Radar | Nov 27,2023

Mar 13 , 2021

By Austine Sequeira

Following the adverse global economic recession induced by the COVID-19 pandemic last year, the world is eager to see an economic recovery. The much anticipated V-shaped recovery is highly sought after, but if reports by the World Bank are any suggestion, it will not probably happen this year.

In economic parlance, a V-shaped recovery is the economic growth statistics charted in a “V” shape - signifying the sharp decline of growth and subsequent sharp recovery. The world has witnessed such recoveries in the aftermath of the US economic depression of 1920-21 and 1953.

Is there hope for a V-shaped recovery now?

The world today is building up an arsenal of Covid-19 vaccines. Vaccine inoculation is happening in big economies. These developments, although muted, have brought a ray of hope for a better tomorrow. Three economies have been officially declared to approach the end of the recession by several economic publications: China, India and Bangladesh. It is too early to predict whether these economies are exhibiting V-shaped recoveries. Nevertheless, they have reversed the downturn of 2020 caused by Covid-19 and have started clocking in growth from the first quarter of 2021.

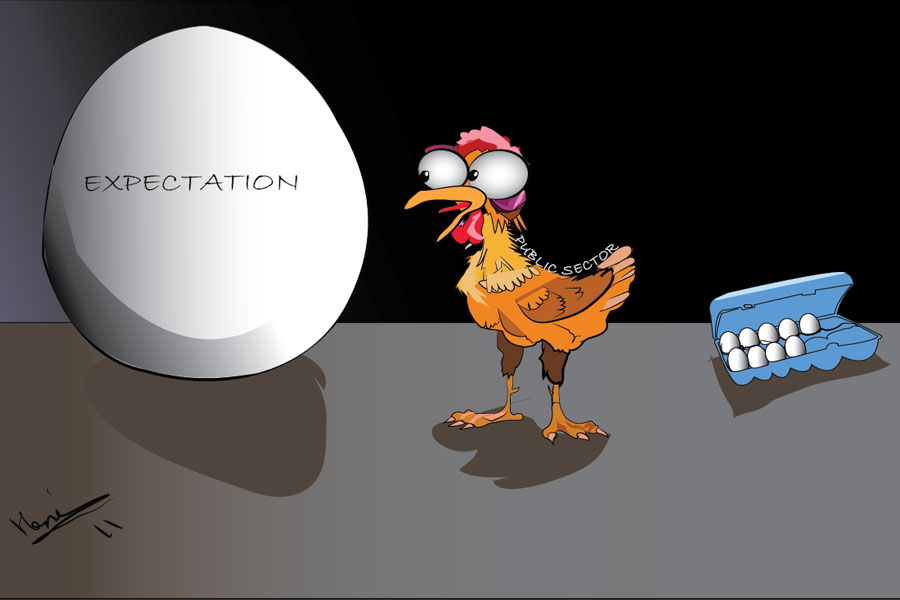

Interesting to note here is that enhanced spending on infrastructure building by the public sector at the cost of public debt and a greater role for the private sector-driven service sector through incentives has been key to revival in normal times. Surprisingly, negating this prophecy, the economies that are exhibiting sharp recoveries, such as China, India and Bangladesh, are currently being supported by the revival of the manufacturing sector.

Globally, Covid-19 restrictions on travel and transportation of goods and services are yet to be withdrawn. Therefore, international trade is taking some more time to resume at pre-Covid-19 levels. This has created great opportunities for local manufacturing sectors to ramp up production and replace imports with homegrown products and serve cross-border opportunities.

How can the most be extracted out of manufacturing?

Although the world is moving toward automation, the manufacturing sector will continue to generate jobs, consume resources and add value. Both the Indian and Chinese economies have shown resilience to downturns with support from the manufacturing sector. Their manufacturing sector has balanced their foreign trade, enabled lower supply-side inflation, and inflated their current account surplus.

Unfortunately, large African economies, including Ethiopia, are yet to address the issue of supply-side inflation by promoting local manufacturing through incentives and tax breaks. Africa generally suffers from low income and saving rates, which adversely hits capital formation and investment. The solution is not higher taxes, export of natural resources and agro-products but production-linked incentives and value-added exports.

We have not seen a single, successful export-oriented unit or special economic zone in the African continent during the past five years. Unlike India, China and other ASEAN States, African leaders do not talk about “self-sufficiency”. This buzzword has the power to build a vibrant small and medium enterprise (SME) sector locally.

A key to the growth of a manufacturing sector, and particularly the SME sector, is a vibrant financial services sector. Large manufacturing projects need voluminous, continuous funding, while the SME sector needs low-cost working capital. The government of the day must play an important role of “an enabler” by controlling interest rates and formulating production-linked incentive schemes so that the banking sector extends soft credit to the industry. Free movement of non-monetary resources is another subject the administrators must tackle to unshackle the manufacturing sector.

There was a time when the SME sector grew on informal financial means and was prone to tax leakages. Financial intermediation, digitation and tax reforms can help reform SME compliance. This sector today can attract large credit inflows from banking sectors and start up investment from prestigious international funds in emerging economies such as China and India.

Let us hope the African economists and leaders alike note the global post-COVID-19 developments and initiate far-reaching changes for sustainable growth.

PUBLISHED ON

Mar 13,2021 [ VOL

21 , NO

1089]

Radar | Nov 27,2023

Radar | Sep 28,2019

Viewpoints | Jul 13,2025

Editorial | Dec 19,2018

View From Arada | Jan 11,2020

Fortune News | Dec 09,2023

My Opinion | Nov 25,2019

My Opinion | May 24,2025

Radar | Mar 16,2024

Fortune News | May 27,2023

Photo Gallery | 178525 Views | May 06,2019

Photo Gallery | 168721 Views | Apr 26,2019

Photo Gallery | 159539 Views | Oct 06,2021

My Opinion | 137080 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...