Feb 16 , 2019

By Haben Mehari

An anticipated and significant announcement was made as a one-page template late last year.

The administration of Prime Minister Abiy Ahmed (PhD) indicated that there were plans for the establishment of a stock market in Ethiopia by 2020, which would be called the Addis Abeba Stock Exchange. It was for many a fulfilment of the decade-long argument by business leaders and economists to persuade the EPRDF-controlled government that capital markets are more than the institutionalised casinos they are purported to be by the incumbents but effective platforms for pooling capital and allocating it efficiently.

Indeed, there is currently nothing of substance being done on the ground. There are no committees established to study and report on the matter nor are there bills being drawn up to strengthen the financial infrastructure to accommodate a strong stock market. This though does not mean that the discussions over its sustainability and importance to the economy cannot be discussed. Just as crucially, lessons that can be taken from other African countries ought to be considered.

There are around 29 stock exchanges, including two regional exchanges, in Africa. They may not boast the combined market capitalisation of the companies listed on the tech-laden Nasdaq, but they have impressive growth records. In 2017, six of these stock markets outperformed the Nasdaq, on which Apple, Microsoft, Alphabet and Amazon are listed.

The Nasdaq grew its index, which is a weighted average of prices of selected stocks, by 28pc, while Malawi’s Stock Exchange rose by twice as much and markets in Ghana, Uganda, Mauritius and South Africa were able to gain between 30pc and 44pc throughout the year.

The growth in these indexes were not without significant challenges though. Lack of liquidity has served as the primary stumbling block, which is largely ascribed to lack of choice in investments, poor pricing in markets, weak digitisation and challenges of awareness by the general public of the benefits of active trading.

As a country considering a stock exchange at the moment, Ethiopia can learn a great deal from the challenges and achievements of the 29 Stock Exchanges that already exist in Africa.

Ethiopia, arguably, has significant advantages when it comes to diversity of companies that can be listed in the stock market, with major state-owned enterprises, including telecom, aviation and logistics monopolies, awaiting partial privatisation and share companies of the banks and insurances having the opportunity to play a leading role.

There are many businesses in Ethiopia that are family owned. There is a benefit for them too in listing a portion of their company on the stock exchange. It will help them get cheaper and more diverse access to funding and expand their businesses without a significant loss of business control.

It would be unlikely to reach the level of market valuation of exchanges in South Africa Egypt or even Kenya, but if the nation succeeded in having 50 companies listed, it would be in the top 10 largest exchanges in Africa. Most of the stock exchanges it would leave behind have been operational for more than two decades.

The factors of failures or success of the stock exchanges can be used for cross-referencing. For instance, on the Nairobi Stock Exchange, brokers often charged five times as much as an average investor might pay in the London Stock Exchange, making investing in the stock market unattractive.

There are positive lessons that could be taken as well. The Johannesburg, Egyptian and Moroccan exchanges have performed well in actively engaging a number of partners in educating the population on the benefits and techniques of active investments to increase the total number of private investors.

Based on these major initiatives, a stock exchange in Ethiopia has the best chance of being as successful as it has been much anticipated.

PUBLISHED ON

Feb 16,2019 [ VOL

19 , NO

981]

Advertorials | May 27,2024

Money Market Watch | Nov 09,2024

My Opinion | Apr 20,2019

Commentaries | Dec 14,2019

Commentaries | Jul 13,2019

Viewpoints | Jul 13,2019

Radar | Apr 24,2021

Sponsored Contents | May 02,2023

Editorial | Jun 08,2019

Fortune News | Feb 22,2020

My Opinion | 132681 Views | Aug 14,2021

My Opinion | 129133 Views | Aug 21,2021

My Opinion | 126994 Views | Sep 10,2021

My Opinion | 124576 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 26 , 2025

Teaching hospitals everywhere juggle three jobs at once: teaching, curing, and discov...

Jul 19 , 2025

Parliament is no stranger to frantic bursts of productivity. Even so, the vote last w...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jul 27 , 2025

The Bank of Abyssinia has gone all-in on paperless banking, betting that biometric log-ins and touch-free kiosks will save it hundreds of mi...

Jul 27 , 2025 . By RUTH BERHANU

As Addis Abeba ushers in this year's rainy season, city officials have committed to planting 4.2 million...

Jul 27 , 2025 . By BEZAWIT HULUAGER

Ethio telecom's latest annual performance review painted a picture of rapid infrastructural expansion and...

Jul 27 , 2025 . By BEZAWIT HULUAGER

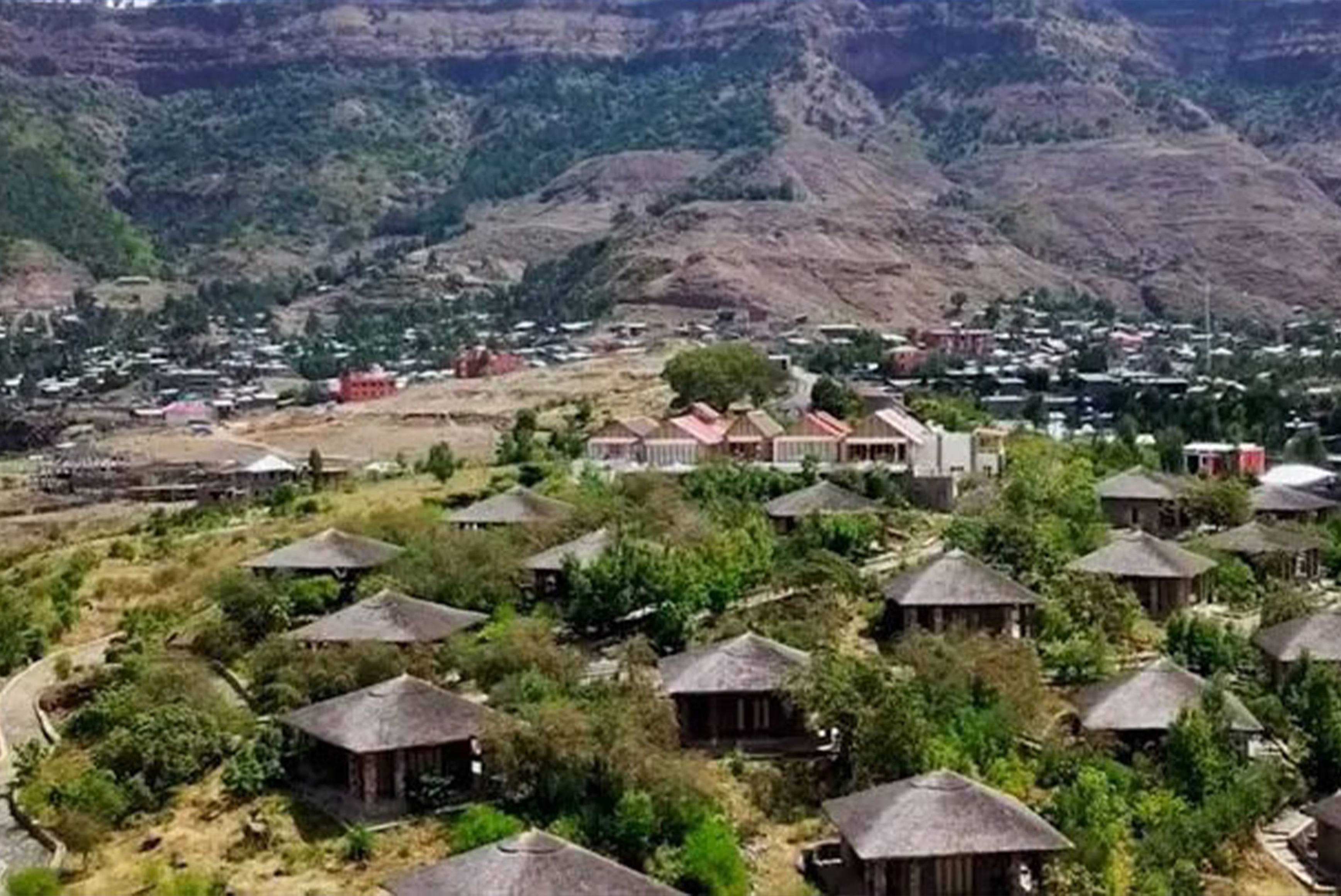

Once a crown jewel of the country's tourism circuit and a beacon for international pilgrims, Lalibela now...