Editorial | Sep 21, 2024

May 7 , 2022

By Koichi Hamada

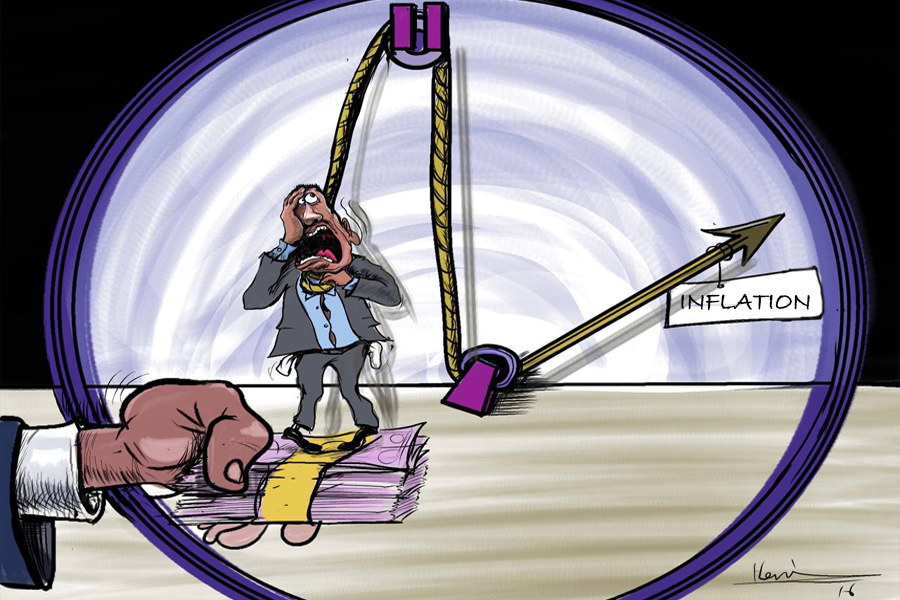

To understand the increase in consumer price inflation around the world, one must look not only at supply and demand but also at the wedge that the coronavirus introduced between them. And now Russia’s war on Ukraine has added another source of inflationary pressure, writes Koichi Hamada, professor emeritus at Yale University, was a special advisor to former Japanese Prime Minister Abe Shinzo.

Until a few years ago, major economies were struggling to achieve even mild inflation, with policymakers in the United States, the United Kingdom, and the eurozone struggling to meet their targets of two percent annual price growth. But with the arrival and persistence of COVID-19, the world changed dramatically. Two years later, everyone is worried about soaring inflation and how it can be contained.

The rates of consumer price inflation have varied across countries, reflecting their economic conditions and people’s expectations of future inflation. At the end of 2021, the US annual inflation rate was 4.7pc, compared to 4.8pc in the UK and five percent in the eurozone. A common feature is that inflation rates appear to be accelerating. Hence, after experiencing negative rates of inflation for much of the year, Japan’s month-to-month inflation rate in December 2021 had risen to 0.8pc.

Why did inflation emerge during the pandemic, and under what conditions will it level out or even disappear?

In general, inflation starts when demand for goods or services exceeds their supply. Demand-pull inflation typically occurs when demand is boosted by expansionary monetary or fiscal policies. In a simple demand-supply diagram, the downward sloping demand curve shifts up and to the right, and the equilibrium price and quantity both rise.

Similarly, cost-push inflation occurs when the upward-sloping cost curve shifts upward, such as when the prices of energy and raw materials rise. In this scenario, the price level typically will increase, and the quantity traded will decrease.

But in the case of COVID-19, there was a different mechanism at work. Inflation was generated by the difficulty of matching demand and supply in the marketplace. Consider a retail market. During the worst period of the pandemic, many people could not (or were reluctant to) go to stores. The virus obstructed many trading opportunities, not only in retail but also in air travel, restaurants, entertainment, and many other sectors.

In the standard supply-demand diagram, the demand curve and the supply curve both stayed the same as in the pre-pandemic era. People still wanted to travel, and the airline industry still wanted to serve customers if it could do so without endangering them or flight personnel. But in the absence of possibilities to match supply and demand safely, trading opportunities were lost.

The virus was thus a wedge that intervened vertically between the demand curve and the supply curve. When this happens, trading quantity will be reduced, and there will be a difference between the demand price and the supply price. The difference is the vertical length of the wedge, which represents the cost of making trade possible and safe. The higher price that consumers must pay is the symptom of inflation. Usually, this inflationary situation is combined with smaller (or, in extreme cases, nonexistent) trading opportunities.

That brings us to the question of when COVID-induced inflation will retreat. The short answer is that it will abate when the disease or the factors blocking the market from normal matchings disappear.

If governments view reduced trade as undesirable, they will try either to increase consumption by stimulating demand or to keep supply chains intact by subsidizing producers – as many governments have done. But such spending will be inflationary for the economy as a whole, and it may well become a source of full-fledged demand-pull inflation.

Moreover, the public may develop higher price expectations that will feed back into the inflation process. Jason Furman of Harvard University recently warned of this possibility and characterised the US situation as being largely a case of demand-pull inflation. Prices have increased alongside the recovery of trading opportunities in many markets, he observes, and he worries about the continuing effects of a buildup in demand from US President Joe Biden’s huge pandemic response and recovery packages.

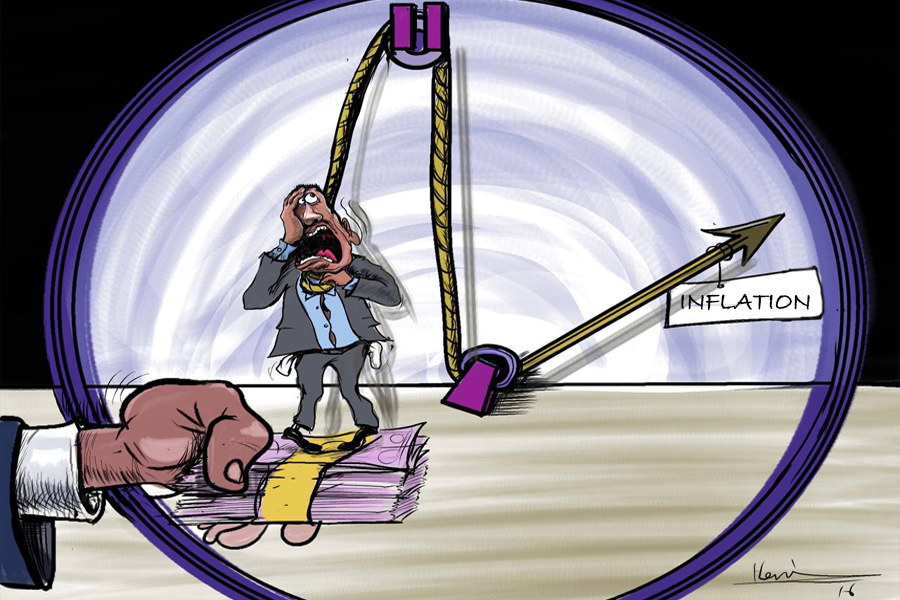

Russia’s invasion of Ukraine has confronted the world with another source of inflationary pressure. To enforce sanctions against Russia for its aggression, the West must reduce or stop its purchases of Russian oil and gas. That means the relative price of hydrocarbons must rise, implying an increase in prices overall. In this scenario, there will be momentum toward greater cost-push inflation – a painful but perhaps necessary choice for the West to punish Russia.

A nuclear war tends to be considered outside the realm of possibility, as it would result in the total destruction of both Russia and the US. But this has the effect of increasing the use of conventional arms – a case of what the American political scientist Glenn Snyder called the “stability-instability paradox” of mutual assured destruction.

By launching its war in Ukraine, Russia has taken full advantage of this paradox. The conflict is likely to be prolonged, and for a Western deterrence policy to reduce the human costs of the war, supply and demand sacrifices will need to be endured worldwide. That means we will be feeling the effects of higher energy prices – and higher inflation – for some time to come.

PUBLISHED ON

May 07,2022 [ VOL

23 , NO

1149]

Editorial | Sep 21, 2024

Fortune News | Aug 12,2023

Agenda | Jun 25,2022

My Opinion | Feb 19,2022

Fortune News | Nov 07,2020

Featured | Sep 28,2019

Editorial | Jun 22,2024

Radar | Nov 24,2024

Editorial | Aug 19,2023

Fortune News | Oct 23,2021

My Opinion | 131256 Views | Aug 14,2021

My Opinion | 127606 Views | Aug 21,2021

My Opinion | 125579 Views | Sep 10,2021

My Opinion | 123225 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

May 31 , 2025

It is seldom flattering to be bracketed with North Korea and Myanmar. Ironically, Eth...

Jun 21 , 2025

In a landmark move to promote gender equity in the banking industry, the National Bank of Ethiopia (NBE) has released its inaugural Gender F...

Jun 21 , 2025 . By BEZAWIT HULUAGER

Officials of the Ministry of Urban & Infrastructure have tabled a draft regulation they believe will...

Jun 21 , 2025 . By AMANUEL BEKELE

A sudden ban on the importation of semi-knockdown and completely knockdown kits for gasoline-powered vehi...

Jun 21 , 2025 . By RUTH BERHANU

Mufariat Kamil, minister of Labour & Skills (MoLS), is rewriting the rules on overseas work, hoping t...