Radar | Sep 29,2024

Oct 15 , 2022

By Landry Signé

The real game changer is the AfCFTA. Removing tariffs for a wide range of products across the continent will lower production costs and shift foreign direct investment towards manufactured goods. This, in return, will reduce transit costs and shorten supply chains, significant benefits in a globalised economy, writes Landry Signé, a professor and a managing director at Thunderbird School of Global Management and a senior fellow at the Brooking Institution.

Africa is on the cusp of an economic transformation. By 2050, consumers and businesses investing on the continent will reach roughly 16.1 trillion dollars.

The coming boom offers tremendous opportunities for global businesses, especially US companies looking for new markets.

But unless African policymakers remove existing barriers of regional trade and investment, the continent's economy will struggle to reach its true potential.

Two major trade agreements, the African Growth and Opportunity Act (AGOA) and the African Continental Free Trade Area (AfCFTA), make it easier for African countries to trade with one another and the United States. The agreements are promising to remove long standing impediments of industrialization.

AGOA, passed by the US Congress in 2000, gives countries in sub-Saharan Africa preferential trade access, allowing them to export duty free products to the US. Although AGOA expires in 2025, US president Joe Biden's sub-Saharan Africa strategy, unveiled in August, highlights its positive impact and promises to work with Congress on ways to proceed after it lapses. AfCFTA, on the other hand, is an intra-African trade agreement with no expiration date. Established in 2018, its goal is to deepen trade ties between African countries by removing tariff and non-tariff barriers.

Although these agreements' scope, focus, beneficiaries, and structure differ significantly, they are essential to strengthening African regional integration. Rather than viewing them as separate or competing agreements, policymakers and investors should recognise how they can complement each other in creating, sustaining, and transforming value chains across the continent.

Value creation is critical to Africa's economic transformation. In 2014, manufactured goods accounted for about 41.9pc of the trade between African countries, compared to 14.8pc of their exports to the rest of the world. Greater regional integration will provide Africa with a larger supply market, accelerating manufacturing specialisation and making African producers more competitive globally. More robust manufacturing industries will provide jobs for low-skilled workers, particularly those not integrated into the formal economy currently.

AGOA has already created some opportunities for cross-border value chains. Yet, despite some success stories like Madagascar's apparel industry, which relies on an extensive regional supply chain, such opportunities remain limited. While integration has improved since AGOA's implementation, particularly since 2015, it remains somewhat superficial. Less than 17pc of Africa's commercial value is currently generated through intra-African trade.

The real game changer is the AfCFTA. Removing tariffs for a wide range of products across the continent will lower production costs and shift foreign direct investment towards manufactured goods. This in return will reduce transit costs and shorten supply chains, significant benefits in a globalised economy.

The International Monetary Fund (IMF) predicts that under the AfCFTA, Africa's expanded goods and labour markets will become more efficient, driving significant competition between the countries. By creating a true continental market that prompts a higher rate of intra-African trade, the AfCFTA will likely provide a further incentive to US-based multinationals.

Effective regional integration is essential for Africa. Without it, the continent will continue to be overlooked and outpaced globally in manufacturing, information technologies, and agriculture. When considering the future configuration of AGOA and the AfCFTA, policymakers should regard them as complementary mechanisms for ensuring Africa's long-term economic development.

PUBLISHED ON

Oct 15,2022 [ VOL

23 , NO

1172]

Radar | Sep 29,2024

Viewpoints | May 11,2024

Commentaries | Feb 06,2021

Commentaries | Apr 17,2020

Radar | Aug 18,2024

Viewpoints | Feb 17,2024

Viewpoints | Jul 26,2025

Radar | Aug 03,2025

Viewpoints | Aug 30,2025

My Opinion | Apr 20,2024

Photo Gallery | 154888 Views | May 06,2019

Photo Gallery | 145159 Views | Apr 26,2019

My Opinion | 135107 Views | Aug 14,2021

Photo Gallery | 133593 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Sep 15 , 2025 . By AMANUEL BEKELE

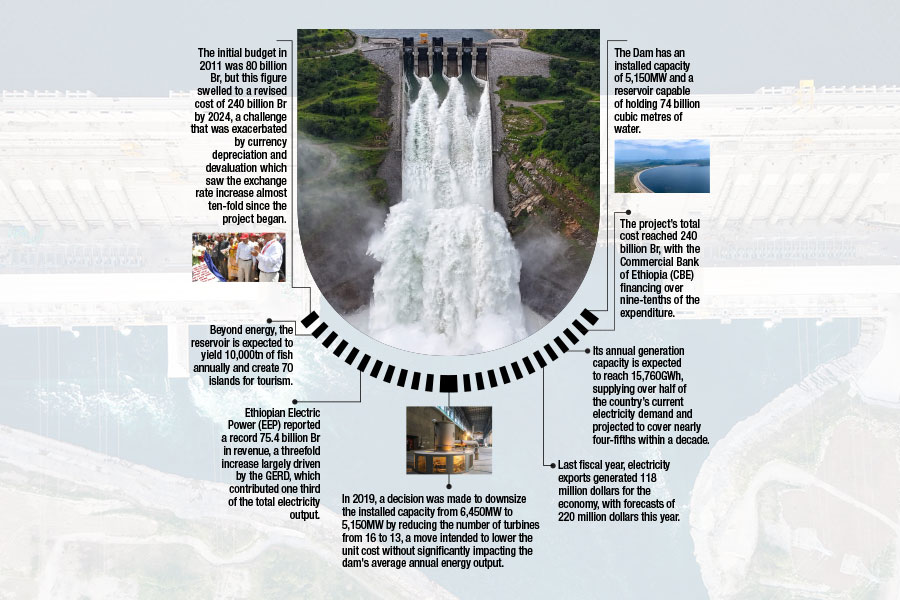

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Sep 13 , 2025 . By BEZAWIT HULUAGER

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...