Life Matters | May 31,2025

Business owners in the import-export sector are hopeful the price adjustment will be in their favour to turn things around as shipping rates show a significant drop, slashing the prices of Ethiopian Shipping Logistics (ESL).

The new list of prices was revealed a month after the new management under Berisso Amalo (PhD) replaced Roba Megerssa. The adjusted prices show a decline of as much as 183pc, as routes unclog back to pre-pandemic periods and global consumer spending.

Executives attribute the price slash to decreased international prices, while ESL seeks to play its part in managing the inflation rate, which stands at 33.7pc in the country.

"It'll definitely impact local prices," said Demsew Benti, communications director.

ESL has been the country's flagship logistics company for six decades, travelling to over 327 seaports. It had quadrupled in price during the pandemic due to container shortages and plummeting production from China, accounting for most of its market share. Asia imported 63.5pc of all goods into the country last year.

The company amassed a little over 5.6 billion Br in profit through its shipping, freight forwarding, trucking, and dry port services. The expanded portfolio of services emerged from a merger of four different enterprises that coalesced over time, with the latest consolidation being Comet Transport Share Company in 2016. Listed among Ethiopian Investment Holding (EIH) companies, it now manages nine dry ports and 11 vessels, transporting over seven million metric tonnes annually.

The executives have observed a monthly demand shift in the new payment schedule.

"There is definitely increased traffic after cutting prices," Demsew told Fortune.

Experts estimate that the surge in shipping costs during 2021 added about two percentage points to global inflation.

A study published last year on shipping costs and inflation presented to the Centre for Economic Policy Research suggests that rises in shipping costs impact lower-income countries more severely than developed ones. It looked at the economies of 149 countries and suggests that when shipping costs rise, the local-currency price of imported goods goes up almost immediately, with 90pc of the increase transmitted within two months.

Industry players are looking to turn a corner by taking advantage of the price adjustment that will impact the market.

The rates differ for each country, with an average 40pc decline for a 20ft container observed. The largest rate decrease is from selected ports in India, with rates falling by as much as 183pc for a 40ft container. Chinese shipments have declined by 47pc for 20ft containers and 64pc for 40-foot containers.

Mehari Yohannes, who has been a tyre importer for over a decade, said rates from China, which have declined two-thirds to around 6,000 dollars for a 20ft container, are sure to attract importers. He has been struggling to get sufficient access to dollars despite exporting sesame.

"It'll have significant consequences in the market," he said.

Mehari said shipping rates have held up a sizeable proportion of costs ever since the pandemic. He believes that paying less out of a limited foreign currency allowance will boost the revenues of several import businesses.

The merchandise trade deficit had widened to 14 billion dollars in the last fiscal year due to import bills bloating by 26.6pc to a staggering 18 billion dollars. With consumer goods accounting for 42pc of the import bill and an import-to-GDP ratio of 14.3pc, the weight of costs adding to imported inflation can not be understated.

Experts stress the importance of trans-Atlantic routes from Asia towards Europe and the United States having a significant sway over rates worldwide.

According to Mulugeta Assefa, founder of MACCFA freight and logistics, Asian producers choose the Western market over African importers. He explained that the combination of decreased manpower during the pandemic to manage freight operations and producers' preferences had shrunk the supply to ports around the Red Sea.

"These markets pay tenfold for goods and services," said Mulugeta.

While Mulugeta foresees a certain degree of stabilisation in inflation due to the slashed rates, he believes several factors are at play for Ethiopia's general rise in price levels.

The logistics sector veteran indicated that ESL's monopoly over shipping in Ethiopia might allow it to set prices well above market clearing rates. He established the company (MACCFA) nearly three decades ago and acknowledged the large volumes of negotiations handled by Enterprise when dealing with international carriers.

"As supply chain disruption worldwide subsides, it is to be expected that rates will fall," he told Fortune.

PUBLISHED ON

May 27,2023 [ VOL

24 , NO

1204]

Life Matters | May 31,2025

Radar |

Fortune News | Nov 24,2024

Fortune News | Apr 28,2024

Fortune News | Mar 04,2023

Viewpoints | Jun 14,2025

Radar | Jun 07,2020

Radar | Jan 27,2024

Fortune News | Dec 04,2022

Fortune News | Oct 06,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

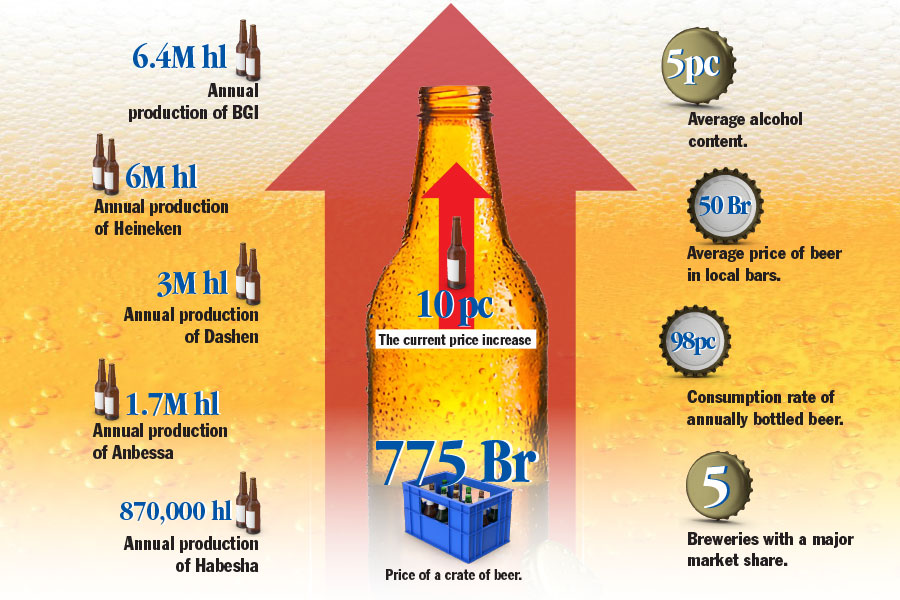

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...