Money Market Watch | Sep 01,2024

Nov 21 , 2018

By

Some good things have come out of policies directed to achieve the Growth & Transformation Plans, evident in the foreign direct investment the nation attracts. But there have also been significant missteps that led to today’s trade imbalance, lack of foreign currency and double-digit inflation.

The last element is of special note. It is the one thing that the average Abebe and Abebech notice as the prices of food, rent and clothing spikes. It is not that prices do not escalate often; the government considers an annual inflationary rate below 10pc, such as nine percent, the fruits of an effective monetary policy. But there are times when there are special escalations that leave a lasting effect on the lives of people as when it reached 40pc in 2011.

Over the last month, the cost of living declined by 0.5pc to 11.5pc in October, according to the Central Statistical Agency. It is high but still digestible given the 15.6pc it reached last February. But there are cases to be made that the decrease in prices may not last and that the macroeconomic malaise will get worse.

Take the increase in the retail prices of petroleum products by the Ministry of Trade & Industry. The price of fuel is often what leads to the spiral in the cost of goods in Ethiopia, right up there with the devaluation of the Birr against a basket of major currencies and a bad harvest season.

Added to this is the incremental increase in the price of electricity. Since it is very cheap to begin with, it looks like the effect might not be felt in the end. But as the cost aggregates, especially on major manufacturers of goods, the price increases will be felt on the consumer at the supermarket or at the barbershop.

The government seems to be making some cutbacks as the nation is in financial difficulties. A number of factors have combined for this to occur, such as ill-performing state enterprises, projects with major cost overruns, massive debt and economic unproductivity.

It looked as if the light at the end of the tunnel was close. The incumbents were singing the song of double-digit growth, which we believed given that roads and buildings were popping up all over the place.

Of course, we chose not to notice that the government was taking on huge loans; that projects like the new waste-to-energy facility in Addis Abeba were too good to be true; and that parastatals were growing too large and powerful for the nation’s meek parliament to reign in.

Officials often like to hold the three years of protests responsible for a number of ills in the economy. No doubt, unrest has had an effect. But the primary driver has always been indulgent monetary and fiscal policies. At this point, this is a cliché recycled every year by the International Monetary Fund’s Article IV consultations, but only because it is true.

The government grew too big for its own good, crowding out the private sector in the allocation of resources. Things might have turned up had there been no complication of factors such as drought, political protests, sluggish performances of international commodity prices, slower than thought manufacturing industry growth and mismanagement of funds.

The private sector remained tame, simple and small. It could neither offer sufficient employment opportunities nor supply enough goods to meet market demands. There has been little thought put into a scenario when the government, the major driver of the economy, which is also expected to correct for market failures, is without enough resources to offer the economy a cure.

Since this is a problem that has persisted for years, there are no economic prescriptions that will fix it right away. The sickness is at the core of the economy, thus pouring more money into it will be like putting makeup on an ill person.

Fiscal and monetary discipline is the most effective, yet least flamboyant, means of addressing the macroeconomic predicaments, coupled with targeted and gradual economic reforms toward opening up space for Ethiopia’s private sector.

The cost of living will probably increase, when such reforms take effect which the populace will find uncomfortable and will be tough politically for Prime Minister Abiy Ahmed’s (PhD) administration. But if indeed Abiy intends to walk the talk on his promise to do what is best for the public instead of indulging in political expediency, this should not be much of a problem.

PUBLISHED ON

Nov 21,2018 [ VOL

19 , NO

969]

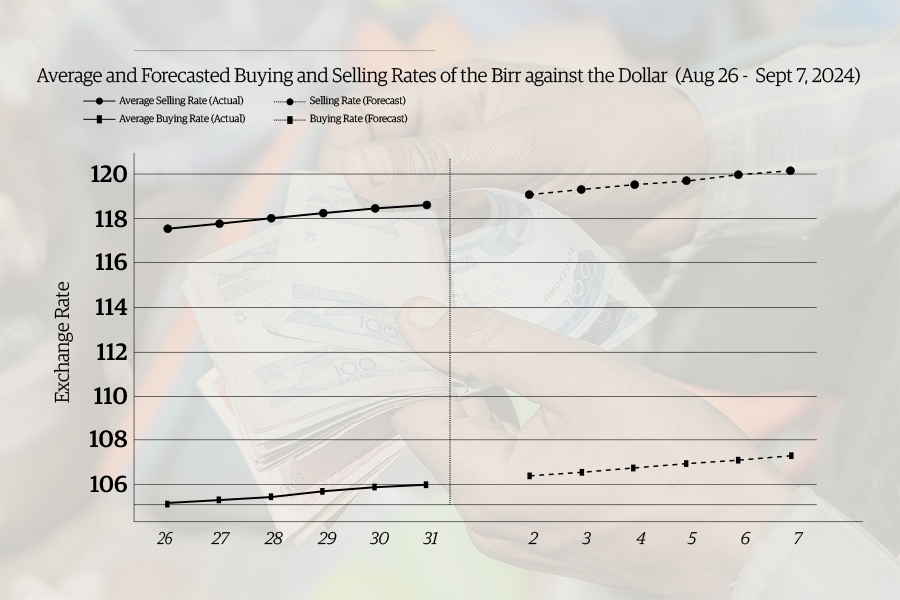

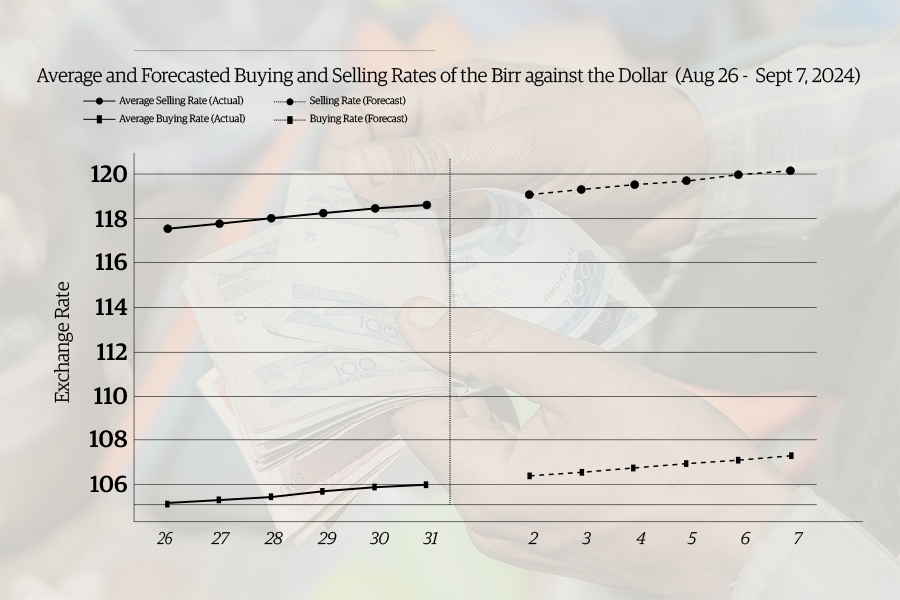

Money Market Watch | Sep 01,2024

Fortune News | May 17,2025

Fortune News | Feb 06,2021

Money Market Watch | Apr 13,2025

Fortune News | Oct 16,2021

Commentaries | May 28,2022

News Analysis | Mar 04,2023

Sunday with Eden | Jun 05,2021

Fortune News | Jul 13,2024

Sunday with Eden | Apr 02,2022

Photo Gallery | 175496 Views | May 06,2019

Photo Gallery | 165718 Views | Apr 26,2019

Photo Gallery | 156067 Views | Oct 06,2021

My Opinion | 136824 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

Oct 18 , 2025 . By BEZAWIT HULUAGER

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...