Fortune News | Nov 07,2020

Feb 22 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

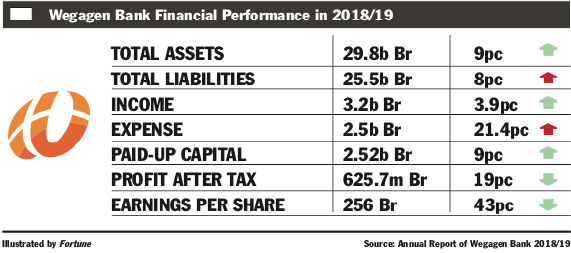

The Bank increased its paid-up capital by nine percent.

Wegagen Bank Financial Performance 2018/19

Wegagen Bank Financial Performance 2018/19 Wegagen Bank, which joined the list of the top three most profitable banks two years ago, reported a less than stellar performance in the last financial year.

Profits for the 23-year-old Bank slumped by 19pc to 625.7 million Br, leading its earnings per share (EPS) to plummet by 109 Br to 256 Br. In terms of EPS, Wegagen is one of the worst performers in the industry this past year.

The decline in EPS is a result of the decline in profit after tax coupled with capital expansion, according to Abdulmenan Mohammed, a financial statement analyst with close to two decades of experience.

Wegagen increased its paid-up capital by nine percent to 2.5 billion Br.

The previous year, the company amassed a huge profit due to 107 million Br in capital gains from the sale of its investment in Raya Brewery, according to Kindie Abebe, vice president of the Bank in charge of Corporate Services.

"Such gains didn't exist last year,” Kindie said. "The Bank wasn't also able to mobilise deposits as it expected, and as a result, it couldn't give loans as planned."

In the year Wegagen’s performance related to financial intermediation was solid. Interest income on loans and advances, treasury bills, NBE bonds and other deposits rose by 19pc to 2.5 billion Br.

"Despite the very challenging operating environment," remarked Mengisteab G. Kindan, board chairperson of the Bank, "the Bank continued to be profitable despite the registered growth in key indicators."

Double-digit inflation, poor export performance, unrest in some parts of the country, debt stress and the forex crunch were mentioned by the chairperson.

The main culprit for a reduction in profit is a considerable decline in commission fees and foreign exchange dealings income.

Non-interest earning activities - such as gains from foreign exchange, service charges and commissions - fell by 23pc to 652.1 million Br, undermining Wegagen's profit.

Wegagen should investigate the causes of the reduction and come up with a strategy to improve its performance in these areas, says Abdulmenan.

The total expenses of Wegagen expanded. Interest paid to savings soared by 37pc to one billion Birr due to expanding deposits. Salaries and benefits increased by 17pc to 794.2 million Br, and general administration expenses went up by 10pc to 569.5 million Br.

Salary raises for employees due to inflation and new staff recruitment to cope with branch openings combined to lift expenses, according to Kindie.

In the reporting year, Wegagen maintained a provision for the impairment of loans and other assets to 83.2 million Br, a decrease of six percent.

The level of provision for doubtful debts of Wegagen is reasonable, according to Abdulmenan.

Wegagen, which operates 339 branches, increased its total assets at a rate well below the industry average. Its total assets increased by only nine percent to 29.8 billion Br due to lower lending activities.

It disbursed loans and advances of 16.1 billion Br, an increase of nine percent, and mobilised deposits of 23.6 billion Br, an increase of 15pc. The Bank reported the lowest loan growth rate in the industry, as its lending activities were constrained by lower deposit growth.

The low loan disbursement to priority sectors not only made an impact on interest income but also the export business and the income from foreign currency, according to Kindie.

“The management needs to look into its deposit mobilisation strategies and lending operation,” remarked the expert.

Wegagen’s asset base expanded mainly in the form of cash, loans, investments in bonds and equity securities, and fixed assets financed from deposits and capital, according to the vice president.

"In addition to the paid-up capital, the Bank was able to accumulate 1.8 billion Br in the form of various reserves to enable the Bank to absorb potential risks,” said Kindie.

The Bank used the three billion Birr it mobilised from new deposits for lending and the purchase of government bonds from the National Bank of Ethiopia. Fifteen percent of it was held as a liquidity requirement.

During the fiscal year, the loan-to-deposit ratio of Wegagen went down to 68pc from to 73.7pc.

Despite the reduction in the loan-to-deposit ratio, the figure is reasonable, according to Abdulmenan.

The investments in NBE bonds increased by seven percent to 6.9 billion Br. These investments account for 23pc of the Bank's total assets and 29pc of its total deposits.

The liquidity position of Wegagen improved slightly in value terms but declined by a small amount in relative terms. Its cash and bank balances increased by five percent to 4.2 billion Br.

The ratio of liquid assets to total assets decreased from 14.8pc to 14pc, and the ratio of liquid assets to total liabilities decreased from 17.2pc to 16.3pc.

“The liquidity level of Wegagen is reasonable,” says Abdulmenan.

"Due to this proper fund management," said the vice president, "we didn't face a liquidity problem during the year."

Wegagen's capital adequacy ratio (CAR) increased from 23.5pc to 24.2pc. Abdulmenan says this figure indicates that Wegagen is a well-capitalized bank.

The shareholders also agreed to bump the capital of the company up to six billion Birr over the next five years. The Bank is also constructing its own buildings in the city centre.

PUBLISHED ON

Feb 22,2020 [ VOL

20 , NO

1034]

Fortune News | Nov 07,2020

Fortune News | Aug 07,2021

Fortune News | Jan 15,2022

Fortune News | Jan 28,2023

Commentaries | Mar 25,2023

Radar | Sep 11,2020

Radar | Oct 03,2020

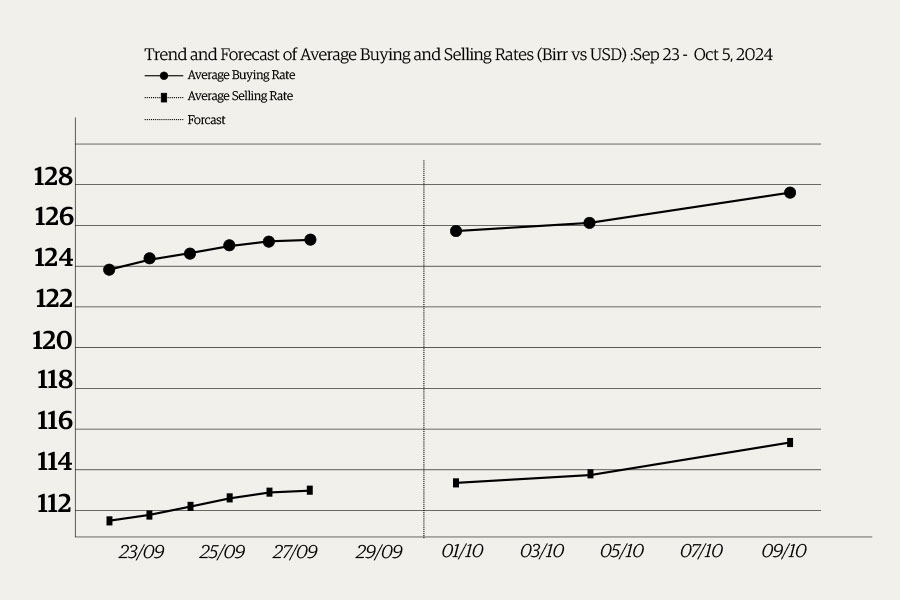

Money Market Watch | Sep 28,2024

News Analysis | Sep 26,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...