Agenda | Dec 23,2023

Aug 26 , 2023

Small and medium enterprises (SMEs) foresee collateral-free credit and microloans through the private money platform Kacha Financial Technologies which partnered with a couple of commercial banks to facilitate the service.

The agreement with Nib Bank and the newly branded Global Bank of Ethiopia (GBE) envisions developing platforms for international transfers and digital saving schemes in the next five years.

Kacha caps the momentous ceremony off at the Hyatt Regency Hotel on Africa Avenue (Bole Road), with another agreement its executives signed with the LendTech Group, a global technology company that provides proprietary technology to control a customer’s entire lifecycle from qualification to funding status. The CEO, Abraham Tilahun, championed the transformative role of digital financial tools to improve access to finance and expressed his intention to have Kacha play a role in the digital payment strategy spearheaded by the federal government.

Agenda | Dec 23,2023

Radar | Jun 01,2024

Fortune News | Jul 28,2024

Radar | Jun 11,2022

Commentaries | Apr 20,2019

Fortune News | May 21,2022

Fortune News | Nov 20,2021

Fortune News | Dec 14,2019

Radar | Mar 25,2023

Obituary | Nov 09,2024

My Opinion | 128425 Views | Aug 14,2021

My Opinion | 124668 Views | Aug 21,2021

My Opinion | 122764 Views | Sep 10,2021

My Opinion | 120591 Views | Aug 07,2021

May 3 , 2025

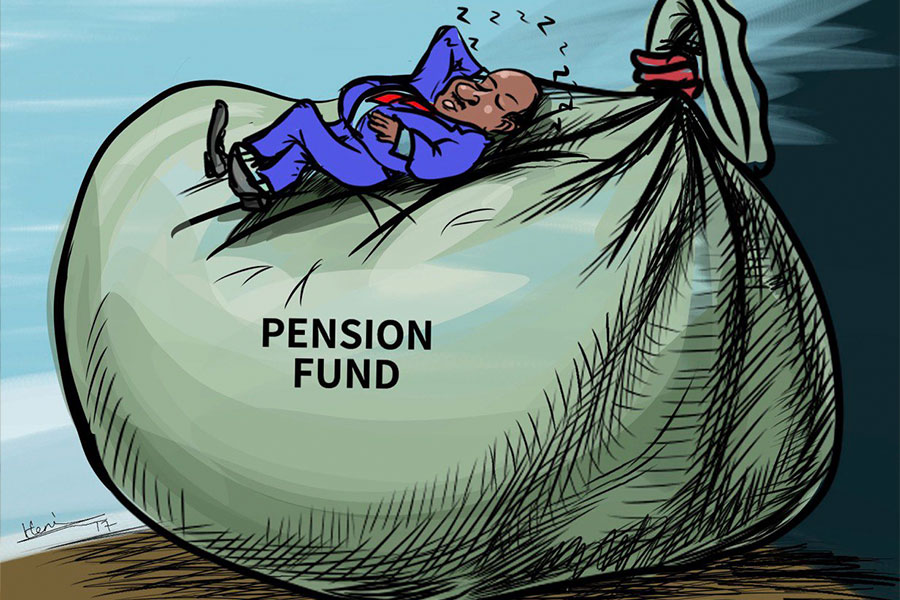

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...

Apr 26 , 2025

Benjamin Franklin famously quipped that “nothing is certain but death and taxes.�...

Apr 20 , 2025

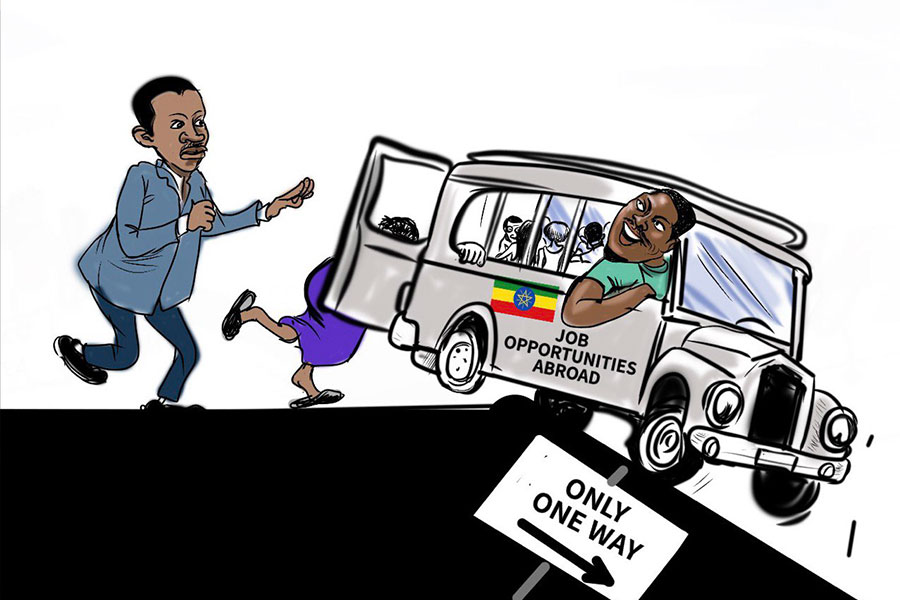

Mufariat Kamil, the minister of Labour & Skills, recently told Parliament that he...

Apr 13 , 2025

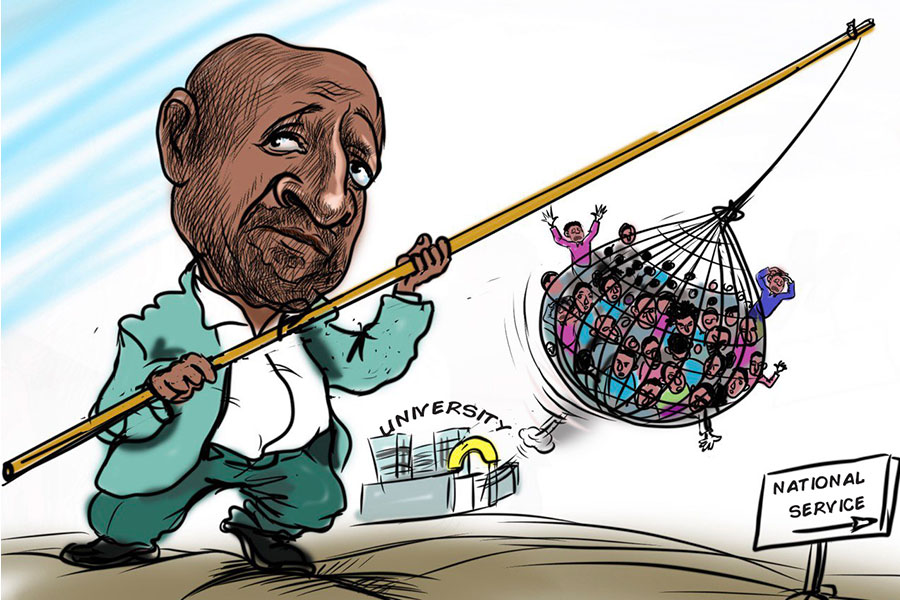

The federal government will soon require one year of national service from university...