My Opinion | 129539 Views | Aug 14,2021

May 11 , 2025. By BEZAWIT HULUAGER ( FORTUNE STAFF WRITER )

Federal officials have drafted a sweeping policy for automotive development, aspiring to turn Ethiopia into an assembly hub that can join South Africa and Morocco. The text, prepared with input from domestic manufacturers, promises incentives for electric, hydrogen-powered and liquefied-petroleum-gas vehicles, a clampdown on used-car imports, and a new loan scheme meant to put more vehicles within reach of taxi drivers and small businesses.

“The goal is to make local manufacturing the backbone of Ethiopia’s automotive future,” said Kedilmagist Ibrahim, an adviser to Alemu Sime, minister of Transport and Logistics, who is steering the project.

Charging equipment for electric vehicles will be exempt from tax, and a roadmap for battery disposal is in the works even though, as Kedilmagist conceded, “there are no global precedents” to follow.

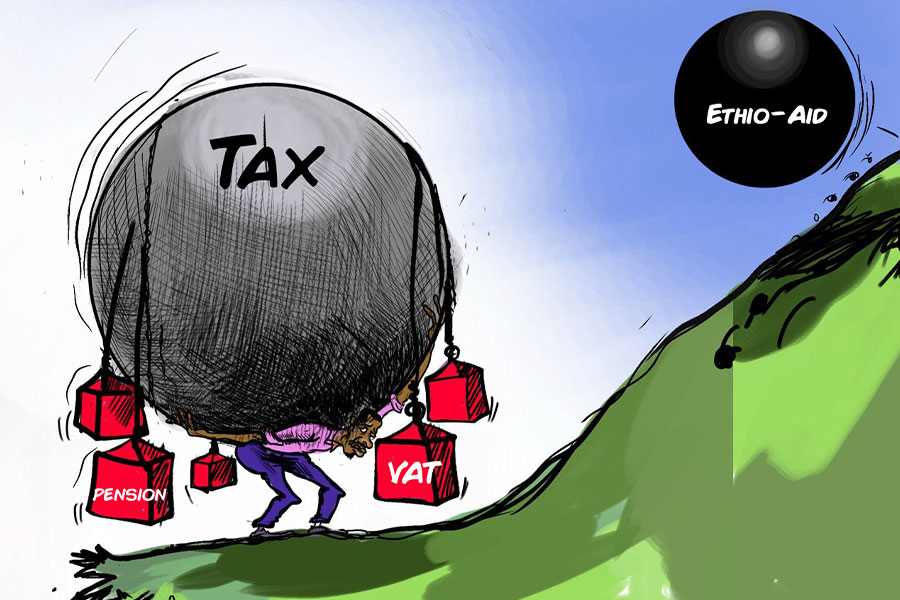

Duties already tilt heavily against imported cars. A 2021 study put tariffs and levies on new vehicles between 46.75pc and 67.45pc, while used models face rates from 156pc to 765pc. The draft policy widens that gap by imposing an additional 20pc excise duty on every new passenger car or light commercial vehicle that lands fully built at the port. Importers will also have to present emissions and road-worthiness certificates before shipment, and the customs service is to revise its tariff schedule to reflect the tighter differentiation.

The Ministry wants to close another gap between consumers and lenders by introducing an asset-based vehicle loan. Banks usually tie auto financing to personal credit, shutting out many potential buyers. The change is designed to let buyers pledge the car as collateral, a move officials hope will expand ownership and spur assembly volumes.

Financing snags tripped up taxi owners earlier this year after city officials ordered fleets to replace ageing vehicles.

Multiverse Enterprise Plc, run by businessman Seid Negash, stepped in with a proposal, teaming up with the Defence Engineering Industry Corporation to assemble and finance about 5,000 diesel and electric taxis. The state-owned Commercial Bank of Ethiopia (CBE) endorsed the plan, earmarking 17pc of a 35-billion-Br fund for down payments. Multiverse wants to swap 15,000 cabs and claims to have supplier credit in forex, yet Seid remains uneasy.

"The policy is welcome," he said, “but the limited liquidity in banks is still a concern.”

Quality rules will toughen alongside the tax measures. Salvaged or flooded vehicles will be barred, as will cars lacking an original equipment manufacturer destination certificate. The authorities want to see models cobbled together from spare parts out, and imports to carry microdot markings to defeat tax evasion and fraudulent registration.

The government intends to set up a dedicated automotive park, steer assemblers into existing industrial zones, and help others secure land through public-private partnerships. Ethiopia counts 14 active assemblers; they would need the extra room if output expands toward the policy’s target of at least 5,000 units a year per plant.

Applicants for the planned incentives will have to show factory addresses, original equipment manufacturer (OEM)- supplied equipment lists, and production lines with four workstations, utilities, and quality-control kits. Only global OEMs, their licensed partners, or contract assemblers under OEM supervision can register. They should also import semi-knockdown (SKD), wholly knockdown (CKD), or fully built kits that qualify for duty relief.

According to Kedilmagist, the Ministry conducts price studies to ensure taxpayers do not prop up inefficient players.

“If local assemblers cannot perform under these supportive conditions, we must rethink the incentives,” he said.

The targets are steep. Ethiopia’s rated capacity is 63,900 two- and three-wheelers, 14,900 cars, 1,200 light trucks, and 3,500 minibuses and buses. Electric-vehicle capacity is 84,000 units, yet fewer than one in 10 production slots is used. Assemblers built 21,800 vehicles last fiscal year, including over 2,000 electric cars. Imports swamp local lines, with more than 25,000 EVs shipped in during the first half of the current year alone.

To narrow that gap, the Finance Ministry issued a directive last month telling government offices to favour locally assembled electric cars in tenders, offering a 15pc price preference when local value added exceeds 35pc.

“There are many policies, but implementation is lagging,” said Semereab Serekeberhan, deputy board director of the Ethiopian Automotive Industries Association and a 20-year veteran.

He recalled writing to the Industry Minister six months ago to protest a 20pc customs duty increase on CKD and SKD kits and a 10pc surtax. Officials brushed off the complaint, he said, arguing that the market should move away from fuel-powered vehicles anyway.

“The population’s purchasing power has already declined,” he said. “Raising prices does not guarantee sales.”

Plant utilisation has fallen sharply. Five years ago, many factories ran at 10pc to 30pc of capacity; now, even 10pc is hard to reach. Semereab blames shifting rules, citing an earlier decree that companies win at least 35 million Br in contracts over four years to qualify for procurement tenders, a threshold most local assemblers could not clear.

The Chinese manufacturer Lifan Motors has laid off more than 250 employees and is faced with a threat of closure. Critics argue that investors and customers hesitate when taxes change without forewarning.

Moges Negash, an automotive engineer who sells vehicles at Moges Motors, contends that some firms abuse assembler licenses to import fully built cars under more generous terms.

“Unknown taxes and rules inflate prices and disrupt the market,” he said.

He warned that high volume alone will not save the sector.

“Customers should believe in the product first,” he told Fortune.

The draft’s export section eyes the African Continental Free Trade Area (AfCFTA), which began lowering duties among 54 member states in 2021. Ethiopia wants to join South Africa and Morocco as the continent’s leading car producers. To do so, it plans to toughen emission and safety standards, expand the Ethiopian Standards Agency and lay out long-term export strategies. Manufacturers able to meet those rules would, in theory, gain a tariff-free gateway to a market of 1.4 billion people.

However, the promised boom depends on execution. Officials say an electric-battery disposal policy and a scrappage plan for obsolete cars are “underway,” but they remain in draft form. Kedilmagist insisted that the Ministry will consult stakeholders before final approval. Leaders of the Automotive Association are pushing for revisions, arguing that taxes inputs discourage local content and favour imports despite the headline incentives.

Seid Negash, whose Multiverse deal rests on bank financing and supplier credit, still backs the program. He expects the policy “could improve customers’ purchasing power,” provided banks overcome their liquidity problems.

PUBLISHED ON

May 11,2025 [ VOL

26 , NO

1306]

My Opinion | 129539 Views | Aug 14,2021

My Opinion | 125844 Views | Aug 21,2021

My Opinion | 123856 Views | Sep 10,2021

My Opinion | 121658 Views | Aug 07,2021

May 24 , 2025

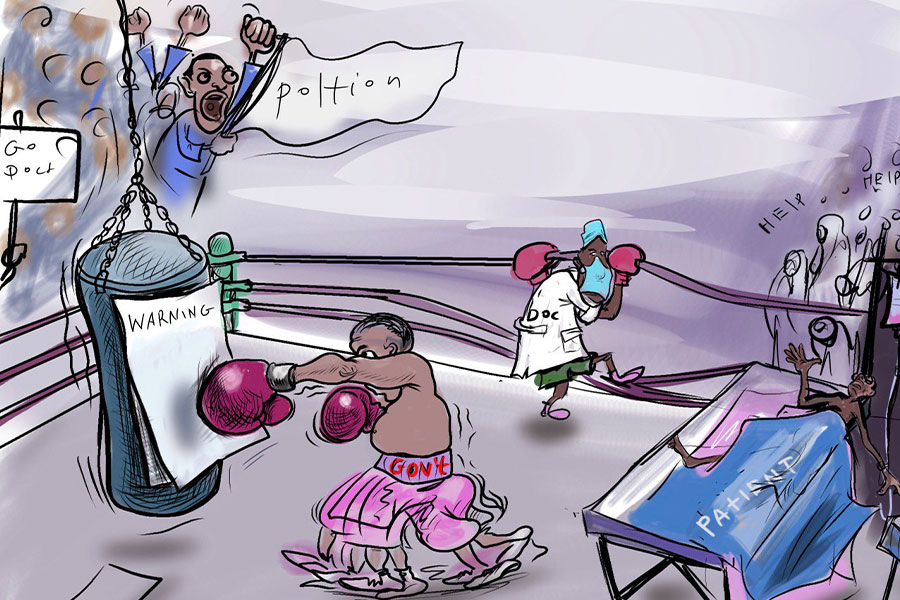

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...

May 3 , 2025

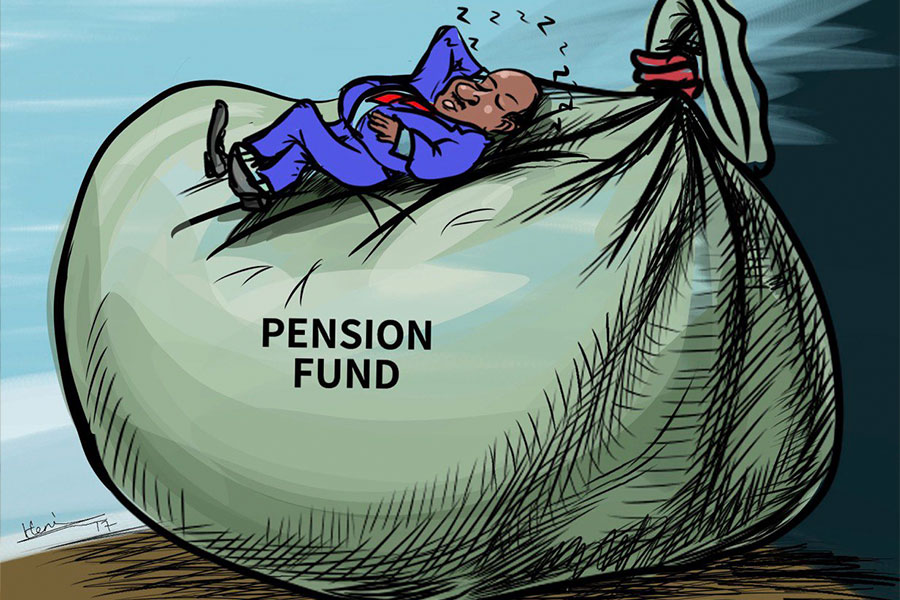

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...