My Opinion | 129665 Views | Aug 14,2021

Jul 13 , 2024.

The banking industry is experiencing a transformative period under the oversight of National Bank of Ethiopia (NBE) Governor Mamo Mihretu. Last month, the central bank introduced five new directives that sought to enhance corporate governance and asset classification for the industry. These directives mandate the creation of comprehensive databases for related party transactions and the continuous updating of credit profiles, with a three-year compliance timeline for commercial banks. Industry figures such as Neway Megersa of Siinqee Bank and Dereje Zenebe of Zemen Bank have supported these changes, although they advocate for a more flexible implementation schedule. Neway stated the necessity of technological investments to comply with new regulations, while Dereje believed in improved liquidity and financial stability benefits. Dereje captured the essence of the reform, stating that "banks now belong to depositors more than they do to shareholders." Central bank authorities believe these directives are poised to enhance transparency, risk management, and depositor empowerment while addressing systemic risks associated with bad credit.

Despite the general optimism, some concerns remain. Dawit Keno of Hijra Bank, an interest-free institution, criticised the new regulations for not sufficiently catering to the unique needs of his segment. He called for establishing a dual banking system and creating a dedicated department within the central bank to oversee interest-free banks. Nevertheless, Dawit remains optimistic about the central bank’s new monetary policy framework, which seeks to ease liquidity constraints. The NBE has shifted from a quantity-targeting approach to an interest-based market model, setting policy interest rates at 15pc and conducting biweekly auctions. Governor Mamo described this as a "major shift" intended to address macroeconomic imbalances and facilitate a dynamic interbank market.

The proactive position by the NBE is part of a broader three-year strategic plan introduced seven months ago, which seeks to restore fiscal and monetary stability. The plan, along with a draft proclamation to re-establish the NBE’s autonomy, shows the central bank's resolve to strengthen its regulatory role. Industry veteran Eshetu Fanatye noted that substantial technological upgrades are essential to meet the new requirements, viewing Governor Mamo's tenure as a period of calculated and strategic reforms.

PUBLISHED ON

Jul 13,2024 [ VOL

25 , NO

1263]

My Opinion | 129665 Views | Aug 14,2021

My Opinion | 125970 Views | Aug 21,2021

My Opinion | 123981 Views | Sep 10,2021

My Opinion | 121781 Views | Aug 07,2021

May 24 , 2025

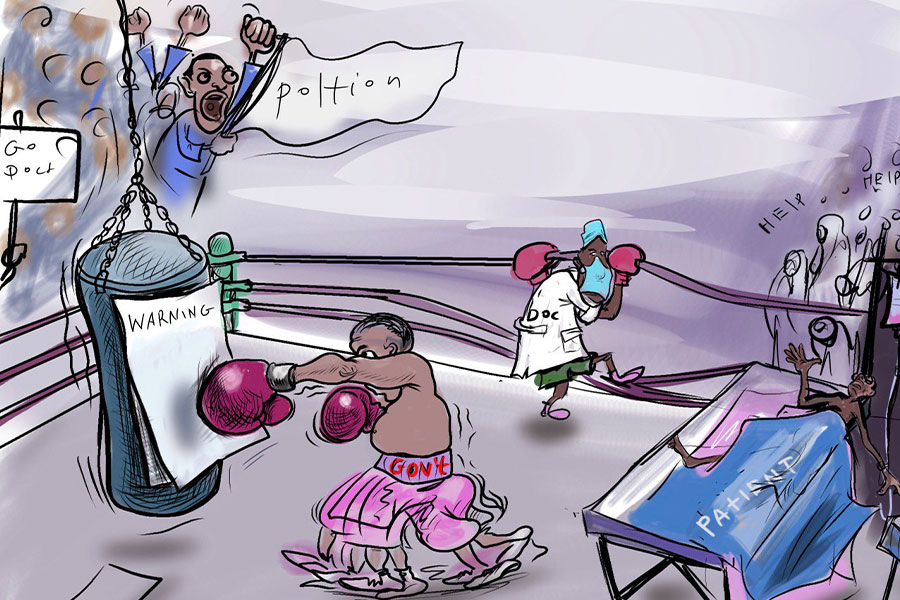

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...

May 3 , 2025

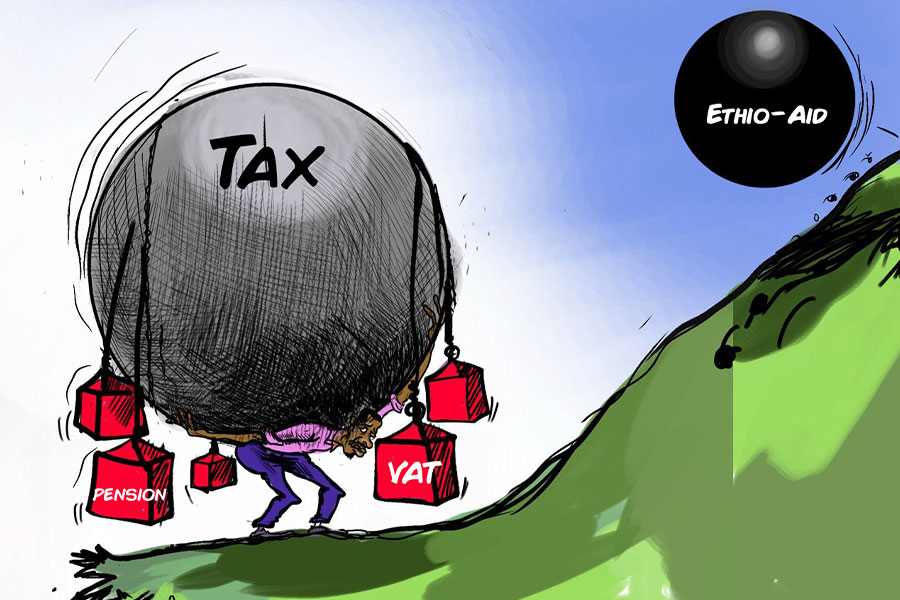

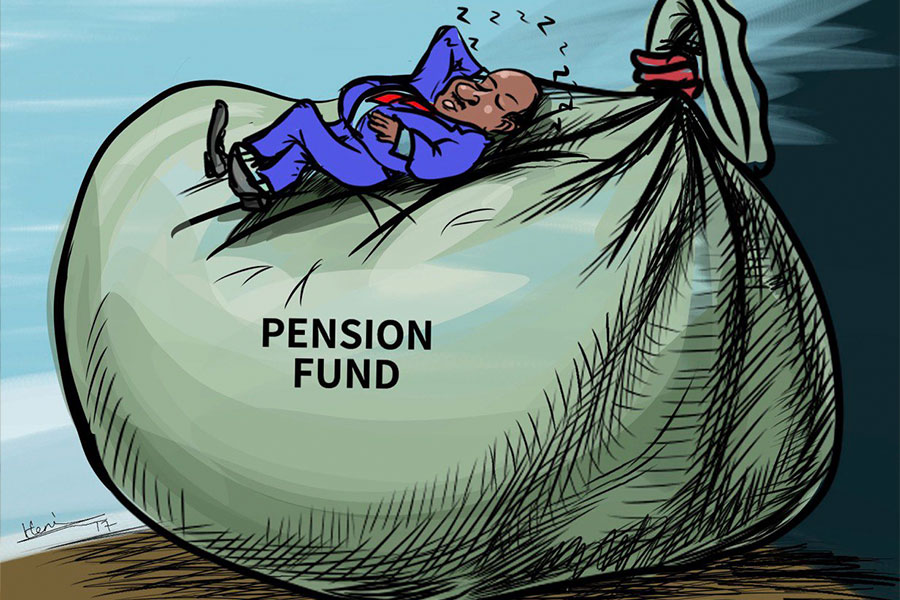

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...