My Opinion | 133416 Views | Aug 14,2021

Jun 15 , 2025. By NAHOM AYELE ( FORTUNE STAFF WRITER )

The federal government presented legislators with a budget proposal for the fiscal year 2025/26, marking an unprecedented shift in the country’s fiscal approach.

The budget bill totals 1.93 trillion Br, 14.3 billion dollars, based on last week’s Central Bank selling exchange rate. This represents nearly double the allocation from the previous fiscal year's budget of roughly one trillion Birr.

Budget experts and economists say the sudden surge defies historical trends and signals structural shifts with implications for economic sustainability, efficiency, and policy direction.

In the four years leading up to the budget bill before Parliament, the federal budget had followed a stable trajectory, climbing from 562 billion Br in 2022/23 to 971 billion Br by 2024/25, displaying an annual growth rate of about 20.2pc. Historically, the growth was characterised by moderate increases in recurrent and capital expenditures, steady subsidies to regional states, and consistent allocations toward Sustainable Development Goals (SDGs).

However, the 2025/26 proposal departs sharply from this trend, featuring an almost 100pc jump in total federal expenditures year-on-year. The budget includes 1.2 trillion Br for recurrent expenses, 415 billion Br for capital expenditure, 315 billion Br for transfers to regional states, and an additional 14 billion Br to support regional states in achieving the SDGs.

Finance Minister Ahmed Shide told Parliament that about 73pc of the budget, approximately one trillion Birr, will be covered by domestic tax revenues. His administration expects another 236 billion Br from international development partners, while he views the remaining deficit as being financed through project-specific funding.

The Finance Minister stated that fiscal discipline would be maintained, vowing to avoid borrowing directly from the Central Bank and instead issuing treasury bills (T-bills) to manage the 2.2 per cent GDP fiscal deficit, targeting a net deficit of around one per cent.

Ahmed also reinforced the government’s commitment to macroeconomic reforms and its ambitious 10-year growth strategy, setting an 8.9pc economic growth target for the coming fiscal year, higher than the IMF's 6.6pc forecast.

Despite these ambitious plans, federal lawmakers quickly raised concerns during parliamentary discussions.

However, budget analysts raise questions about the structural shift in budgeting.

The dramatic increase in recurrent spending, climbing from 162 billion Br in 2022/23 to 1.18 trillion Br proposed for 2025/26, revealed an unprecedented 162pc rise, pushing the recurrent-to-total budget ratio from 46.5pc to over 61pc. Such a tilt toward recurrent expenditure raises concerns about productivity and fiscal sustainability, suggesting a preference for consumption-heavy outlays over developmental investments.

Capital expenditures, while also increased by 21pc to 415 billion Br, saw their overall budget share shrink from 29pc to 21.5pc, signalling diluted focus on developmental projects. Subsidies to regional states increased nominally but fell proportionally, uncovering deprioritisation.

Some of the critical voices came from the ruling party itself.

Kefena Ifa, a member of the ruling Prosperity Party representing a constituency in the Oromia Regional State, criticised the capital expenditure allocation as insufficient, arguing for its importance in infrastructure development.

Another MP, Sosina Getahun, questioned whether allocated funds were exclusively meant for ongoing projects and specifically inquired about completion timelines for key infrastructure, raising the Chuarit-Alfea road project in Amhara Regional State, where construction had dragged on for three years without conclusion.

As federal lawmakers debate the ambitious budget bill, experts say the critical factor remains whether the government can effectively translate ambitious fiscal promises into tangible outcomes. Many see the fiscal realignment as marking an inflexion point, with the potential either to propel transformative growth or create long-lasting fiscal strain.

Experts echoed that the capital expenditure budget remains inadequate, given critical gaps in infrastructure such as electricity, roads, and clean water. These experts speculate whether this sudden increase represents a one-off adjustment or the beginning of a new structural fiscal pathway. If permanent, elevated recurrent obligations may constrain future budgets, raising issues around debt sustainability and inflation.

Mered Fikireyohannes, CEO of Pragma Capital, one of these experts, cautions that insufficient capital spending could stall essential mega-projects crucial for economic growth and societal advancement. According to Mered, public investment in infrastructure is vital, as it stimulates private sector activity and enhances government tax revenues.

“Low capital expenditure risks economic stagnation,” he told Fortune, “particularly troubling given Ethiopia’s rapidly growing population.”

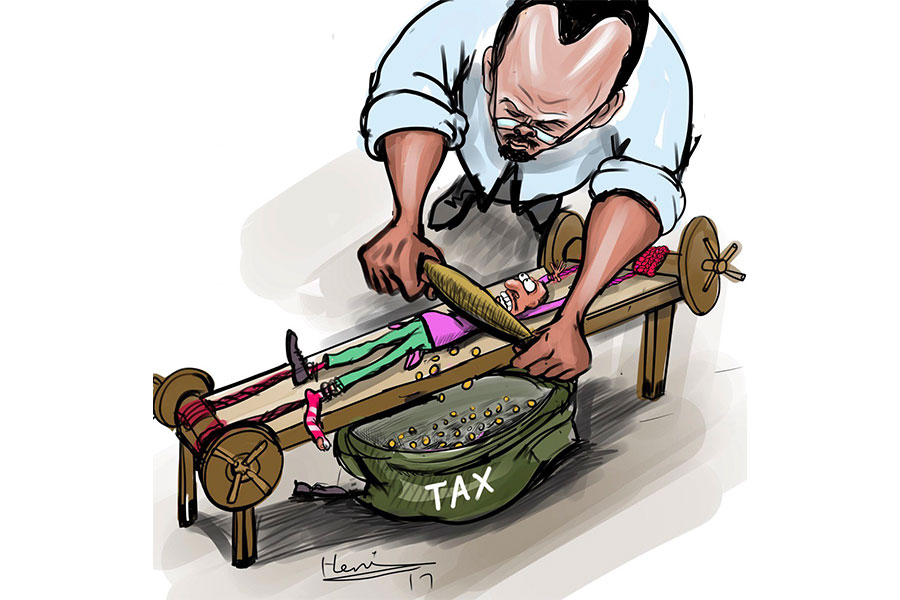

Mered pointed out existing challenges even with recurrent expenses, noting that 486 billion Br allocated towards debt repayment indicated precarious financial management. He criticised the tax collection strategy, claiming that many businesses evade taxation.

Ministry of Finance figures showed that 63pc of the 3.2 million licensed businesses did not contribute to tax revenue, increasing the fiscal burden on compliant taxpayers. According to Mered, the authorities should integrate these businesses into the tax net, enhancing tax and customs collection, and stating the role of regional authorities in improving revenue mobilisation.

Atlaw Alemu (PhD), an economics lecturer at Addis Abeba University, raised concerns about the government’s plan to introduce new taxes, arguing such measures might excessively burden consumers. He warned of the adverse effects that new taxes could have on consumer behaviour, potentially leading to reduced consumption and subsequently diminished business revenues.

Atlaw, too, urge the authorities to focus instead on broadening the tax base and bringing currently untaxed entities into compliance.

According to the budget proposal, total government revenue for 2025/26 is projected at 1.51 trillion Birr, of which taxes represent approximately 73pc, marking a notable rise in the tax-to-GDP ratio to 5.7pc. Anticipated tax revenues are projected to show a major jump, at 129.4 billion Br, a 110pc increase from the previous year, underpinned by the implementation of various tax reforms.

These include the Minimum Alternative Tax (MAT), designed to ensure that companies pay a minimum amount of corporate tax, even if they benefit from various exemptions, deductions, and incentives that reduce their regular tax liability. An increase in withholding income tax is in the pipeline, alongside a modern stamp system excise tax, and the full application of a 15pc excise tax on oil and VAT on fuel.

Fiscal authorities also plan to introduce a Property Tax in selected urban centres, a Motor Vehicle Circulation Tax for commercial vehicles, and bolster overall tax administration through digital technology and strengthened audit processes. A National Tax Taskforce has been established to oversee and improve revenue collections and ensure accountability.

Implementation, however, remains uncertain given historical underperformance in budget execution. In past fiscal cycles, ambitious allocations frequently went unrealised due to procurement delays and capacity constraints.

In the fiscal year 2024/25, key sectors, such as Administration and General Services, realised 70pc of the approved funds, while Economic Affairs managed under 60pc of the allocated capital funds.

In contrast, sectors dominated by recurrent costs, such as Defence and Public Order, consistently utilised over 85pc of their budgets due to predictable salaries and operational expenses. The proposed budget bill continues this pattern, allocating 200 billion Br to defence and security, demonstrating rigidities in reallocating funds during economic fluctuations.

Justice and Legal Affairs, which faced underspending in past cycles, received a modest increase to 75 billion Br.

Notably, Economic Affairs anticipates a 20pc capital budget increase, which will facilitate digital tax system advancements and private-sector collaboration for sustained growth. However, experts like Yohannes Bekele, senior adviser at an international development organisation, warn that without improvements in procurement and project management, increased funding alone might exacerbate existing execution delays.

Regulatory bodies, such as the Federal Auditor General, which has historically been efficient with modest budgets, and the Capital Market Authority, receive slight increases, reflecting the government's acknowledgement of the need for strengthened oversight.

The bill has been referred to the Budget & Finance Affairs Standing Committee, chaired by Desalegn Wedaje, for further review before it is voted on in Parliament.

PUBLISHED ON

Jun 15,2025 [ VOL

26 , NO

1312]

My Opinion | 133416 Views | Aug 14,2021

My Opinion | 129931 Views | Aug 21,2021

My Opinion | 127736 Views | Sep 10,2021

My Opinion | 125288 Views | Aug 07,2021

Aug 9 , 2025

In the 14th Century, the Egyptian scholar Ibn Khaldun drew a neat curve in the sand....

Aug 2 , 2025

At daybreak on Thursday last week, July 31, 2025, hundreds of thousands of Ethiop...

Jul 26 , 2025

Teaching hospitals everywhere juggle three jobs at once: teaching, curing, and discov...

Jul 19 , 2025

Parliament is no stranger to frantic bursts of productivity. Even so, the vote last w...