Commentaries | Sep 02,2023

Dec 9 , 2023.

Making a paradigm shift seems elusive for those in the driving seat of Ethiopia's monetary policy. Its central bankers, nestled in their traditional roles of financial sector oversight, have historically skirted the more proactive role of their liberal world counterparts in steering the economy by deploying monetary policy tools. The reluctance comes partly from the tepid response of Ethiopia's economy to such tools and a perceived lesser need for public engagement.

Rare are the incidents when Ethiopia's central bankers venture into the public discourse with policy prognostications. Governor Mamo Miheretu's address to federal legislators two weeks ago was an exception to the rule. However, what followed his appearance before Parliament brought more confusion than clarifying the central bank's policies. It ignited wildfire speculations about an impending and significant devaluation of the Birr against major currencies.

Officials of the National Bank of Ethiopia (NBE) were compelled to react and issued a rare statement dispelling the rumours. Their move only exposed the central bank's traditional reticence in monetary policymaking, a role that has often been subordinated to the fiscal whims of the government of the day.

The NBE's historical focus has been more on regulatory enforcement within the financial sector than on shaping the monetary policy landscape. This approach has led to a perception of the central bank as a policing entity, more involved in heckling heads of private banks and insurance firms than in influencing broader economic trends. The perception has been reinforced by the bank's alignment with the fiscal priorities of those on Lorenzo Te'azaz Road, popularly referred to as Arat Kilo, rather than carving out an autonomous monetary policy path.

A detailed analysis of macroeconomic data from the last decade reveals a troubling economic milieu. This period is characterised by an alarmingly growing budget deficit and escalating inflation, exacerbated by the central bank's approach to monetary expansion. This expansion has been mainly in service of the government's spending demands, particularly in the face of escalating public expenditures driven by various factors, including war financing and ballooning budget for defence-related spending.

The fiscal imbalance has been sharp.

The budget deficit, excluding grants, grew from 2.9pc of GDP in the 2011/12 fiscal year to 3.9pc a decade later. Such persistent deficits not only raise concerns about fiscal sustainability but also hint at an over-reliance on debt accumulation. The fiscal trajectory has contributed significantly to the inflationary woes, with the consumer price index reaching a staggering 27pc recently, a rate that profoundly impacts consumers' purchasing power, especially in food prices, which disproportionately affect lower- and fixed-income households.

Central to the challenges facing the economy is the role of the central bank in controlling inflation, or lack thereof. While high inflation can partly be attributed to external factors such as surges in global commodity prices and supply chain disruptions, it also reflects the NBE's struggles with managing the money supply. The Bank's direct lending to the federal government has been a major driver of public debt and deficit levels, fueling inflationary pressures.

The decade witnessed significant increases in both narrow and broad money supplies, raising questions about the central bank's approach to monetary policy. The broad money supply, for instance, ballooned from 190 billion Birr to 1.7 trillion Br. While such expansion could be seen as a Keynesian effort to stimulate economic activity, the consequent inflation suggests that the increase in money supply significantly outpaced economic growth.

The foreign exchange market regime presents its own set of problems. Often described as outdated and unfair, the current system contributes to a paradoxical economic reality. Despite consistent GDP growth, the country faces a persistent trade deficit and a negative balance of payments. The import costs consistently eclipse export revenues - 90 dollars to 30 dollars - leading to a depreciating Birr and depletion of foreign currency reserves.

In theory, a depreciated Birr should boost export competitiveness. However, the strategy has - historically - led to increased inflation without substantially improving export revenues. The issue is compounded by the composition of imports and the elasticity of demand for its exports. The widening gap between the official exchange rate and the black market rate further exacerbates this crisis, exposing the distortions the current foreign exchange regime imposed.

The situation poses a dilemma for Governor Mamo and his advisors. They must choose between continuing with the status quo, which risks further economic instability, or undertaking bold reforms in the forex market regime. The fear among some senior officials of liberalising the forex market should be understandable. Their concerns are grounded in the historical context, where past efforts at devaluation have not yielded the desired economic benefits but have instead aggravated inflation.

The divided opinions within the administration further complicate Mamo's dilemma. A policy shift towards liberalising the forex market, while potentially addressing long-standing distortions, is not without risks. The predicament revealed the need for a more nuanced approach to managing the Birr's exchange rate.

The experiences of other countries transitioning from fixed to liberalised forex regimes should offer valuable insights. Countries like South Korea and Poland, which underwent such transitions, have seen benefits, including increased export competitiveness, foreign direct investment, and overall economic stability. However, these transitions were not without challenges, and Ethiopia's path will likely require careful planning and phased implementation.

The potential advantages of a liberalised forex market are manifold. Such a market could lead to more efficient capital allocation, stimulate foreign direct investment, and provide a more accurate reflection of Birr's actual value. However, this transition must be managed carefully to mitigate risks such as capital flight and inflation.

The Governor and his team must weigh the principles of market efficiency against the need for stability and control. A liberalised market could offer long-term economic benefits, but the short-term risks and potential for volatility cannot be overlooked. This balancing act will require strong regulatory frameworks and competent institutional support to ensure a smooth transition.

Mamo and the administration he serves stand at a crossroads. The choice between maintaining the status quo and embarking on a path of forex market liberalisation will have profound implications for the country and its people's economic future.

The status quo may offer a semblance of stability, but it is unsustainable. Liberalising the foreign exchange market regime promises greater efficiency and potential for growth. However, the journey towards full liberalisation will require careful navigation of the inherent trade-offs and risks, with a keen eye on domestic conditions and global economic trends.

PUBLISHED ON

Dec 09,2023 [ VOL

24 , NO

1232]

Commentaries | Sep 02,2023

Viewpoints | Apr 15,2023

Commentaries | Mar 19,2022

Fortune News | Jun 14,2020

Viewpoints | Sep 08,2024

Viewpoints | Dec 21,2019

Viewpoints | Jul 01,2023

Commentaries | Dec 30,2023

Fortune News | Aug 16,2020

Viewpoints | Aug 18,2024

Photo Gallery | 156128 Views | May 06,2019

Photo Gallery | 146414 Views | Apr 26,2019

My Opinion | 135222 Views | Aug 14,2021

Photo Gallery | 134930 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 15 , 2025 . By AMANUEL BEKELE

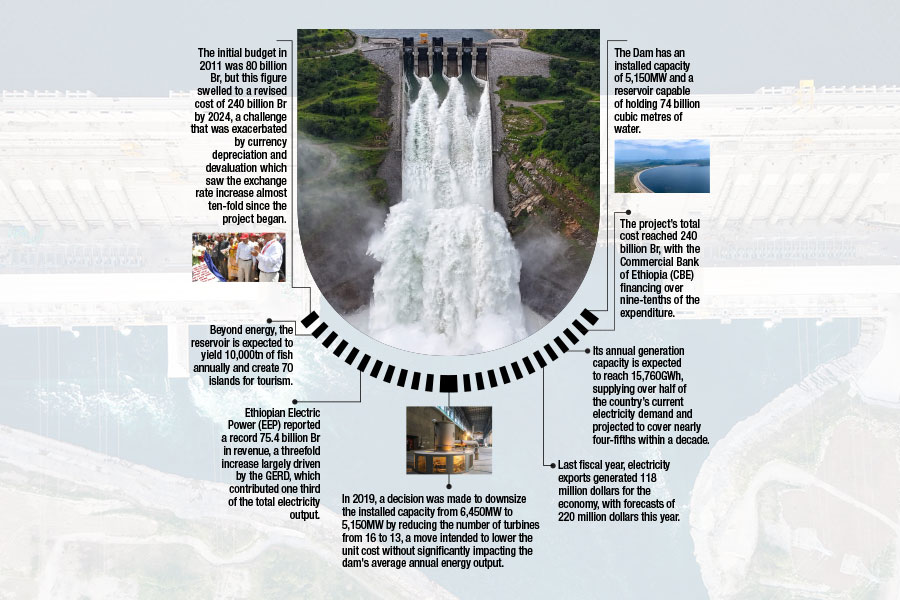

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...