Fortune News | Dec 19,2020

Nov 5 , 2022

By Ameha T. Tessema (PhD)

Members of society, particularly the ones on the lower economic curve, are suffering due to the trajectory of inflation leading to economic hardship. One of the monetary policies to curb inflation could be to increase the price of credit to manage money in circulation. A system of commission agencies in banking can help pull money in circulation into the banking system and motivate society to invest, writes Ameha T. Tessema (PhD). He can be reached at ambet22002@yahoo.com

An alternative to protect an economy from inflation is to consider a system known as an Interest Rate Commission Agent Banking System (AIRCABS). Adopting this system involves an agent bank providing credit by including an agreement between the fund seller and buyer. After disbursement, the loan would be administered with a reasonable interest rate commission from the agreed investors' loan funding credit price.

It aims to multiply investors and entrepreneurs. It also motivates creativity to have innovative alternative products and services by which the government manages inflation.

It can directly increase the bank, investors and entrepreneurs' profits, raising the production level of goods and services. It can improve society's productivity and consumption level enabling the government to manage the inflation rate.

To adopt a commission agency, banks can develop three-track lending strategies.

The "360 Degree" lending strategy involves the investor, entrepreneur, and bank. An investor funds the entrepreneur's project without being asked for collateral from the bank. The bank here serves as an agent. It sells a loan to another prospective investor whenever one wants to collect its fund. If the entrepreneur fails to service the debt, the project can be transferred to another. Loans revolve from an investor to the entrepreneur until they are settled, and the bank collects interest commissions from the would-be investors.

The "180-Degree" lending is between investors, entrepreneurs, and agent banks. Here, a prospective investor is looking for a feasible project to finance, and the bank has one seeking a loan. The bank pushes the funds to the entrepreneurs and hands the project to the investor without them knowing each other. It is up to the bank to look for a feasible project. Collateral pledging by an entrepreneur is mandatory here. If an investor fails to continue in the loan period, the agent bank can sell the loan to another investor in the market.

If an entrepreneur fails to pay the loan, the agent bank rents the project to another entrepreneur with similar interest. When there is no hope of collecting the debt from an entrepreneur, the agent bank can foreclose the collateral to collect the remaining debt. The collateral may be the project under investment or an asset.

The collateral pledged against the loan disbursed from an investor's account should have a safe margin rate between 91pc and 100pc. For a 90pc loan on the collateral value, an entrepreneur covers the remaining, buying insurance for a safe margin. The insurance company may cover the default amount beyond the original loan balance or according to the agreement between the entrepreneur and the insurance company.

Here the agent bank may not advise the entrepreneur to buy insurance coverage for loan repayment. Instead, it manages the loan to be paid as specified in the loan contract. If an entrepreneur fails to pay the debt obligation above 100pc of the collateral value, the agent bank auctions the collateral together with the project under-investment. The money then reimburses the remaining unpaid balance of the investor.

The agent bank sells the pledged collateral when no alternative investment solution is found. However, its main objective is to benefit the investor and the entrepreneur by mitigating the risk related to the entrepreneur's business. Therefore, the agent bank rents the project to a new entrant with the same project interest until the loan is settled. This can be done by holding the collateral without ownership transfer.

If the loan to total asset ratio is calculated as larger than 100pc, the rent would be higher than the current loan repayment. If the loan to total asset ratio is less, the rent could be equal to or greater than the loan repayment to settle it on the due date. Here the agent bank transfers the credit risk of an investor and entrepreneur to the new entrant.

Another is referred to as the "90-Degree" lending strategy. The parties involved are the money depositor and the bank. The depositor assumes a position as investors consult with the bank that has already invested the depositor's fund in a selected project. The bank shifts to an agent position after a formal agreement is made, and the newly entrant investor benefits from a proportional credit price. The agent bank collects a commensurate interest rate commission from the investor's credit price.

These lending strategies encourage investors and entrepreneurs to take more risks and improve investment contributing towards GDP growth and fending inflation off from money circulation. The rise in investment increases the per capita income of individuals.

AIRCABS helps the production of substitution and provides an alternative to fighting inflation sourced from devaluation. It can reduce imports and increase the export of goods and services, taming inflation to a tolerable level.

PUBLISHED ON

Nov 05,2022 [ VOL

23 , NO

1175]

Fortune News | Dec 19,2020

Radar | Apr 01,2024

Verbatim | May 03,2025

Fortune News | Sep 19,2020

Fortune News | Jan 15,2022

Radar | Oct 09,2021

Viewpoints | Jul 30,2022

Fortune News | Mar 16,2019

Fortune News | Apr 24,2021

Fortune News | Oct 11,2020

Photo Gallery | 154937 Views | May 06,2019

Photo Gallery | 145206 Views | Apr 26,2019

My Opinion | 135114 Views | Aug 14,2021

Photo Gallery | 133662 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Sep 15 , 2025 . By AMANUEL BEKELE

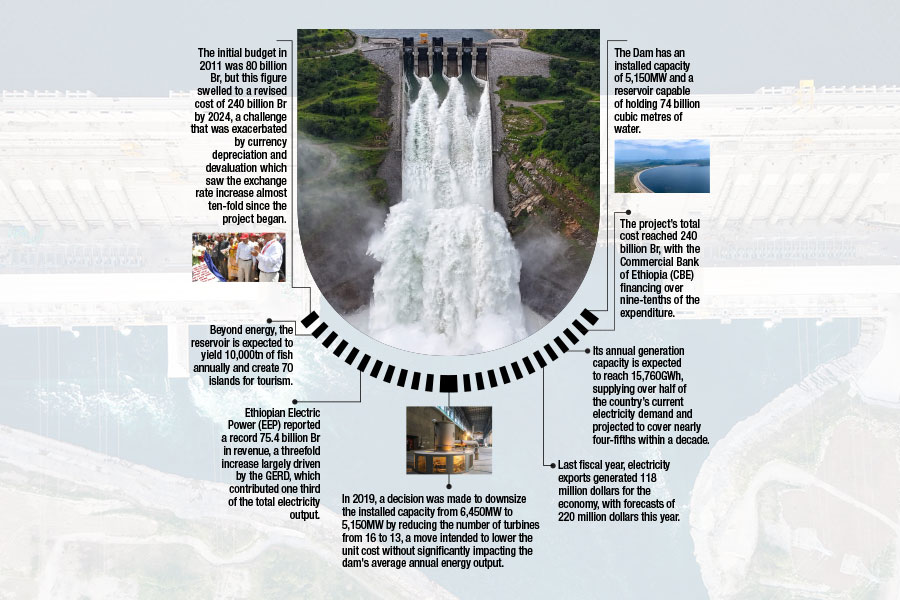

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Sep 13 , 2025 . By BEZAWIT HULUAGER

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...