Radar | Jan 19,2024

Sep 10 , 2023

By Dani Rodrik

In the face of supposed free trade, there has been an escalation in IP rules that often favoured big corporations, creating monopolies and stifling competition. The current policy shifts aren't about abandoning free trade but reshaping it to address vital national issues, including labour displacement, climate transition, and public health, writes Dani Rodrik, professor of International Political Economy at Harvard Kennedy School, in this commentary provided by Project Syndicate (PS).

One of the most common questions I hear nowadays is: “The era of free trade seems to be over. How will the world economy fare under protectionism?” However, the distinction between free trade and protectionism (like the one between markets and the state or mercantilism and liberalism) is not especially helpful for understanding the global economy. Not only does it misrepresent recent history; but it also misconstrues today’s policy transitions and the conditions needed for a healthy global economy.

“Free trade” conjures an image of governments stepping back to allow markets to determine economic outcomes on their own. But any market economy requires rules and regulations – product standards; controls on anticompetitive business conduct; consumer, labour, and environmental safeguards; lender-of-last-resort and financial-stability functions – typically promulgated and enforced by governments.

When national jurisdictions are linked up through international trade and finance, additional questions arise: Which countries’ rules and regulations should take precedence when businesses compete in global markets? Should the rules be designed anew through international treaties and regional or global organisations?

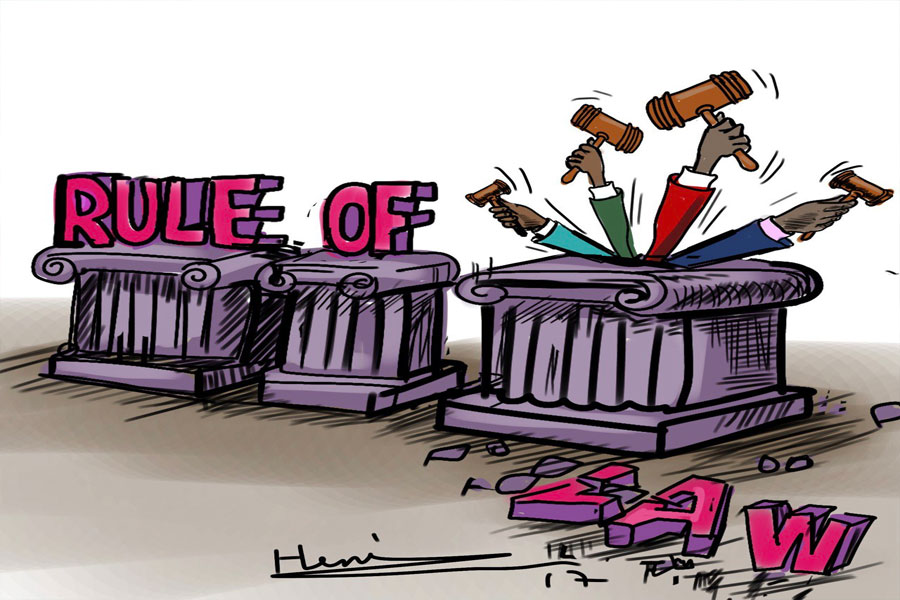

Viewed in this light, it becomes clear that hyper-globalisation – which lasted roughly from the early 1990s until the onset of the COVID-19 pandemic – was not a period of free trade in the traditional sense. The trade agreements signed over the past 30 years were not so much about removing cross-border restrictions on trade and investment as they were about regulatory standards, health and safety rules, investment, banking and finance, intellectual property (IP), labour, the environment, and many other issues that previously lay in the domain of domestic policy.

Nor were these rules neutral. They tended to prioritise the interests of politically connected big businesses, such as international banks, pharmaceutical companies, and multinational corporations, over all else. These businesses not only got better access to markets globally; they also were the primary beneficiaries of special international arbitration procedures to reverse government regulations that reduced their profits.

Similarly, tighter intellectual property (IP) rules – which allow pharmaceutical and tech companies to abuse their monopoly positions – were smuggled in under the guise of freer trade. Governments were pushed to free up capital flows while labour remained trapped behind borders. Climate change and public health were neglected, partly because the hyper-globalisation agenda crowded them out but also because creating public goods in either domain would have undercut business interests.

In recent years, we have witnessed a backlash against these policies, as well as a broad reconsideration of economic priorities more generally. What some decry as protectionism and mercantilism is a rebalancing toward addressing critical national issues such as labour displacement, left-behind regions, climate transition, and public health. This process is necessary both to heal the social and environmental damage done under hyper-globalisation and to establish a healthier form of globalisation for the future.

US President Joe Biden’s industrial policies, green subsidies, and made-in-America provisions are the clearest examples of this reorientation. True, these policies are a source of irritation in Europe, Asia, and the developing world, where they are seen as antithetical to established free-trade rules. But they are also models for those – often in the same countries – seeking alternatives to hyper-globalisation and neoliberalism.

We do not have to go too far back in history to find an analogue to the system that could emerge from these new policies. During the post-1945 Bretton Woods regime, which prevailed in spirit through the early 1980s, governments retained significant autonomy over industrial, regulatory, and financial policies, with many prioritising the health of their domestic economies over global integration. Trade agreements were narrow and weak, placing few constraints on advanced economies, but even fewer on developing countries. Domestic control over short-term capital flows was the norm, rather than the exception.

Despite this more closed global economy (by today’s standards), the Bretton Woods era proved conducive to significant economic and social progress. Advanced economies experienced decades of rapid economic growth and relative socioeconomic equality until the second half of the 1970s. Among low-income countries, those that adopted effective development strategies – such as the East Asian Tigers – grew by leaps and bounds, even though their exports faced much higher barriers than developing countries today. When China joined the world economy with great success after the 1980s, it did so on its terms, maintaining subsidies, state ownership, currency management, capital controls, and other policies more reminiscent of Bretton Woods than of hyper-globalisation.

The legacy of the Bretton Woods regime should give pause to those who believe that permitting countries greater leeway to pursue their policies is necessarily detrimental to the global economy. Ensuring one’s own domestic economic health is the most important thing a country can do for others.

Of course, historical precedent does not guarantee that the new policy agendas will give rise to a benign global economic order. The Bretton Woods regime operated in the context of the Cold War, when the West’s economic relations with the Soviet Union were minimal, and the Soviet bloc had only a small foothold in the global economy. As a result, geopolitical competition did not derail the expansion of trade and long-term investment.

The situation today is entirely different. America’s main rival is China, which occupies a substantial position in the world economy. A proper decoupling between the West and China would have significant repercussions for the entire world, including the advanced economies, owing to their heavy dependence on China for industrial supplies. One, therefore, can find plenty of good reasons to worry about the future health of the world economy.

But if the global economy does become inhospitable, it will be because of American and Chinese mismanagement of their geopolitical competition, not because of any supposed betrayal of “free trade.” Policymakers and commentators must remain focused on the risk that matters.

PUBLISHED ON

Sep 10,2023 [ VOL

24 , NO

1219]

Radar | Jan 19,2024

Commentaries | Sep 03,2022

Sponsored Contents | Jun 15,2022

Fortune News | Apr 03,2023

Viewpoints | Oct 30,2022

Radar | Sep 10,2022

Commentaries | Mar 11,2023

Viewpoints | Feb 03,2024

Fortune News | May 27,2023

Radar | Jun 22,2024

My Opinion | 121132 Views | Aug 14,2021

My Opinion | 117239 Views | Aug 21,2021

My Opinion | 115952 Views | Sep 10,2021

My Opinion | 113660 Views | Aug 07,2021

Commentaries | Jan 18,2025

Agenda | Jan 19,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jan 18 , 2025

Adanech Abebie, the mayor of Addis Abeba, addressed last week a warm-up session for h...

A severe cash shortage squeezes the economy, and the deposit-to-loan ratio has slumpe...

Jan 4 , 2025

Time seldom passes without prompting reflection, and the dawn of 2025 should nudge Et...

Dec 28 , 2024

On a flight between Juba and Addis Abeba, Stefan Dercon, a professor of economic poli...

Jan 19 , 2025

The looming scarcity of essential imported materials has overshadowed traditional wea...

Jan 19 , 2025 . By AKSAH ITALO

The family of the late Hailu Shawel, a civil engineer and a prominent opposition lead...

Jan 19 , 2025 . By AKSAH ITALO

The edible oil industry is on the brink of collapse, with the number of fully operati...

Jan 19 , 2025 . By AKSAH ITALO

Pharmaceutical manufacturers have underperformed, failing to deliver 4.1 billion Br w...