Viewpoints | Aug 10,2019

Oct 7 , 2023

By Erik Berglof

It is crucial to decarbonise the world to limit global warming to 1.5° Celsius. However, pressuring emerging economies to reach net-zero emissions too quickly could lead to an explosion of dollar-denominated debt and financial volatility across the developing world. Integrating these countries into the decarbonisation effort requires a more nuanced strategy.

Over the past year, policymakers and scholars, some from developing countries, have proposed solutions to this conundrum. As global leaders gather for the annual meetings of the International Monetary Fund (IMF) and the World Bank in Marrakesh this week, three proposals, in particular, merit serious debate.

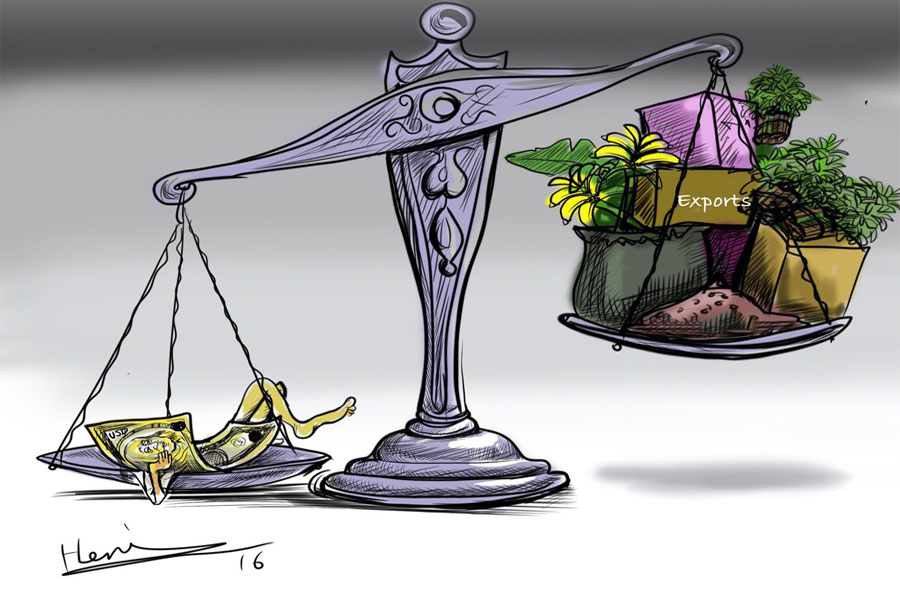

While emerging and developing economies have contributed little to the climate crisis, their carbon dioxide emissions are increasing rapidly. To achieve the economic growth their citizens expect, stay within their carbon budgets, and shift away from fossil fuels, these countries must invest significantly in green technologies, primarily financed through international capital flows.

The United Nations Conference on Trade & Development's (UNCTAD) 2023 World Investment Report projects that developing countries require 1.7 trillion dollars in annual investments to achieve a green transition. In 2022, they secured only 544 billion dollars. Most of this financing is dollar-denominated, exacerbating the debt burdens of low-income countries struggling to service their obligations following the COVID-19 pandemic and Russia's full-scale invasion of Ukraine.

Relying on other foreign-currency funding seems just as impractical, given that most of these countries' revenues are in their local currencies.

The three proposals currently being discussed complement one another. The most well-known, the Bridgetown Initiative 2.0, has brought local currency financing to the forefront of the global policy debate.

The original Bridgetown Initiative - championed by Barbadian Prime Minister Mia Amor Mottley and her climate adviser, economist Avinash Persaud - focused on issuing special drawing rights (SDRs, the IMF's reserve asset). The updated proposal, however, urges the IMF and multilateral development banks (MDBs) to offer subsidised guarantees that account for mispriced currency risks, thereby reducing developing countries' borrowing costs.

The second proposal is to scale up and provide guarantees to the Amsterdam-based TCX, a risk-pooling mechanism designed to provide low-income countries with a cost-effective way to shield themselves from currency fluctuations. The third proposal encourages MDBs and bilateral development finance institutions to consolidate their liquidity requirements through an "onshore" platform that operates with local currencies.

Although these three proposals are tailored for different countries and economic contexts, with widely varying effects on the long-term evolution of local currencies and domestic capital markets, they could be scaled up. The Bridgetown Initiative, for example, focuses on large emitters within emerging and developing economies. This is crucial for keeping global temperatures below the 1.5°C threshold and could also be applied to many developed countries.

Similarly, though TCX primarily deals with smaller and more volatile currencies, the proposed onshore vehicle would be tailored for countries with sufficiently mature institutions. This group could be expanded to include larger and more developed economies, allowing for a wider array of hedging mechanisms.

The Bridgetown Initiative assumes a premium for hedging foreign exchange risk in emerging and developing economies. While the initiative's proponents have released a detailed empirical analysis that points to the existence of such a premium, its impact remains to be seen. Nevertheless, the overarching argument that investing in green technologies in these countries is much costlier than in advanced economies is undeniably persuasive.

The TCX strategy hinges on the lack of correlation between various currencies. Naturally, the more currencies TCX includes, the greater the pooling benefits. By contrast, the economic rationale for the onshore platform stems from the expected reduction in hedging costs when the intermediaries have access to local currencies. While the ability to expand this approach is still uncertain, there is potential for achieving economies of scale.

To avert a financial meltdown, the international community must assist emerging and developing countries manage massive capital inflows. All three proposals should be combined with renewed efforts to bolster local institutions and markets. Unlike the other two proposals, the onshore mechanism could advance this goal by partnering with central banks and commercial lenders.

The urgency and global salience of the climate crisis have created a unique opportunity to advance this agenda. Enhancing developing countries' ability to mobilise domestic savings and stabilise currency fluctuations would yield benefits far beyond the net-zero transition.

The proposed onshore mechanism, which would facilitate increased coordination among MDBs, aligns with the broader goal of streamlining the international financial system. Currently, credit-rating agencies penalise MDBs for lacking access to the same liquidity backstops as commercial banks. But, multilateral lenders could significantly increase their lending capacity by coordinating their liquidity management.

While the development of local currency and capital markets has been limited thus far, there is cause for hope. Recent shocks to the international system have affected emerging economies less severely than previous crises, indicating greater macroeconomic resilience.

Rising debt levels have raised fresh concerns, however, especially in the countries most vulnerable to climate change's effects. Enhancing these economies' resilience is crucial not just for the stability of the global financial system but also for sustaining the momentum of the fight against climate change.

PUBLISHED ON

Oct 07,2023 [ VOL

24 , NO

1223]

Viewpoints | Aug 10,2019

My Opinion | Aug 26,2023

Viewpoints | Apr 22,2022

Life Matters | Mar 27,2021

Viewpoints | May 11,2023

Life Matters | May 29,2021

Letter To Editor | Apr 18,2023

Fortune News | Jan 28,2023

Sunday with Eden | Dec 31,2022

Editorial | Sep 30,2023

Photo Gallery | 97136 Views | May 06,2019

Photo Gallery | 89359 Views | Apr 26,2019

My Opinion | 67297 Views | Aug 14,2021

Commentaries | 65801 Views | Oct 02,2021

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 27 , 2024

The Prosperity Party (PP) - Prosperitians - is charting a course through treacherous...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Apr 28 , 2024

A dire situation unfolds across public universities, where students face the harsh re...

Apr 28 , 2024 . By MUNIR SHEMSU

A European business lobby in Ethiopia issued a scathing review of the tax system last...

Apr 28 , 2024

The Federal Supreme Court has recently ruled in the prolonged commercial dispute surr...

Apr 28 , 2024 . By MUNIR SHEMSU

Transport authorities placed blame on driving schools and vehicle inspection centres...