Apr 29 , 2023

By Abdulmenan M. Hamza

The parallel foreign exchange market now operates by its own rules, and the official exchange rate is utterly divorced from the country's economic reality. The exchange rate regime has become untenable, and attempts to maintain it have only caused further economic distortions, argues Abdulmenan Mohammed, a London-based financial report analyst.

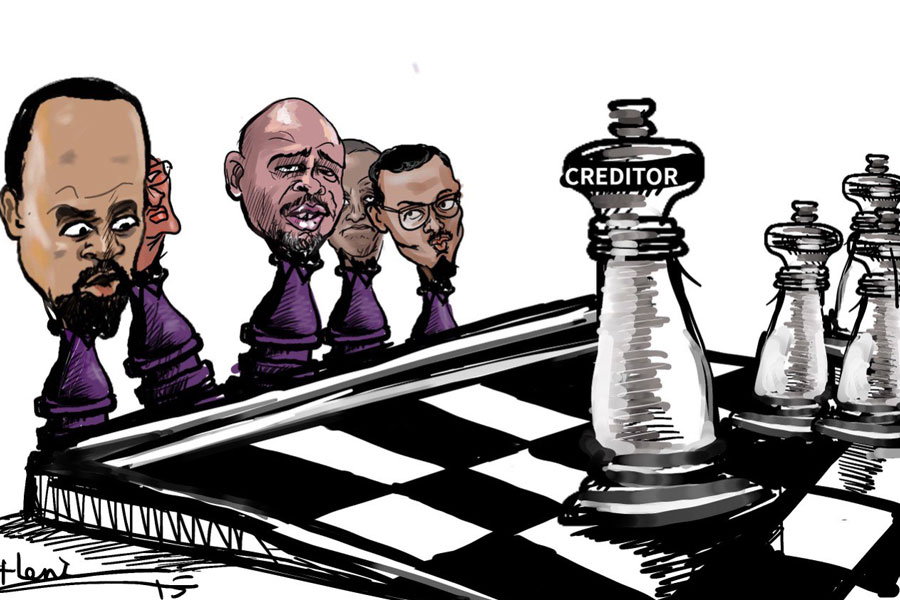

Last month, Ethiopia hosted a team from the International Monetary Fund (IMF) as they discussed the country’s economic plan and progress. In the eye of the storm was the liberalisation of the exchange rate regime, which some media outlets described as the IMF’s demand for the unification of official foreign and parallel exchange rates. This was purportedly a prerequisite for resuming IMF programmes, which Ethiopia desperately needs.

Five years ago, the exchange rate in the parallel market commanded a 30pc premium; today, that figure has ballooned to a staggering 100pc premium over the official rate. This was in complete contradiction to the authorities’ aims when they initiated the rapid depreciation of the Birr. They had hoped such a move would significantly narrow the parallel market premium and boost export performance. The policy, however, has proved to be a disappointment. Not only has it failed to address exchange rate disparity, but it has also caused many problems.

In an economy beset by high inflation, the rapid depreciation of the Birr has only exacerbated matters. The severe foreign exchange shortages and the fast depreciation have caused the parallel market premium to soar to unprecedented heights. Consequently, the parallel foreign exchange market now operates by its own rules, and the official exchange rate is utterly divorced from the country’s economic reality. The exchange rate regime has become untenable, and attempts to maintain it have only caused further economic distortions.

Forex demand has consistently outstripped supply, necessitating the implementation of “priority list” rules. The unreliable forex supply discourages remittances and exports, fostering rent-seeking and corruption. A select few with privileged access to foreign exchange at the official rates reap excessive profits, often resorting to corrupt practices in the process.

The widening gap between the official and parallel rates has spawned numerous economic distortions, leading many to believe that a significant devaluation of the Birr is inevitable. However, policymakers must carefully evaluate the consequences of previous devaluations and the rapid depreciation of the Birr, and weigh the costs and benefits of such a policy measure. They should also exercise caution and consider complementary policy actions.

The recent rapid depreciation of the Birr has aggravated the inflationary situation, exposed the banking industry to greater foreign exchange rate risks, substantially increased external debts denominated in Birr, and burdened the government with hefty external debt servicing costs in Birr.

Acknowledging the potential negative impacts of devaluation and eventual exchange rate unification is crucial. A significant devaluation could lead to downplaying its consequences to the economy’s peril.

Proponents of exchange rate unification argue that the official exchange rate will likely mirror the parallel market rate, implying minimal inflationary impacts. This argument, however, is founded more on faith than hard evidence. A considerable amount of imports are made through the official exchange rate, and their domestic prices reflect this rate. Petroleum is a prime example. Exchange rate unification would undoubtedly have significant repercussions on the prices of goods and services.

The belief that unifying exchange rates would cause all foreign exchange inflows to funnel through the official channel is misguided. Many parallel market participants believe a substantial premium should persist even after unification. In this scenario, those who supply foreign exchange to the parallel market may adopt a wait-and-see approach to gauge demand. This expectation can be dispelled only by availing sufficient foreign exchange through official channels – a difficult feat, even with IMF support.

Devaluation would not only cause inflation; but, it also has serious ramifications for banks and the government’s external debts. Banks would be exposed to increased foreign exchange risk, and those with substantial foreign exchange commitments would suffer significant losses. In recent years, many commercial banks have incurred losses from foreign exchange dealings and transactions, an issue that has not garnered the attention it warrants.

A significant devaluation could inflate the government’s external debt stock held in Birr, making principal payments and servicing costs increasingly burdensome on the federal budget.

A diverse approach is necessary to complement devaluation through exchange rate unification. The government should secure enough foreign exchange reserve to satisfy official channel demands for a reasonable period, pursue tight fiscal policies to reduce or maintain current expenditures, tighten monetary policy to curb inflation, enhance export performance (particularly in manufacturing) to earn more foreign currency and secure external debt restructuring to reduce annual external debt repayments.

Notwithstanding these, macroeconomic policymakers must also devise a “Plan B” to address potential challenges such as sharply surging inflation, rapid parallel market exchange rate depreciation, substantial widening of the budgetary deficit, and increased forex risks for the banking industry.

In addition to exchange rate unification, the nature of Ethiopia’s exchange rate regime post-unification warrants serious deliberation. A functional exchange rate regime is essential. Suppose policymakers decide to introduce a flexible exchange rate system. In that case, they must ensure it is supported by appropriate policy instruments to manage foreign exchange risks and pursue a credible monetary policy.

PUBLISHED ON

Apr 29,2023 [ VOL

24 , NO

1200]

Commentaries | Jun 24,2023

Fortune News | Aug 14,2021

Agenda | Dec 30,2021

Fortune News | Jun 03,2023

Commentaries | May 20,2023

Editorial | Apr 15,2023

Radar | Jun 20,2020

Commentaries | Jul 03,2021

Viewpoints | Nov 18,2023

Photo Gallery | 171490 Views | May 06,2019

Photo Gallery | 161732 Views | Apr 26,2019

Photo Gallery | 151460 Views | Oct 06,2021

My Opinion | 136298 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...