My Opinion | 129539 Views | Aug 14,2021

May 12 , 2025. By BEZAWIT HULUAGER ( FORTUNE STAFF WRITER )

Labour churn erodes the flagship industrial-park experiment, unsettling managers who hoped the zones would anchor an export-led industrialisation drive. During the first nine months of the current fiscal year, 36,600 workers were recruited, but 37,000 walked out, managers of the state-owned Industrial Parks Development Corporation (IPDC) told Parliament last week.

A sharp export slump mirrors the labour flight. Factories inside the special economic zones shipped goods worth only 83 million dollars, 65pc of the 127 million dollar target for the period.

“The export market still hasn’t recovered from Washington’s suspension of the African Growth & Opportunity Act,” Fesseha Yitagesu, CEO of the Corporation, conceded at the hearing.

The trade benefits were revoked in January 2022 over alleged human rights violations during the civil war in northern Ethiopia. The loss of duty-free access has left a hole that the Corporation's management and investors have yet to patch.

A study by Habtamu Worku, an economist at the National Bank of Ethiopia (NBE), quantified the scars. At the programme’s 2019 peak, the industrial parks exported 3.23 million kilograms of apparel and footwear worth 30 million dollars a month to the United States under AGOA’s duty-free terms. Earnings collapsed to 11.3 million dollars in 2021 after the Biden Administration revoked market access, while shipment volumes fell to 2.31 million kilograms.

After a brief uptick to 12.9 million dollars in early 2022, monthly receipts slid again, landing at 10.6 million dollars by mid-2024.

Habtamu argued in this paper that the macroeconomic shock was “smaller than many feared,” yet far from trivial. The Corporation saw the loss of 18 companies, 11,400 jobs, and 45 million dollars in revenue. Volumes dropped 32.3pc, and values fell 13pc. Ethiopia’s goods sold to the U.S. in 2021 totalled 276 million dollars, 90pc of them garments once sewn in the gleaming sheds that dot the parks.

Profit remains elusive. Between July and March, the Corporation projected three billion birr from renting factory units, leasing cultivated land and providing auxiliary services. It collected three billion Birr, about 65pc of the plan, leaving a sizable cash-flow gap. Net profit followed suit. A forecast of 951 million Br dwindled to 192 million Br, barely one-fifth of the goal. Fesseha blamed tenants who “aren't paying rent as stipulated” and noted that bills fall due quarterly.

Despite financial strains, investment is a comparatively bright spot. The parks attracted 689 million dollars in fresh capital, 86pc of the target, spreading across 98 approved projects. Nine are bona-fide foreign direct investments (FDI), one is a joint venture, and the remaining 88 involve domestic investors, a reversal of earlier patterns. Local investors now supply 60pc of new money, up from roughly 10pc four years ago. Once assembly lines start humming, planners expect 22,614 jobs, though the recent high turnover shows that hiring is no guarantee workers will stay.

Import substitution, long hailed by federal officials as a path to preserve scarce foreign exchange, has been less convincing.

Birhan Eshetu, an international trade-policy analyst, argues that import substitution remains vital for Ethiopia’s growth trajectory. But, he noted that the current programme concentrates on textiles while the country’s import bill is dominated by food and beverages. For him, quality is a sticking point.

“Local goods often fail to meet market expectations,” he said, even though park operators still enjoy duty exemptions on imported machinery and a seven-year tax holiday.

To accelerate scale-up, Birhan called for extended tax holidays, duty relief on inputs and modernised logistics, including port procedures so containers clear in days rather than weeks.

The Corporation's management disclosed that factories supplied 115 million dollars in goods to the local market during the past nine months. However, several federal lawmakers complained output is slipping, especially at Hawassa, where a substitution has slumped to 37pc as the zone shifted to logistics.

Fesseha pinned part of the blame on the stop-start pattern of textile contracts.

“Military uniforms are produced only every two years,” he said, insisting the dip is temporary.

Park tenants paint a different picture.

“High taxes and cheaper prices have robbed import substitution of its allure,” said Hibret Lemma, head of the Hawassa Industrial Park Investors' Association.

Lines that once spun T-shirts for retailers abroad are now running at only 30pc to 40pc of capacity, even though Hawassa boasts “the highest human-resource footprint in the sector.” Hibret expects to “double our capacity in human resources by December” as orders stabilise.

He is betting on exports instead of the home market. European buyers are being courted, and he remains “hopeful about the U.S. market,” arguing that Washington’s recent decision to lower tariffs on some goods from Ethiopia has made products from rival suppliers less competitive. Hawassa is also branching into solar-cell exports, a diversification Hibret says will strengthen investors’ bargaining muscle in Addis Abeba.

Still, he frets that a new crop of companies is joining mainly to tap subsidised infrastructure rather than to build a coherent cluster.

Members of Parliament’s Budget Standing Committee shared some of that anxiety as close to 75pc of the Corporation’s revenue flows from only two streams, mainly rent and service charges. MPs warned that relying on a narrow base leaves the Corporation vulnerable when tenants fall behind. Executives assured them they are scouting for new income lines, including value-added logistics and agro-processing hubs, but such initiatives will take time.

Land, not money, is the pinch point that threatens expansion plans. The Corporation initially mapped estates covering 17,000hct but has held title deeds to 3,000hct.

The Corporation oversees parks in Bole Lemi, Qilinto, Kombolcha, Hawassa, Jimma, Mekelle, Semera, and the Dire Dawa Free Trade Zone. Together, the sites cover 115,918hct, and investors have lodged requests for 22 factory sheds, more than the 18 initially planned. Management says an additional 888,000hct of land will be needed to supply raw materials such as cotton, hides, and oil seeds if all the spinning and tanning lines go live.

The crunch is especially acute at Bole Lemi, on the southeastern edge of Addis Abeba, whose attraction lies in its 15-minute truck run to Bole International Airport. Residents who have taken compensation packages refuse to leave, creating a standoff.

“Meddlesome men are causing us trouble,” Fesseha told lawmakers.

The gridlock is stalling private capital. An investor who asked to remain anonymous said he received a promise eight months ago for a parcel in Bole Lemi. Expecting a turnkey facility, he borrowed half a million dollars from the Development Bank of Ethiopia (DBE) to buy machinery. When he visited the allotted plot, he found “roads and empty land.” Erecting basic sheds and utilities will cost at least another 200,000 dollars, which he had not budgeted.

Rent was initially pitched at 15,000 Br a hectare; the draft contract now demands 20 million Br.

“Foreign investment is untenable at that price,” he told Fortune.

Security tops the ledger of unexpected costs. Executives say that unrest on trade corridors has pushed premiums higher, while firms at Dire Dawa now route containers through Djibouti under armed escort. The extra outlays, together with rising energy bills, narrow margins already squeezed by softer export prices.

Seleshi Kore (PhD), deputy chairman of Parliament’s Standing Committee on Urban Development, Construction & Transport, urged managers to review “the effectiveness and productivity” of every tenant, intensify land acquisition and verify that investors have the financial muscle to deliver promised jobs.

“Find an in-house solution, as the minimum-wage regulation is not being enforced right now,” he said on the labour crunch, warning that high turnover can repeal any wage savings.

According to the expert, reforms are urgent as Ethiopia inches toward membership in the World Trade Organisation (WTO).

“Domestic businesses should be supported before the deal is signed,” he said, cautioning that lower tariffs without local capacity could widen the trade deficit. "They have to compete globally."

PUBLISHED ON

May 12,2025 [ VOL

26 , NO

1307]

My Opinion | 129539 Views | Aug 14,2021

My Opinion | 125844 Views | Aug 21,2021

My Opinion | 123856 Views | Sep 10,2021

My Opinion | 121658 Views | Aug 07,2021

May 24 , 2025

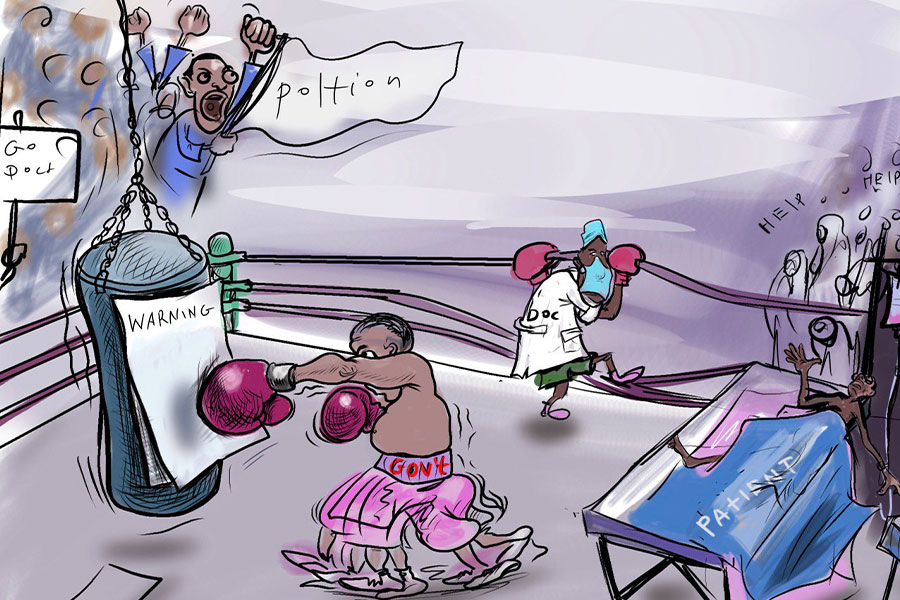

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...

May 3 , 2025

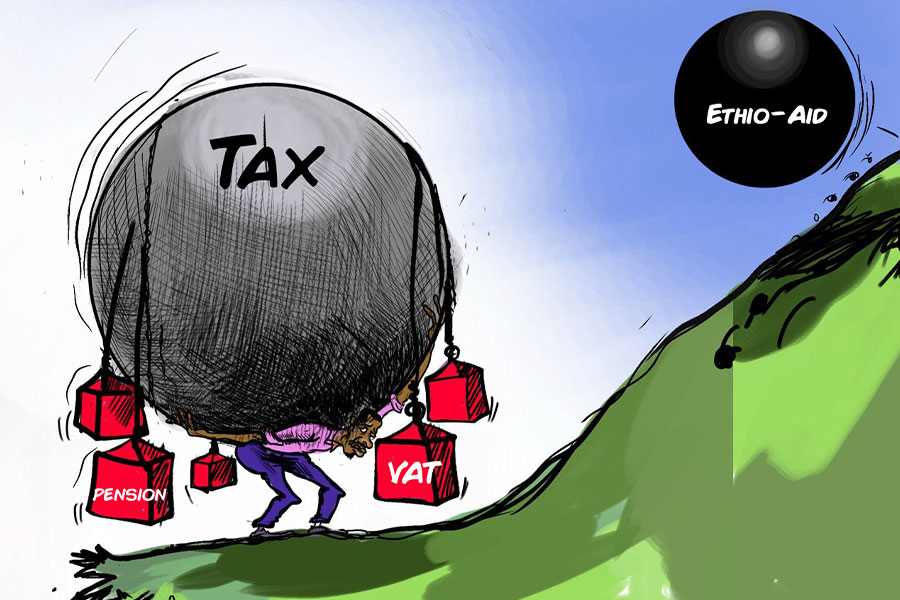

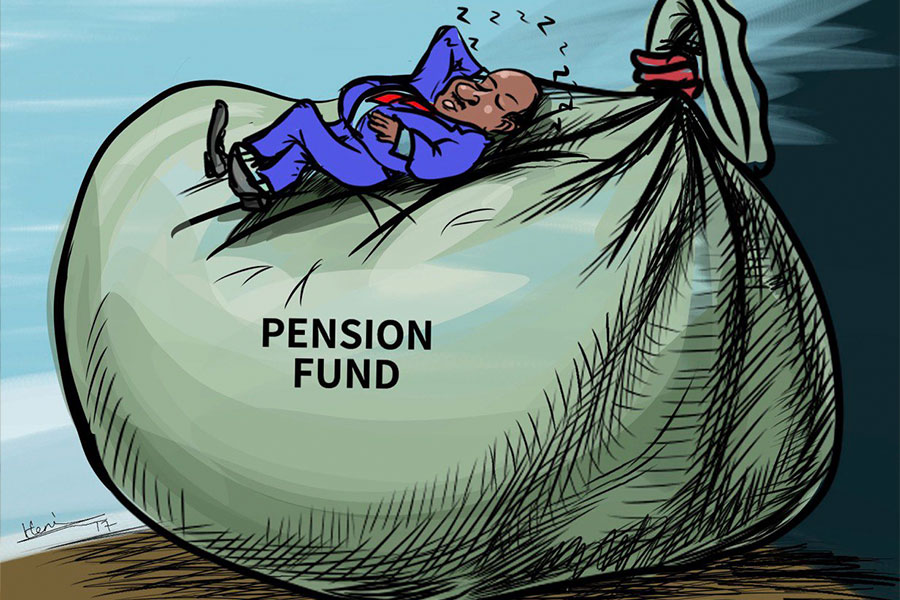

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...