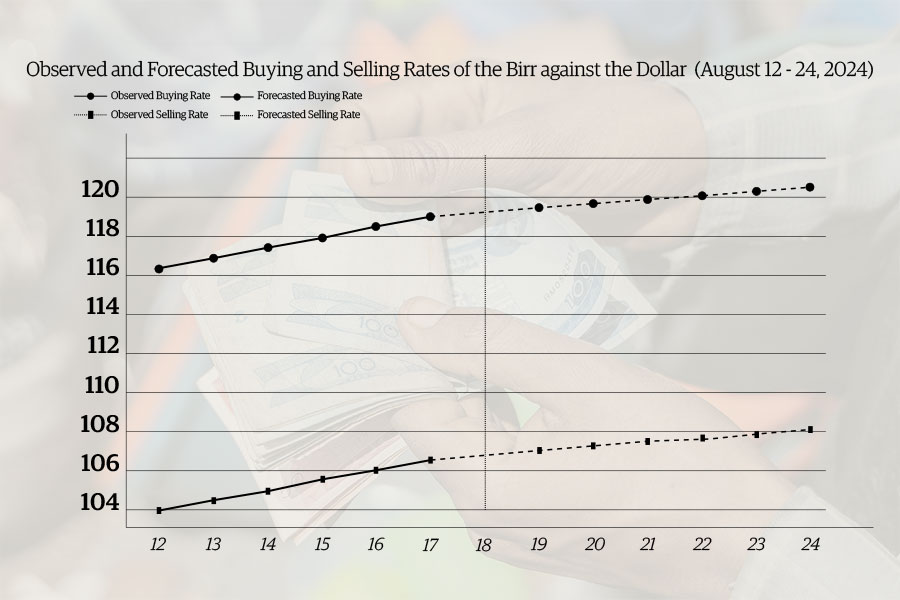

Money Market Watch | Aug 18,2024

Commentaries | Feb 22,2020

Fortune News | Feb 25,2020

Commentaries | Jan 11,2020

Photo Gallery | 180607 Views | May 06,2019

Photo Gallery | 170801 Views | Apr 26,2019

Photo Gallery | 161883 Views | Oct 06,2021

My Opinion | 137300 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...