My Opinion | 129539 Views | Aug 14,2021

May 11 , 2025. By BEZAWIT HULUAGER ( FORTUNE STAFF WRITER )

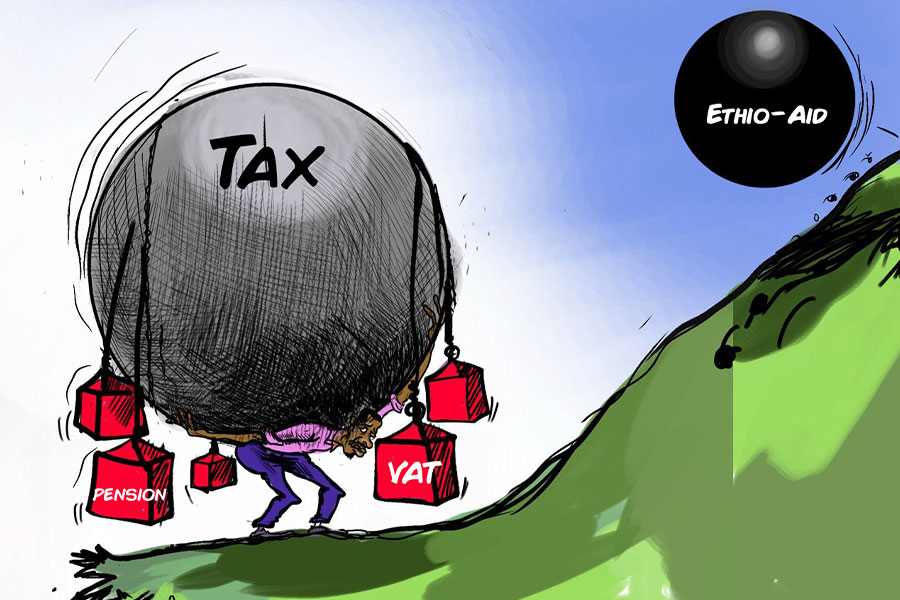

The federal government collected 653.2 billion Br in tax revenue in the third quarter of the current fiscal year, narrowly surpassing the Ministry of Revenue’s target of 646.7 billion Br but falling short of the Administration's ambitious goal of 1.5 trillion Br.

While the achievement marks a considerable 74.5pc increase from the previous year, translating into an additional 279 billion Br, it revealed the daunting task ahead as the country struggles to finance annual spending exceeding 1.2 trillion Br.

Aynalem Negusse, minister of Revenue, conceded last week when she appeared before Parliament. She told MPs that the performance was “an over-achievement on our plan, but only a step toward where we need to be.”

According to the Minister, expanding the tax base is necessary due to inflationary pressures and the weakening Birr, both of which diminish the real value of the revenues mobilised.

Domestic taxes contributed 345.9 billion Br, and customs duties accounted for 307.25 billion Br. Of this, 61 billion Br was transferred to regional states, marking a 37pc increase from the previous fiscal year.

Federal officials, including Prime Minister Abiy Ahmed (PhD), have consistently attributed the expansive informal economy to a major barrier to achieving a tax-to-GDP ratio target. The Administration hoped to increase this ratio by one percentage point this year, targeting 10pc, which officials argue would provide vital fiscal space for infrastructure projects, social programs, and debt servicing. Despite these efforts, the informal sector remains pervasive, reducing potential tax revenue and complicating enforcement measures.

The Ministry's officials face ongoing difficulties from illicit trade, which has intensified considerably over the past year. Customs officials seized contraband valued at 15 billion Br, a 32pc increase compared to last year. Among the illicit items, khat, a popular stimulant crop and a major source of export revenues, is the primary concern. Smugglers have diverted substantial volumes from legal export channels, harming legitimate traders and reducing tax revenues.

Anwar Yusuf, general manager of Kulmuye Trading Plc, a company that exports khat, described the export environment as "unbreathable," noting a daily volume reduction of up to 400Kg due to the 25pc lower prices of smuggled khat.

A member of Parliament, Debebe Admasu, echoed the alarm about the surge in khat smuggling.

Official statistics disclosed the severe impact of contraband khat on export revenues. The country earned only 180 million dollars from khat exports in the 2023-24 fiscal year, well below the target of 450 million dollars and down from 402 million dollars three years ago. In the most recent quarter, earnings plummeted to 28.3 million dollars generated from 2,580tns exported, representing a 35pc decline. Less than 10pc of the 65,817tns intended for export passed through official channels.

In response, the federal government initiated a relicensing campaign over the past four months, renewing 300 existing licenses and issuing 600 new ones. Yet, industry insiders contend that these measures have had a marginal impact.

Customs Commissioner Debela Kabeta concurred. Attributing khat’s susceptibility to smuggling historically, he disclosed plans to establish a regulated trade centre in Aweday, in Oromia Regional State, to streamline transactions.

The Trade Bureau in the Regional State has also intensified anti-smuggling measures, confiscating contraband worth 485 million Br, including khat, petroleum, livestock, and electronics. Getachew Kopisa, the Bureau's head, attributed increased smuggling activities to substantial price discrepancies with neighbouring countries and inadequate regional trade integration. Commissioner Debela states that pursuing illicit profits and external pressures further exacerbate the issue.

Federal officials blame tax evasion as an impediment to revenue collection. The Ministry's officials told MPs they have identified 641 companies with serious irregularities. Investigations revealed more than 2,200 fake receipts, amounting to 3.49 billion Br, and uncovered 19 firms evading taxes on online transactions totalling 5.03 billion Br. According to the Commissioner, 85pc of imported goods were under-invoiced.

Minister Aynalem raised concerns about illegal checkpoints and insufficient federal oversight, especially within the mining sector, notorious for its illicit activities. MPs criticised gaps in digital tax collection, noting that only 35pc of the expected digital revenue had been successfully mobilised. The Minister countered that 60pc of digital tax collections occur through bank transfers, complicating immediate revenue registration.

However, Berhanu Barete, an MP, expressed doubt about the Ministry’s capability to effectively fight tax evasion, particularly in the rapidly growing digital marketplace.

“Your monitoring has weakened,” he told officials during a Parliamentary session.

Minister Aynalem acknowledged shortcomings in collecting revenue, particularly from profit taxes and VAT, attributing challenges partly to limited taxpayer awareness.

The Addis Abeba Revenue Bureau recently introduced a market-based value-added tax system to address these issues, utilising price data from over 2,000 commodities to enhance transparency. However, the reform has met resistance from businesses, particularly those in the textile sector, who have appealed directly to the Ministry of Industry. Parliamentarians have also criticised the VAT imposition on agricultural inputs such as animal feed, arguing it aggravated food inflation despite headline inflation declining from 31pc to 18pc.

For an MP such as Tesfaye Bango, this contradiction unveiled ongoing price hikes for food.

Ministry officials clarified that VAT exemptions were policy decisions beyond their control. Federal legislators have urged the authorities to include domestic workers and security personnel within the formal tax net and revise taxable income thresholds to boost revenue further.

Concerns over fiscal sustainability intensified when lawmakers noted that current tax revenues cover only half of the federal government's annual expenditures of 1.2 trillion Br. The Minister hopet the reported revenue covers the third quarter, expecting a complete yearly picture to offer better information. However, Berhanu argued that the report failed to account for the impact of currency depreciation. Despite a nominal 74pc increase in tax revenues, he asserted the Birr’s purchasing power had diminished by approximately 150pc.

The Birr has lost ground by nearly 140pc since August last year, when the federal government liberalised the exchange market.

For Commissioner Debela, tax collection is legislatively mandated in Birr, thus dismissing immediate concerns about currency depreciation. However, the Commissioner acknowledged potential future impacts from currency depreciation, expecting their effects to be more apparent in subsequent reporting periods.

For tax experts, the broader implications of rampant contraband and evasion suggest that these activities not only reduce immediate sales taxes but disrupt income tax collection throughout supply chains. According to Biruk Nigussie, a former tax assessment manager for the defunct Revenues & Customs Authority for a decade, and a tax advisor for 15 years, deliberate tax avoidance comes from erosion of public trust and opaque public expenditure practices.

“People pay to avoid trouble, not because they believe in the system,” Biruk told Fortune.

He also cautioned that VAT exemptions should be judiciously determined based on thorough economic analysis to avoid exacerbating inflation.

PUBLISHED ON

May 11,2025 [ VOL

26 , NO

1306]

My Opinion | 129539 Views | Aug 14,2021

My Opinion | 125844 Views | Aug 21,2021

My Opinion | 123855 Views | Sep 10,2021

My Opinion | 121658 Views | Aug 07,2021

May 24 , 2025

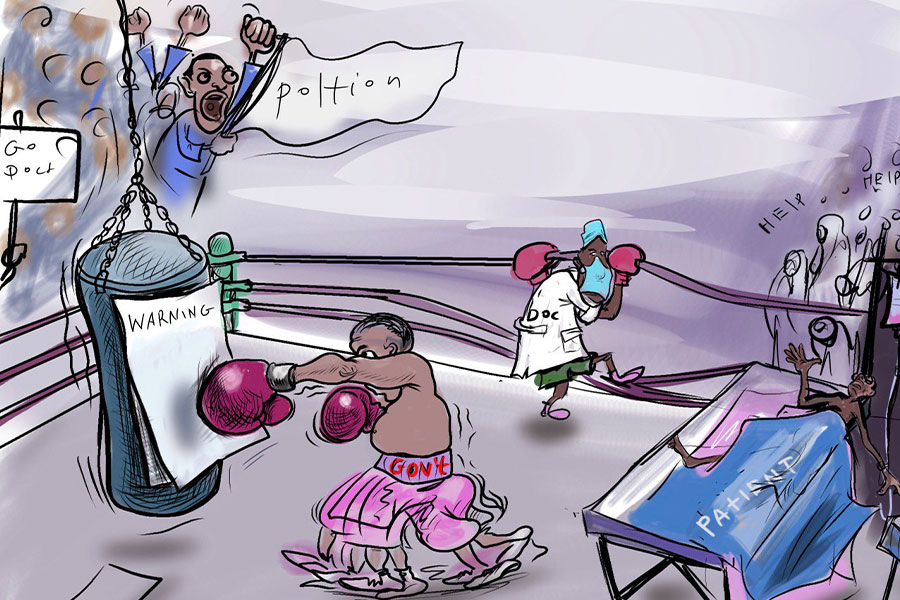

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...

May 3 , 2025

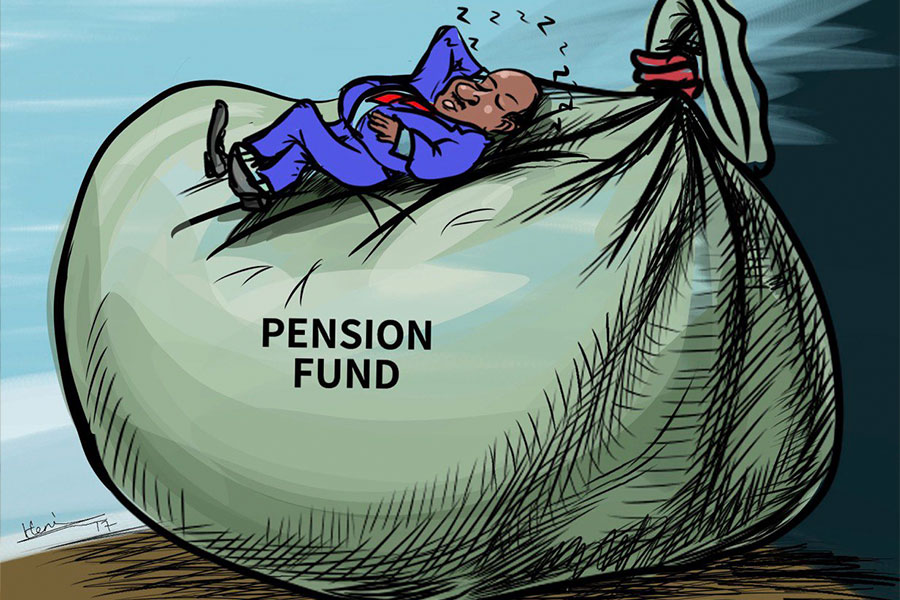

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...