Mar 12 , 2022

By Barry Eichengreen

The sanctions imposed on Russia in response to its invasion of Ukraine are financially and economically devastating, which is precisely their intent. Having witnessed this demonstration of financial shock and awe, will other countries re-think how and where they hold their foreign assets, asks Barry Eichengreen, professor of economics at the University of California, Berkeley.

Russia’s invasion of Ukraine is radically redrawing the global economic, political, and security landscape. Politically, it is pushing Russia away from Europe. It has redoubled NATO members’ commitment to their alliance and led Germany to abandon its aversion to defense spending. Economically, it augurs an extended period of high energy prices as Europe weans itself from Russian oil and gas, in turn raising the spectre of stagflation.

On the financial front, Russian banks have been barred from doing business in the West and have been cut off from SWIFT, the bank messaging system for international payments. The central bank’s securities and deposits have been frozen, rendering it incapable of stemming the ruble’s fall. It is similarly unable to act as a lender of last resort to financial institutions, such as Sberbank, with obligations in foreign currencies. These measures are financially and economically devastating, which is precisely their intent.

Having witnessed this demonstration of financial shock and awe, will other countries re-think how and where they hold their foreign assets? Will they seek a safe haven in China, which has not sanctioned Russia, and its currency, the renminbi?

Recent experience suggests not. Over the last couple of decades, the share of dollars in identified foreign-exchange reserves worldwide has fallen by roughly ten percentage points, as central banks diversified away from the greenback. But the resulting migration has been only one-quarter into the renminbi and fully three-quarters into “subsidiary” reserve currencies such as the Australian dollar, Canadian dollar, Swedish krona, and Swiss franc.

These currencies are easily traded. Combine them and they comprise a reasonably-sized aggregate. They provide reserve managers with diversification benefits, because they do not move in lockstep with the dollar. But all of their issuers, including even neutral Switzerland, are supporting the anti-Russia sanctions, which means that none of these currencies is likely to provide a haven for governments violating international norms.

Why has not there been more migration toward the renminbi?

Part of the answer is that renminbi-denominated bonds and bank deposits are not easily accessed by foreign official investors, at least in the relevant quantities. Dim sum bonds (renminbi-denominated bonds traded offshore, in Hong Kong and elsewhere) and offshore renminbi bank deposits are accessible, but other instruments not so much. Although Hong Kong and Shanghai operate a Bond Connect through which overseas investors can invest in Mainland China’s interbank bond market, few if any central banks are on the list of approved investors authorised to participate in the scheme.

Moreover, Russian President Vladimir Putin’s actions are sure to remind central banks’ reserve managers of a fundamental fact: every leading international and reserve currency in history has been the currency of a political democracy or republic, where there are credible institutional limits on arbitrary action by the executive. Under President Xi Jinping, China has of course been moving in the opposite direction – away from such limits. The collective rule of former Chinese presidents Hu Jintao and Jiang Zemin has given way to a personalistic regime very similar to Putin’s. Few reserve managers will be inclined to place their asset portfolios at Xi’s mercy.

In any case, by definition, China, the single largest reserve holder, cannot hold its own currency as foreign reserves.

So how will the international monetary system be affected by sanctions against Russia? To answer this question, it is important to bear in mind that countries hold reserves for two reasons: to intervene in the currency market to mitigate unwelcome fluctuations, and as a war chest to be tapped in a geopolitical conflict or other emergency.

In practice, the same pool of reserves can be used for both purposes: for market operations in normal times and for emergency purchases in a crisis. One is reminded how the Allied Powers used their gold and foreign-exchange reserves for currency-market intervention in the 1930s and then to purchase war materiel from the United States following the outbreak of World War II.

Russia’s recent experience suggests that a war chest of gold and foreign-exchange reserves may not be as useful as previously supposed. The inability of Afghanistan’s new Taliban-led government to access its dollar reserves in New York points in the same direction.

Less utility in a conflict therefore means that countries contemplating being on the outs with the US and the Western alliance may be inclined to hold fewer reserves. This adjustment would mean that there might also be circumstances where they have less capacity to intervene in the currency market and will have to accept wider exchange-rate fluctuations.

Sensible governments respond to this eventuality by hardening their financial systems against currency risk. They prevent their banks and corporations from incurring excessive foreign-currency liabilities. Prior to launching its war, Russia had moved in this direction, but insufficiently so, presumably because Putin failed to anticipate the West’s massive financial sanctions. Other governments are unlikely to make the same mistake in the future.

PUBLISHED ON

Mar 12,2022 [ VOL

22 , NO

1141]

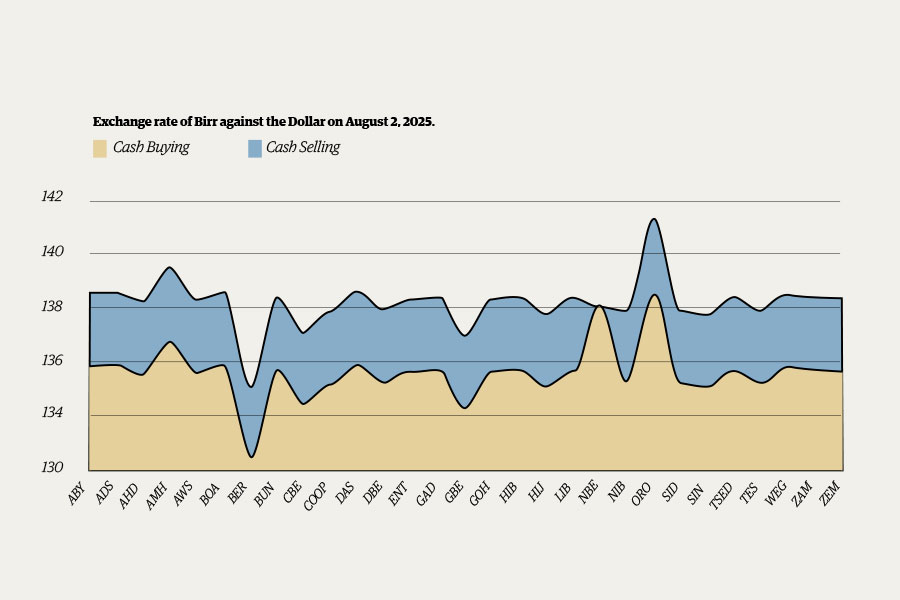

Money Market Watch | Aug 03,2025

Viewpoints | Oct 01,2022

Viewpoints | Aug 25,2024

Commentaries | Feb 13,2021

Commentaries | Oct 30,2021

Photo Gallery | 171503 Views | May 06,2019

Photo Gallery | 161744 Views | Apr 26,2019

Photo Gallery | 151472 Views | Oct 06,2021

My Opinion | 136302 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...