My Opinion | 130252 Views | Aug 14,2021

May 31 , 2025. By Eden Sahle ( Eden Sahle is founder and CEO of Yada Technology Plc. She has studied law with a focus on international economic law. She can be reached at edensah2000@gmail.com. )

Six years ago, a dear friend took a leap. He poured his life savings into building a business not for quick profits, but to create something enduring. He hired twenty young people, many fresh from rural villages, with no homes in the city. So, he gave them shelter, space to sleep in his office compound, and meals to eat, on top of their salaries.

He did more than build a company. He built a refuge. He also made a vow: no bribes, no shady deals. He walked away from lucrative tenders because he chose integrity over convenience. People admired him. They still do.

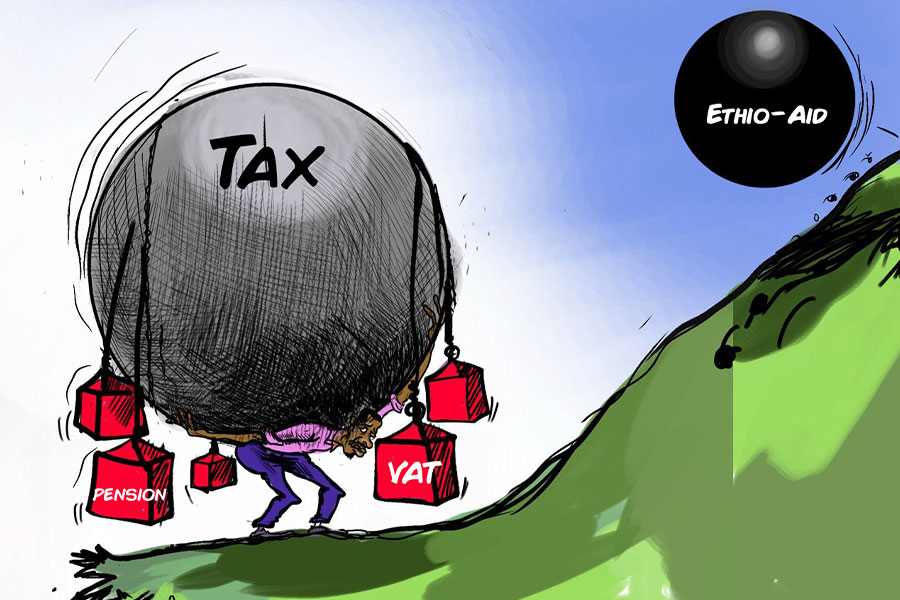

Today, that same man is exhausted, desperate, and unable to operate. His company is frozen. Not because he refuses to pay taxes, he acknowledges what he owes, but because the penalties and interest have snowballed into an unpayable mountain.

His accounts, both personal and business, are locked. He has sold his car and household items trying to catch up. He cannot pay his workers. He cannot support his wife and their two sets of twin toddlers. Most painfully, he cannot earn the income needed to repay the state.

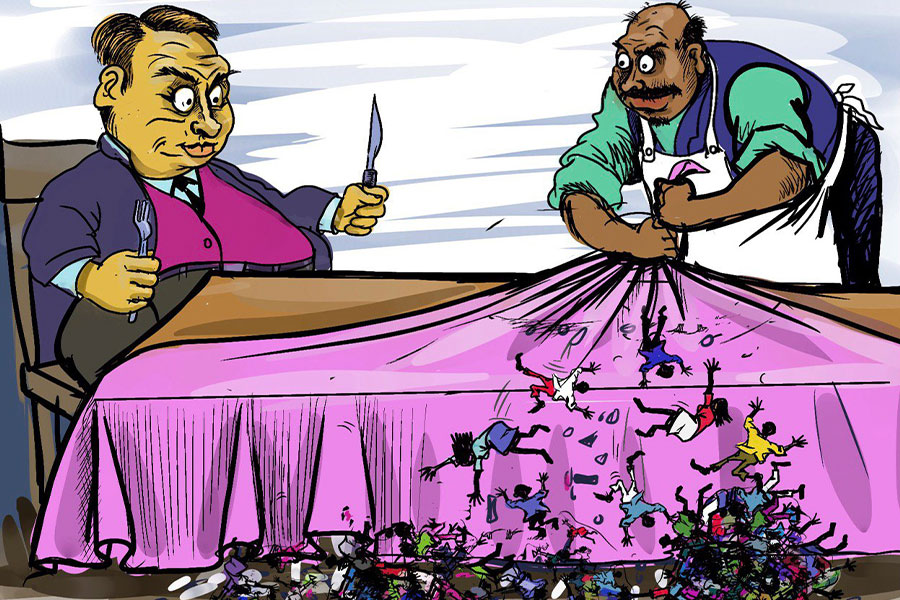

The Minister of Revenues has a clear mandate: collect taxes, uphold the law. But when tax enforcement becomes so rigid that it cripples legitimate businesses, it undermines its own purpose. How can a business repay its debt when it is blocked from earnings? How can workers remain employed if their workplace is shuttered? How does the country raise revenue if it starves the very sources of it?

This kind of tax enforcement does not just hurt entrepreneurs, it hurts everyone. The state loses income. Workers lose livelihoods. Honest businesses lose faith. And in the vacuum, corruption thrives.

Most business owners are not looking to evade taxes. They simply cannot survive punitive penalties and daily compounding interest that grow unchecked. They need air to breathe. Instead, they are suffocating.

Walk into any revenue bureau office or commercial bank and you will hear echoes of the same story: frozen companies, bankrupt owners, unpaid employees; not due to fraud, but due to a system that offers no path to redemption. It is like cutting off water to a farmer, then blaming him for the barren fields.

Other countries have faced this dilemma, and acted differently.

Rwanda introduced a Voluntary Tax Disclosure Programme that waives late penalties for businesses that self-declare unpaid taxes and pay within a timeframe. Germany’s 3.2 billion euro "Growth Opportunities Act" offers tax relief and research incentives to keep SMEs hiring and innovating through economic downturns. Singapore allows structured installment plans and penalty waivers for honest disclosure. Canada’s 3.5 billion dollars SR&ED tax credit supports small businesses that invest in innovation, most of its recipients are SMEs.

These countries understand a vital truth: helping businesses stay afloat leads to more tax revenue, not less. Enforcement must be firm, yes, but never at the cost of economic suffocation.

Because this is not just a tax issue. It is a jobs issue. A family issue. A survival issue. A national issue.

Struggling companies should be allowed to keep operating under conditional licenses, as long as they are actively paying down their debts, even in installments. Do not wall them out of the economy. Give them a path forward.

The message today’s system sends is chilling: that ethics are costly, that honesty does not pay. My friend, the man who once gave his workers beds and bread, now struggles to put food on his own table. His dream is crumbling, and with it twenty others, along with the tax revenue and employment they once generated.

If this is how Ethiopia treats its ethical entrepreneurs, what hope is there for the rest?

We need more than compassion, we need reform. Practical, courageous reform.

Replace compound penalties with performance-based reductions. Scale them down as businesses show good-faith repayment. Cap maximum liabilities so entrepreneurs can realistically plan repayment. Offer amnesty windows for SMEs to clear penalties and pay base taxes over time.

That is not a handout, it is smart economics. Create incentive programs for clean, compliant businesses. Let integrity be rewarded.

Build a fully integrated tax platform where businesses can view their records, create payment plans, submit appeals, chat with tax officers, and track progress. Transparency is not enough, accessibility matters.

Other countries are showing the way.

The U.S. Internal Revenue Service’s new Direct File platform provides live support and online filing, making taxes less daunting. The U.S. SEC has a Small Business Advisory Committee to ensure policy decisions reflect the lived experience of entrepreneurs.

Ethiopia can do the same. A modern digital tax system. A council that brings SME voices to the table. Not just fixes, but investments in trust and growth.

Tax systems must be firm, but they must also be fair. When they are not, they corrode the very foundation of business trust.

No one is asking for taxes to be waived. But when the penalties and bureaucracy are more damaging than the original debt, something is broken. And it needs fixing.

A nation does not rise by grinding its small businesses to dust. It rises by treating them as partners, not just payers. It rises when it makes room for redemption, for recovery, for those who choose to build clean, even when it costs them.

The choice is simple: block the honest or back them. One path drains the future. The other builds it.

PUBLISHED ON

May 31,2025 [ VOL

26 , NO

1309]

My Opinion | 130252 Views | Aug 14,2021

My Opinion | 126553 Views | Aug 21,2021

My Opinion | 124561 Views | Sep 10,2021

My Opinion | 122307 Views | Aug 07,2021

May 31 , 2025

It is seldom flattering to be bracketed with North Korea and Myanmar. Ironically, Eth...

May 24 , 2025

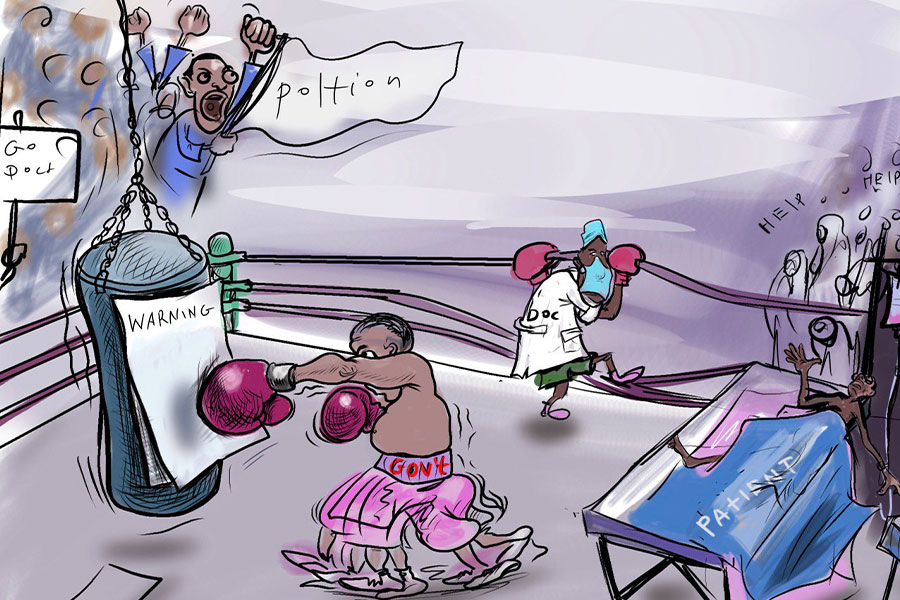

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...