Commentaries | Feb 13,2021

The proposed budget bill for the upcoming fiscal year reflects the federal government's struggle to balance economic stability with growth aspirations. Officials' ability to manage debt, implement reforms, and secure external financing will determine the country's economic trajectory.

Last week, lawmakers received a 971.6 billion Br budget bill strained by high domestic debt servicing costs. This comes amidst hopes for restructuring external debt following Ethiopia's first-ever default earlier this year. The budget reflects the country's macroeconomic instability, with a modest 21.1pc expansion and a 21.9pc increase in recurrent expenditures, which account for 46.5pc of the total budget.

Finance Minister Ahmed Shide underscored fiscal discipline and controlled expenditures, alongside budding reforms to improve foreign currency management and align rates between official exchanges and parallel markets. He plans to build on the successes of the first Homegrown Economic Reform (HGER) towards a stable balance of payments, sustainable debt servicing, and a strong economy.

However, not every MPs were convinced.

Abraham Berta (PhD), an MP from the opposition party Ethiopian Citizens for Social Justice (EZEMA), questioned the effectiveness of the first HGER in addressing the country's macroeconomic instability. He argued that there was insufficient substantial proof to justify claims of success from the first iteration of the reforms.

"Have the living standards of our people increased?" Abraham asked.

Abraham warned against the devaluation as a policy response to the country's foreign exchange woes, citing economists' concerns about its immediate impact on low-income households. "A dangerous antidote", he called the widely held public perception of devaluing the Birr prompted by creditors' pressure.

"Measures should prioritise stabilising the economy and the country," he said.

A series of negotiations have been taking place between the authorities and the International Monetary Fund (IMF) over a bailout package with a credit facility of over 3.5 billion dollars, contingent on economic reforms. One of the IMF's preconditions includes liberalising the foreign currency market. With negotiations scheduled for late September, securing an agreement with the IMF is also a prerequisite for the debt restructuring Ethiopia seeks under the G-20 Common Framework.

The Finance Minister acknowledged ongoing difficulties in managing the foreign currency regime and noted that high-level discussions are underway to determine appropriate measures. He foresees that the current official exchange rate will remain in effect for the next fiscal year, quelling widely held speculation that an impending deal with the IMF will compel his government to devalue the Birr against major currencies.

"These are concerns we're quite aware of," he responded. "A sustainable foreign exchange regime has been part of our objectives."

Ahmed said the budget bill was formulated considering that the current official exchange rate would remain unaffected for the coming year. While he was reserved in revealing the exact nature of the reforms to address the disparity, Ahmed remained optimistic it would not affect the proposed budget.

"It's a matter of carefully determining which policy instrument to use when," he said.

Although a founding member of the IMF, Ethiopia faces difficulties maintaining a sustainable balance of payments. While devaluation might address the overvalued Birr based on import levels, printing history, and capital flight, Eshetu Fantaye, a finance expert, cautions that it disproportionately impacts fixed-income earners. He recalled the 17pc devaluation of Birr six years ago, which has had little impact in addressing either the problem of balance of payments or increased exports, with the external funding from the IMF stopping at 300 million dollars.

"The resistance to some of the reforms is quite intuitive," Eshetu said. "There is no conclusive determination that devaluation is the end-all-be-all."

The government is facing difficulties from its debt burden. This year's budget allocates nearly 140 billion Br to debt servicing, with domestic debt exceeding 1.28 trillion Br. Reliance on domestic borrowing to finance budget deficits is raising concerns about sustainability.

Meanwhile, targeting a 20pc inflation rate in August, the central bank outlined a strategy that included a 14pc credit cap, an 18pc lending rate hike for commercial banks, and restricting direct government borrowing to a third of its previous level. While this last measure reduced government borrowing by 147 billion Br, the inflation rate remains stubborn at 23pc. The gap was instead filled by increased domestic borrowing through mandatory central bank bond purchases and treasury bill auctions.

The 971.6 billion Br budget proposal reflects a modest economic expansion projection (21.1pc) with a 2.1pc deficit to GDP ratio. The budget allocates a 39.2pc uptake in capital expenditures pinned on heavy domestic borrowing at 325.6 billion Br. Veteran economics experts like Fasika Sidelel, recommend striking a balance to avoid crowding out private sector investment by relying too heavily on domestic borrowing or resorting to expensive external loans with high interest rates.

"How resources are directed reflects priorities," he told Fortune.

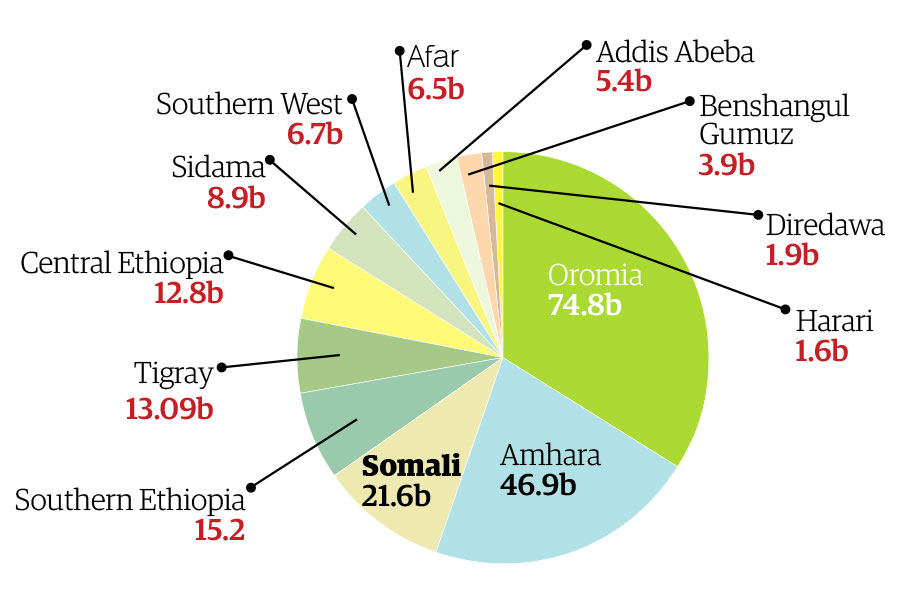

Lawmakers raised concerns about regional development during budget bill discussions. Tola Hailu, an MP from the incumbent party, questioned if infrastructure rehabilitation programs that have reached Tigray and Amhara regional states would extend to his constituency in western Wellega, Oromia Regional State.

"The infrastructure is completely damaged," he said.

His comments stem from the nearly eight billion Birr increase in subsidy for the regional state, despite additional burdens placed on them. The federal government recently passed down the right-of-way compensations for development projects.

Ethiopia's upcoming year will be a true test of economic strength. The success of negotiations with the IMF, the effectiveness of reforms, and the government's ability to manage debt will impact the country's economic trajectory. While the commercial banking sector has forked out around 20pc of its loan disbursements for the past two years to buy mandatory five-year treasury bonds issued by the government, keen financial observers feel that other options might be on the table.

Eshetu said budget formulators cannot rely too heavily on financial flows from abroad when international financing seems to be at its lowest and local commercial banks are overextended. The commercial banks facing concomitant pressures through nearly 21pc in mandatory treasury instrument purchases are not liquid enough to be a reliable source of domestic borrowing, according to Eshetu.

He cited that credit rating agencies have never vetted any banks to help them source funds through international capital markets, either.

"Next year will be a true test of resiliency for the economy," he told Fortune.

PUBLISHED ON

Jun 15,2024 [ VOL

25 , NO

1259]

Commentaries | Feb 13,2021

Fortune News | Jul 08,2019

Viewpoints | Oct 12,2024

Fortune News | Mar 20,2021

Commentaries | Jun 28,2025

Radar | Jul 09,2022

Editorial | May 02,2024

Fortune News | May 11,2019

Commentaries | Oct 07,2023

Fortune News | Feb 18,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...