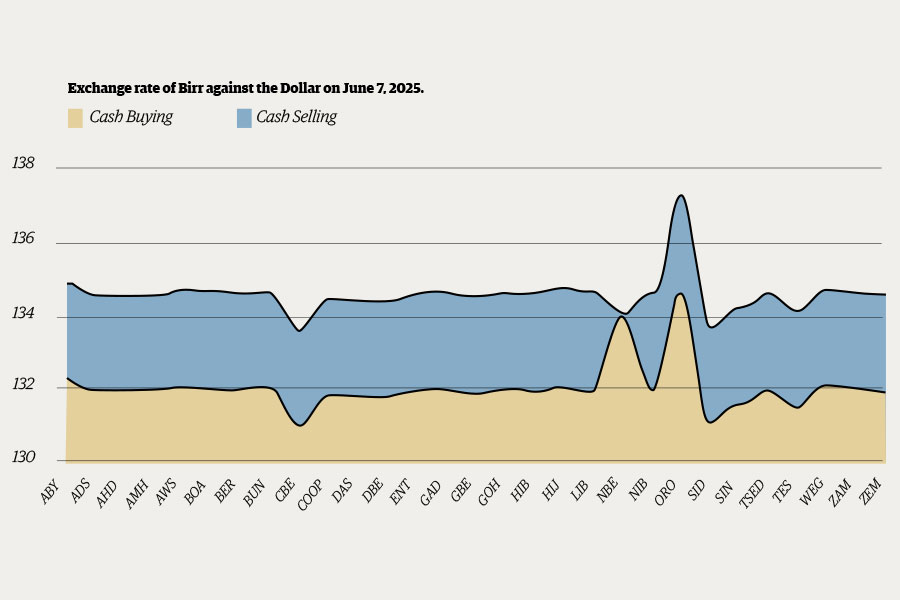

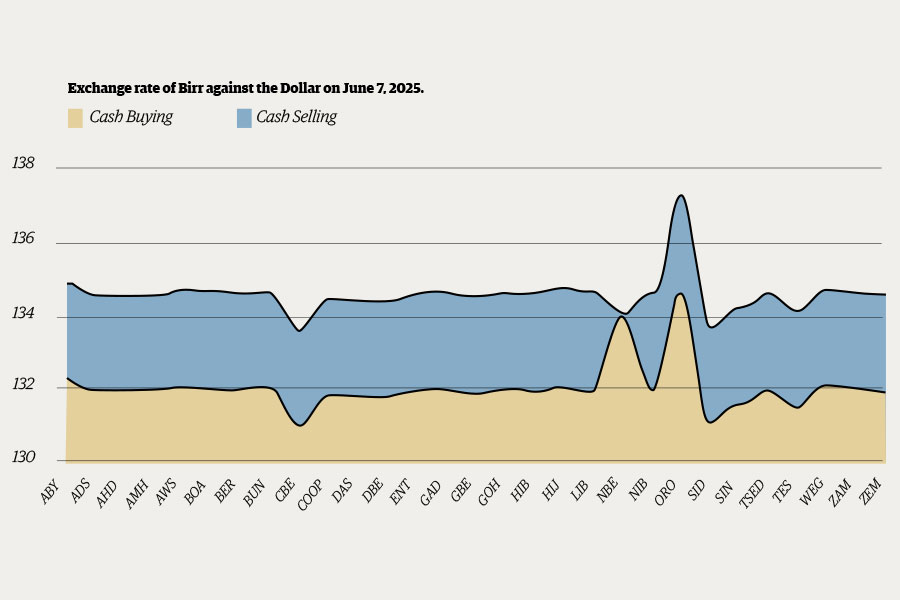

Money Market Watch | Jun 08,2025

After three weeks of controversy, the Ministry of Labour & Social Affairs has bestowed domestic workers' insurance coverage, estimated at 300 million Br, to United Insurance.

The contract limits the deal to three middle east countries - Saudi Arabia, Qatar and Jordan - with which Ethiopia has signed bilateral labour agreements. United won the bid by offering coverage of 400,000 Br for natural death and half a million Birr for accidental death for a premium of 385 Br.

The signing was planned to take place three weeks ago but was suspended as competing insurance companies filed grievances over the tender procedure.

“We’ve discussed with the insurance firms concerning their complaint,” said Berhanu Abera, director of overseas employment at the Ministry. “Yet we reached our decision as we have gone through a proper procurement procedure based on our directive.”

The Ministry floated the tender back in September and got a response from eight insurance firms.

“As the employers cover the premium, our main differentiation was based on coverage limit,” says Dereje Fikre, an adviser to the overseas employment directorate.

After a three-week delay, the agreement was signed last week by Meseret Bezabih, CEO of United, and Berhanu at the Ministry located on Joseph Tito Street.

“Thank you for handling the case genuinely," said Meseret to the officials of the Ministry during the signing ceremony. “We will deliver the service in a prudent and diligent manner.”

In addition to the three countries, Ethiopia is in the process of signing bilateral labour agreements with the United Arab Emirates, Oman, Bahrain, Kuwait and Lebanon.

Once the agreements with these countries are sealed, the remaining insurance companies will have a chance to cover the insurance of the domestic workers.

“The insurance firms have another chance to compete,” Dereje said.

United sealed the deal after vying with six companies that passed the technical evaluation stage of the bidding process.

“We have selected the winning company with the highest coverage for the sake of the workers,” Dereje said.

Though the agreement signing is a relief for the executives of the insurance firm, the management is still discontented with the limitation of the agreement to the three countries.

“We offered the premium value, assuming that we will be given the insurance need of all countries,” said Azalech Yirgu, the insurer's deputy general manager for life & medexin.

The CEO believes that the insurer secured a good deal. “Most of the domestic workers head to Saudi,” Meseret said.

The ministry is providing training to employees in order to minimise risk for the insurance company, according to the executives of United. "Insurance works with the law of large numbers," said Azalech.

Resumed in October, overseas employment was banned for the past couple of years in an attempt to curb illegal migration and exploitation of citizens abroad in regions such as the Middle East. The ban was lifted following the order of former Prime Minister Hailemariam Desalegn.

Along with lifting the ban, the government is taking a series of measures to reverse the dark image of overseas employment. The domestic workers are taking training at the 70 selected technical and vocational training centres. So far, the Addis Abeba administration has trained 54 domestic employees.

“There are many domestic workers in the regional states that are currently taking the training,” Dereje told Fortune.

The Ministry has also licensed 146 agencies to facilitate job opportunities, while more than 69 hospitals were selected by the Ministry of Health across the country to process the medical check-ups. The agents secured the licenses after depositing an equivalent amount of 100,000 dollars in Birr in blocked accounts and opening offices with a minimum of 46Sqm of space that accommodates at least six staff members.

The latest action of the Ministry was hiring an insurance company that will insure the life of the projected one million overseas workers.

To deliver the service, United has hired 12 additional staff and signed a Memorandum of Understanding (MoU) with United Bank to facilitate the claims requested across the country.

“We are training our staff and have installed an online application system for the Agencies,” Meseret said.

A labour expert with over four decades of experience commends the move by the Ministry and suggests the winning company brief the insured about the requirements, how to apply for a claim, the scope and other relevant information. “The insurance firms need to give an orientation beforehand,” said Negalign Mulatu.

United agreed with the suggestion of the expert. “We have requested that the Ministry plan a forum where we can brief the agencies about the insurance service,” Meseret said.

As a sustainable approach to avoid risks in overseas employment, Negalign suggests the government review the status of employers in foreign countries before signing further deals.

PUBLISHED ON

Dec 05,2018 [ VOL

19 , NO

971]

Money Market Watch | Jun 08,2025

Commentaries | May 11,2024

Fortune News | May 16,2020

Fortune News | Mar 14,2020

Radar | Aug 27,2022

Radar | Jun 24,2023

Fortune News | Apr 20,2019

Fortune News | Jan 11,2020

Radar | Nov 09,2024

Exclusive Interviews | Jan 05,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...