My Opinion | 130629 Views | Aug 14,2021

Jun 12 , 2025.

Horizon Plantations Plc, a subsidiary of MIDROC Investment Group, is launching a major agricultural project in the Somali Regional State, aspiring to transform underutilised land into productive farmland. The company has secured 20,000hct across two zones for an ambitious irrigation farm project. Initial investments are projected at nearly 30 billion Br, with the Development Bank of Ethiopia (DBE), a state policy bank, expected to finance 75pc of the project value.

Located in Sitti and Shebelle zones, near the Shebelle River, the area is known to have extensive groundwater resources, ensuring consistent irrigation capabilities. Financially, around 85pc of the total investment is set aside for infrastructure, about 13pc for pre-production activities, and less than two percent for capital expenditure. To date, Horizon has spent close to 21.8 million Br, leaving nearly 29.7 billion Br yet to be sourced.

DBE officials have declined to comment despite repeated attempts, citing an ongoing loan appraisal.

Foreign currency expenses, dedicated mainly to irrigation systems and cold storage, are projected to cost 5.5 billion Br, accounting for about 18.7pc of the total budget.

The company plans to cultivate oilseeds, including groundnuts, sunflowers and soybeans. Cotton, alongside high-value crops such as alfalfa and fruits like oranges, mangoes, papayas, bananas, and lemons, is included in the company's target list of produce.

The company eyes to supply Sheger Edible Oil Factory, another subsidiary of MIDROC. Ethiopia currently meets less than five percent of its edible oil demand through domestic production. By securing a steady supply of raw materials from the project, MIDROC Ethiopia's executives hope to reduce the country’s dependency on imports.

According to Netsanet Gashaye, general manager of Horizon Plantations, their primary objective is to integrate the Somali Regional State into national agricultural supply chains and tap into its considerable agricultural potential. Beyond direct employment, the company's executives hope that the broader agricultural value chain could indirectly benefit as many as 20,000 locals, creating opportunities for income generation through complementary businesses and services.

"We're ready to begin as soon as the financing is disbursed," Nestanet told Fortune.

Once operational, Horizon expects the project to create approximately 1,140 permanent jobs, resulting in an annual wage bill of approximately 220.49 million Br. It also plans to offer additional employee benefit packages.

Horizon anticipates export opportunities, targeting markets in the Middle East and Europe, where demand for oilseeds from Ethiopia and tropical fruits is steadily growing. Domestically, the project also intends to address nutritional gaps and support the livestock sector by increasing the availability of livestock feed and fruits, which are underconsumed compared to global averages.

"The investment will be fully recouped within 10 years," said Netsanet.

Horizon’s financial projections show a steady increase in profitability. By 2026, the project is expected to generate modest net earnings of about 9.89 million Br. However, profits could surge dramatically to over five billion Birr by 2040, marking a 500-fold increase. Cumulative net cash flows are expected to begin at 421.84 million Br in the first year, growing substantially to 12 billion Br over the next decade. Total assets are projected to quadruple, from approximately 6.8 billion Br in 2025 to 27.2 billion Br by 2040, displaying a strong long-term financial outlook with a projected after-tax return on investment of 13pc.

Horizon Plantations is already a noteworthy player in the agricultural sector. It has been active since acquiring substantial coffee estates, notably Bebeka Coffee Estate, Limmu coffee farms ( Gomma one, Gomma two, Kossa, Sentu, Gummer, and Cheleleki coffee farms), Gojeb Farm, Guba Farm, and the Horizon Coffee Processing & Warehousing Plant, along with a large central coffee processing and storage facility spanning 59,000Sqm. The company manages a close to 22,000hcs coffee farm, producing over 30,000tns of coffee cherries each year. About 4,500tns of the yield is processed into export-quality coffee, with Starbucks in the United States among its principal buyers.

Horizon Plantation employs over 5,200 permanent staff, supplemented by approximately 10,000 seasonal workers, a figure that doubles during harvest seasons.

Beyond coffee, Horizon's diverse agricultural portfolio includes bananas, pineapples, maise, and spices such as black pepper, turmeric, cinnamon, and cardamom, as well as honey and dairy products. It is developing another 20,000hct oilseed project in Guba, Benishangul-Gumuz Regional State.

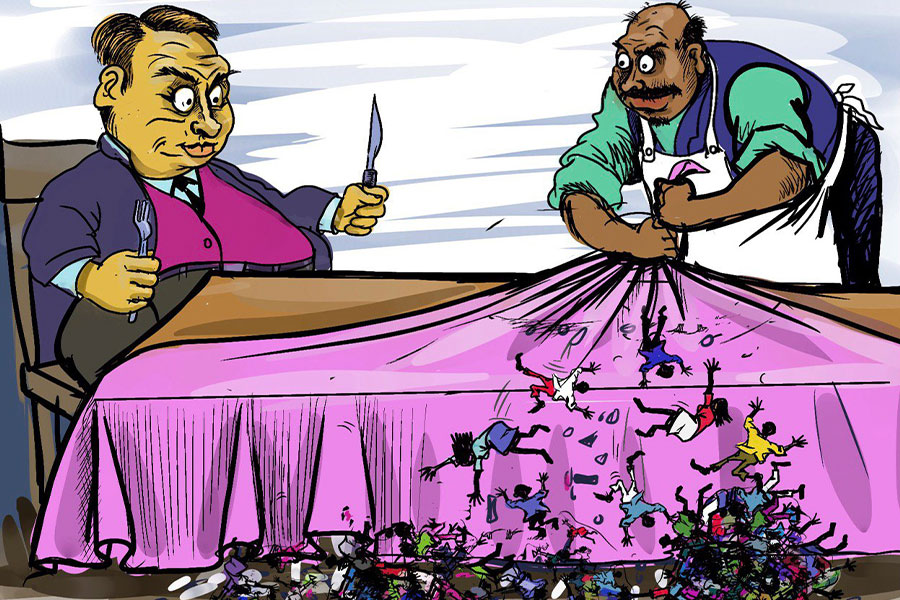

However, despite Horizon's ventures, the Somali Regional State remains underinvested. Recent data reveal that while 18.2 billion Br in new investment was registered, far surpassing the 1.2 billion Br target, only 212 investment licenses, 57pc of what was planned, were issued. Of these, nearly half were in services, a quarter in manufacturing, and only 37 in agriculture. Incentives were granted to 71 investors, primarily in the hotel industry. Two licenses were revoked, and 155 were renewed. The Regional Investment & Industry Bureau reported that import substitution by six firms saved 231 million dollars.

Ahmed Reshid, the Bureau's head, acknowledged progress. The report, however, pointed to ongoing issues such as fragmented coordination, skill shortages, and regulatory inconsistencies.

Sani Tuke, a business consultant from Saniya Business & Investment Consulting, sees Horizon's project as a crucial opportunity for regional economic transformation. However, he stated the importance of adequate oversight to prevent capital misuse and ensure projects deliver the intended outcomes.

"This scale of investment can generate tax revenues, reduce unemployment, and generate foreign exchange," Sani said.

Yet, he cautioned that issues such as high labour costs, delayed compensation, and misaligned investor expectations remain major risks.

Another consultant at Universal Training Business Consultancy, speaking anonymously, underscored additional risks including potential conflicts, weak institutions, environmental stress, and cultural misunderstandings. He cautioned that, without comprehensive long-term planning and genuine community engagement, even well-financed projects risk collapse once external funds are depleted.

PUBLISHED ON

Jun 12,2025 [ VOL

26 , NO

1311]

My Opinion | 130629 Views | Aug 14,2021

My Opinion | 126943 Views | Aug 21,2021

My Opinion | 124947 Views | Sep 10,2021

My Opinion | 122649 Views | Aug 07,2021

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

May 31 , 2025

It is seldom flattering to be bracketed with North Korea and Myanmar. Ironically, Eth...

May 24 , 2025

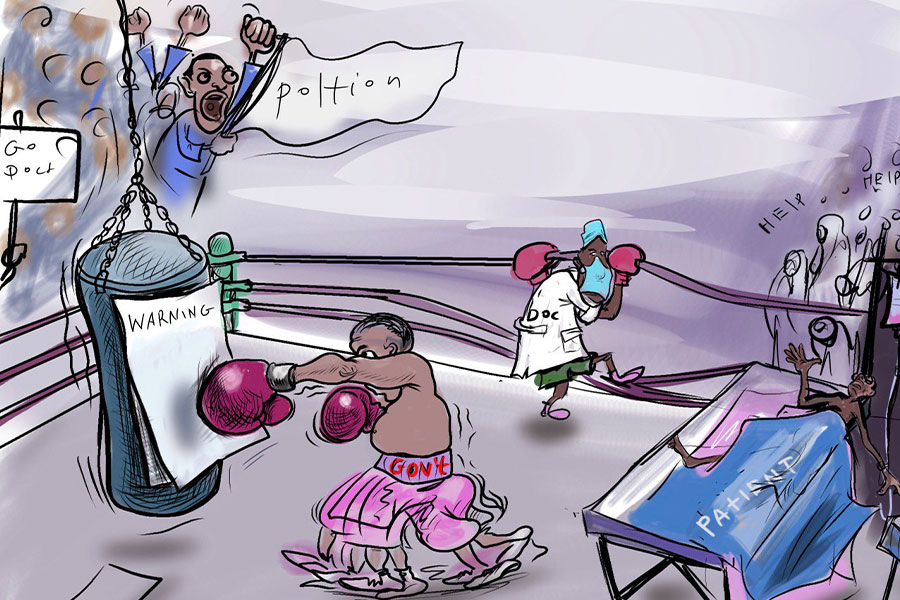

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...