Verbatim | Feb 06,2021

Aug 20 , 2022

By Asseged G. Medhin

For decades, inflation was insignificant, especially in the developed world. In some countries, the economy was actually at risk of deflation, necessitating negative interest rates. Things have changed now, both in developing countries like Ethiopia and in the developed world.

Among the economic factors that affect the financial sector, inflation is near the top. For insurers, inflation is difficult to price both named and unnamed perils, let alone its multiple impacts on loaded claims of the insured. As a result, it is necessary for them to pay close attention to movements in interest rates. Central banks are currently hiking interest rates targeting price stability over economic growth. The hope is to ward off stagflation. For insurers, rising interest rates are good news as investment returns set to improve.

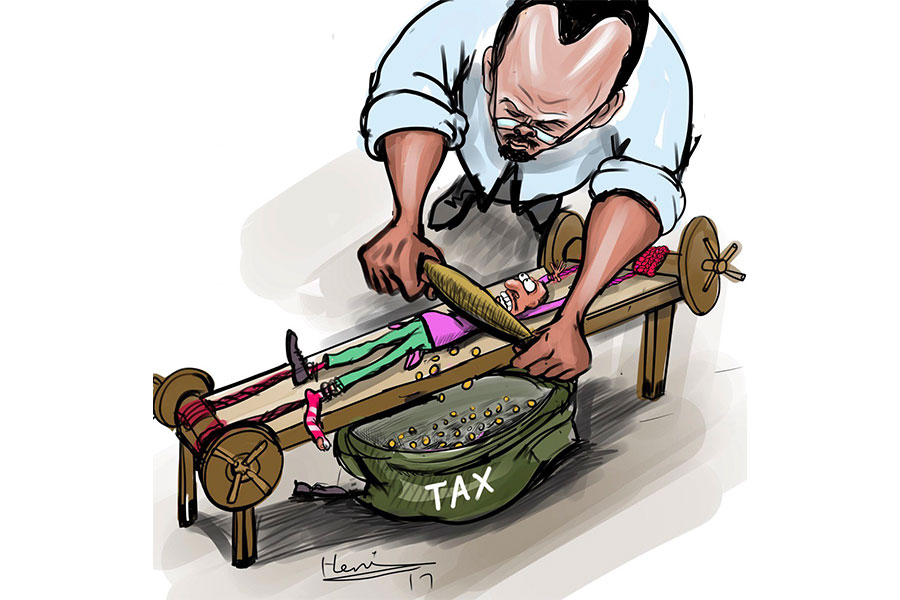

This does not mean that all is well, though. As the price of goods and services soars, companies are increasingly getting pummeled by rising human resource, input, and logistics costs, putting tremendous pressure on the bottom line. In the case of insurance companies, especially in claims management, inflation poses a major risk. Company leaders should review all costs with detailed analysis.

For insurers, the main inflation impact will show in rising claims costs, more in non-life than life insurance in which policy benefits are defined at inception. Motor and liability lines of business will likely be most immediately impacted. Accident and motor and general liability will also be affected, with inflation feeding into bodily injury claims. The key here is the time value of money. Insurance coverage likely to be claimed early will be more costly than the likes of life insurance, which are claimed much later.

The Ethiopian financial sector is unique in many regards, where one finds lucrative profit in a higher inflationary economy while interest rates are defiantly much lower. During periods of financial turbulence, creating a pricing strategy is mandatory: executives should take it as a daily assignment since it is the longest lever they can pull when driving profitability. Yet, so many firms have underinvested in it. Most products and services have their own costs, competition, and value to customers and require unique optimal pricing tactics.

The management should establish a team that analyses the company’s costs to determine where inflation is exerting the heaviest pressure. Companies must establish a baseline of the impact on cost pressure on margins and use that as a floor for formulating price targets.

Insurers' book of claims recovery and claims processing time, unlike reinsurers who works in the most advanced market, which adjusts impact of inflation, demands revision before wrongly declaring gross profit.

The other essential strategy to adjust the impact of inflation is settling claims promptly, not spreading price or increasing premiums on all insurance products. The public, existing and potential customers are in budget constrain and thus the gross written premium will go down. Increasing costs for customers under such circumstances not only breeds mistrust and leaves customers frustrated but almost ensures that future price hikes will not be taken seriously. Especially for the insurance sector, which highly demands building trust with the customer, operating with price shall be carefully handled in an inflationary situation.

Many companies are angling for larger price increases owing to inflation, much to the irritation of customers. The key is to demonstrate to salespeople that customers are not paying more for the same product or service; a sale has many facets, each potentially offering value for the customer and revenue for the company. A good starting point often overlooked is to reexamine the terms stipulated in the insurance contract, which could give wiggle room for higher premiums and improved customer value.

Other strategies include “give-gets,” a simple negotiation in which insurers, for example, postpone a customer’s premium increase in exchange for a longer contract. Another tactic often used by companies is to rearrange the elements of bundled service packages to better meet customers’ needs and merit a higher price.

Letting customers that could not pay more go may be taken as a solution to reducing the cost of inflation. But the cost of customer acquisition is much higher than retaining them. Insurers should not attempt to take the easy way out.

PUBLISHED ON

Aug 20,2022 [ VOL

23 , NO

1164]

Verbatim | Feb 06,2021

My Opinion | Nov 21,2018

View From Arada | Dec 28,2019

Radar | Dec 05,2018

Featured | Apr 22,2022

Agenda | Feb 06,2021

Agenda | Apr 19,2025

Viewpoints | Aug 27,2022

Commentaries | Mar 13,2021

Fortune News | Jan 13,2020

My Opinion | 133144 Views | Aug 14,2021

My Opinion | 129643 Views | Aug 21,2021

My Opinion | 127476 Views | Sep 10,2021

My Opinion | 125012 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Aug 9 , 2025

In the 14th Century, the Egyptian scholar Ibn Khaldun drew a neat curve in the sand....

Aug 2 , 2025

At daybreak on Thursday last week, July 31, 2025, hundreds of thousands of Ethiop...

Jul 26 , 2025

Teaching hospitals everywhere juggle three jobs at once: teaching, curing, and discov...

Jul 19 , 2025

Parliament is no stranger to frantic bursts of productivity. Even so, the vote last w...

Aug 10 , 2025 . By BEZAWIT HULUAGER

After four years of legislative gestation and eight months of bureaucratic buildup, t...

Aug 9 , 2025 . By YITBAREK GETACHEW

All diesel and gasoline vehicles will be barred from operating without an official em...

Aug 9 , 2025 . By YITBAREK GETACHEW

Federal agriculture authorities have unveiled their most ambitious horticulture drive...

Aug 9 , 2025 . By RUTH BERHANU

An elite private school has sparked controversy over fees after its Administration mo...