Viewpoints | Nov 16,2024

Mar 28 , 2020

By Mhraf Worku

The Economic Community of West African Countries (EC0WAS), the regional bloc of countries in West Africa, has been working toward a joint currency across member states. With the Eco, they could be swapping their currency for a new one sooner than later, writes Mhraf Worku (mhrafaworku@gmail.com), a freelance journalist currently based in Addis Abeba.

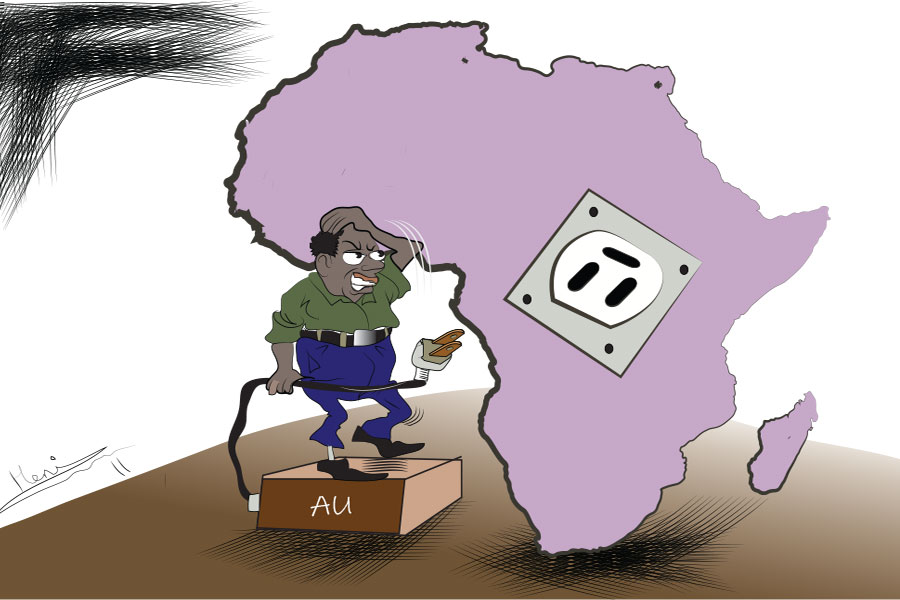

For three decades, the Economic Community of West African Countries (EC0WAS), the regional bloc of countries in West Africa, has been drumming up its efforts to adopt a joint currency across member states. Established in 1975, the 15-country group was founded with the mandate to “create a single, large trading bloc through economic cooperation.” This dream seems to be closer to realisation than ever before.

Sooner than later, the countries could be swapping their currency for a new one, the Eco. As part of the group’s vision of a borderless and integrated region, the idea of a single currency or monetary union is a goal that dates back to the formation of ECOWAS.

The move to an integrated currency is seen as a policy to facilitate better trade, lower transaction costs and realise the bloc’s vision of a fully integrated economic union. Despite announcing the idea around the beginning of the millennium, the bloc has seen the target launch date postponed multiple times after it was initially set to come into effect back in 2003.

Currently, while seven of the 15 countries - Nigeria, Ghana, Cape Verde, Sierra Leone, The Gambia, Guinea and Liberia - have their own currencies, the other eight - Ivory Coast, Mali, Senegal, Niger, Burkina Faso, Guinea-Bissau, Senegal Togo, and Benin - use a common currency, the CFA Franc.

The adoption of a common currency also has an important political dimension to it. For eight of the 15 countries that use the CFA Franc, a move toward the Eco would mean letting go of the CFA. For these nations, the value of the currency is ensured by the European Central Bank. Since the CFA is pegged to the euro, these nations have lower interest rates and in general,enjoy currency stability.

However, to maintain the peg, these countries are required to deposit half of their foreign reserves with the French treasury, a policy that has been seen as limiting the monetary sovereignty of these nations. The continued use of the CFA Franc, however, has garnered criticism, as it is seen by some as a colonial tool still used by France.

The heavy French involvement and the restricted monetary autonomy of these nations over their own economy has served as a political impetus for African politicians to adopt a new currency and end the seven-decade tale of the CFA Franc, which is mired in the dark colonial history of the region.

Although it is set to launch this year, adoption of the Eco faces many challenges. From structural issues to volatility of the region, there are several concerns the countries are yet to face and address.

The effectiveness of a single currency lies on a foundation of economic alignment. As of now, only five of the region’s fifteen countries currently meet the single currency’s criteria of a budget deficit no higher than four percent and inflation rates of not more than five percent. Since there is a divergence in the stability and also size of the different economies in the group, it will be a big challenge to create alignment for the Eco to launch.

For the CFA Franc users, the nations also risk forgoing macroeconomic stability when changing to the Eco. A peg to the Euro is predominantly why these nations have a record of stability, and a move to the Eco could jeopardise that.

This is perhaps why eight of the 15 nations that use the CFA Franc announced back in December 2019 their decision to rename the CFA as the Eco. Ivory Coast’s president, Alassane Ouattara, alongside the French president, Emmanuel Macron, stated that several structural reforms in addition to the renaming of the currency were to take place. While some of the core issues were addressed, such as CFA Franc nations no longer being required to store half of their foreign reserves with the French treasury, there still remain concerns.

One important issue is that the new currency would remain pegged to the euro. This development has thrown yet another curveball at the overall adoption of a common currency within ECOWAS. For the remaining nations, one glaring question has been why the CFA Franc users chose Eco as the name of their currency despite the larger group having chosen to use it initially. Furthermore, there is the issue of what the new currency being pegged to the euro would mean to the rest of the nations and their economic sovereignty.

These structural issues, in addition to civil strife, corruption and high volatility in the region makes it unclear if the necessary changes will take place in the run-up to the launch date of the Eco this year.

For instance, violence has broken out in Guinea after a controversial referendum on a new constitution saw deadly protests taking place. With insurgents in Nigeria and Mali and now with the global crisis caused by COVID-19, the adoption of the Eco will most likely be postponed once again. This is an unfortunate circumstance in the creation of a single, large trading bloc able to boast greater economic competitiveness on the global stage.

PUBLISHED ON

Mar 28,2020 [ VOL

20 , NO

1039]

Viewpoints | Nov 16,2024

Sunday with Eden | Feb 16,2019

Commentaries | Oct 30,2021

Radar | May 04,2024

Radar | Mar 27,2021

Fortune News | Dec 08,2024

Fortune News | Oct 30,2021

Editorial | Jun 08,2019

Editorial | Sep 30,2023

My Opinion | 131590 Views | Aug 14,2021

My Opinion | 127946 Views | Aug 21,2021

My Opinion | 125921 Views | Sep 10,2021

My Opinion | 123545 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...