Fortune News | Jun 04,2022

Jun 1 , 2023

Rammis Bank S.C., the latest entrant into the burgeoning interest-free banking industry, has achieved an impressive milestone in seven months since its launch, amassing 2.1 billion Br in subscribed capital from a shareholder base of over 8,000. This significant accomplishment sets a new competitive benchmark in the Islamic finance arena.

The Bank was slated to commence operations last month.

Abduljewad Mohammed, chairman of Rammis Bank's board, attributed a central role to the Sharia-compliant core banking system in bolstering the Bank's competitive edge. This state-of-the-art system, supplied by Singapore's Azentio Software Company, has been designed to meet the specific needs of interest-free banking, complying with the standards defined by the Accounting & Auditing Organization for Islamic Financial Institutions (AAOIFI), a leading authority in Islamic finance regulations.

According to the Bank's President, Ali Ahmed Ali, the system's strategic advantage is its capability to facilitate periodic instalment payments that fully align with Sharia law's prohibitions on interest charges and receipts.

Ali plans to explore the distinctive opportunities inherent in the interest-free banking landscape to pursue profitable investment avenues. Echoing the underlying principles of Islamic banking, Ali emphasized that Rammis Bank will engage in transactions that extend beyond mere financial exchanges to embody risk and profit-sharing partnerships.

Rammis Bank is preparing to mark its official launch at its purpose-built nine-story headquarters, the Rammis Tower, on Africa Avenue (Bole Road). This strategic placement underscores the Bank's ambition to carve a significant niche for itself in the rapidly evolving interest-free banking industry.

The foray of Rammis Bank into this financial segment signifies a transformative shift towards alternative financial practices. Its founders believe that achievement in raising considerable initial capital and deploying a Sharia-compliant banking system paints a promising picture for the future of interest-free banking in the country.

Fortune News | Jun 04,2022

Radar | May 23,2020

Fortune News | Sep 14,2019

Fortune News | Feb 20,2021

Radar | Sep 19,2020

Obituary | Jun 17,2023

News Analysis | Mar 04,2023

Radar | Oct 23,2021

Fortune News | Dec 27,2018

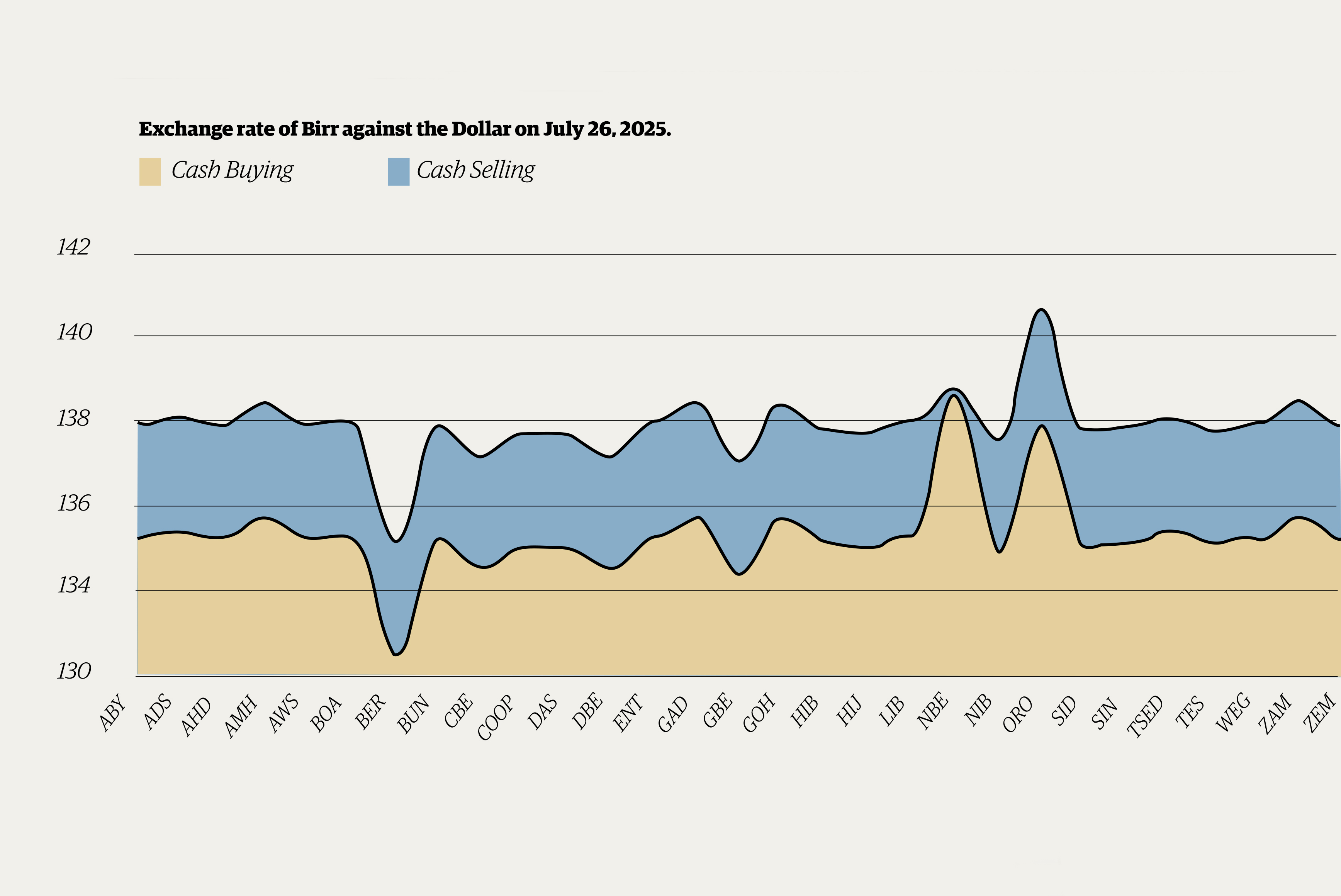

Money Market Watch | Jul 27,2025

Photo Gallery | 157371 Views | May 06,2019

Photo Gallery | 147658 Views | Apr 26,2019

Photo Gallery | 136253 Views | Oct 06,2021

My Opinion | 135306 Views | Aug 14,2021

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...