Editorial | Jun 14,2025

Sep 23 , 2023.

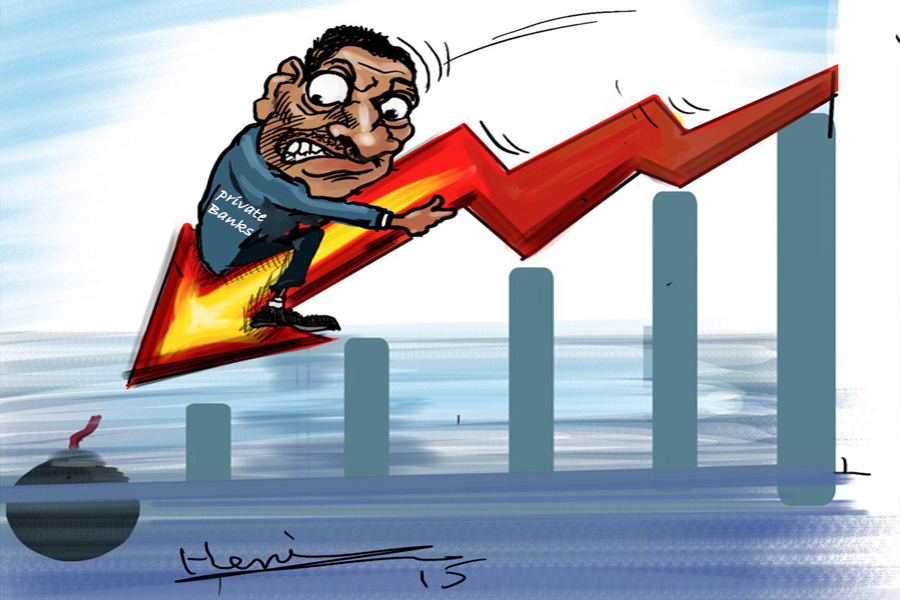

Ethiopia's contemporary political leaders and the policy wonks under their command have been in an unfortunate spotlight. Two weeks ago, Moody's, the global credit-rating agency, downgraded its foreign currency rating for Ethiopia from 'Caa2' to 'Caa3', casting a shadow over its economic trajectory. At the heart of this gloomy announcement lies the looming threat of private sector creditors defaulting on foreign currency-denominated loans.

The economic quandary is an intricate web of interconnected challenges. Notably, two pressing issues have emerged as the Achilles heel for the macroeconomics advising Prime Minister Abiy Ahmed’s (PhD) administration: a mounting balance of payments crisis exacerbated by dwindling trade balances and a persistent dance between fluctuating export performance and an unsettling level of foreign reserves.

The economic ledger of Ethiopia paints a sobering picture.

Rising import bills have overshadowed export revenues, putting immense strain on foreign currency reserves. Whilst revenues from remittances and sporadic capital inflows have offered temporary reprieves, they are akin to a drop in the ocean against the broader context of almost non-existent external grants. External loans are too marginal to make a difference for an economy besieged by a growing budget deficit and high inflation. Official grants made last year (a little over one billion dollars), loans to the federal government (776 million dollars), and state enterprises (325 million dollars) have all registered significant decline from the five-year average beginning in 2016/17.

The mantra remains consistent for policymakers gazing at this predicament: diversify exports, invigorate domestic production, and lure steady foreign investments. Yet, achieving these aims is akin to navigating a maze, fraught with frustration at every turn.

A snapshot of Ethiopia's exports in the recent past reveals a mixed bag.

Traditional commodities like coffee and flowers continue their robust performance on the global stage despite an unexpected dip in global coffee prices. However, the downturn in exports of gold and khat, especially since 2016, is a matter of consternation, given gold's vital role in Ethiopia's foreign exchange repertoire. Such divergences signify the need to reassess and possibly revamp Ethiopia’s export mix.

Yet, it is the surging imports, jumping from 14 billion to 18 billion dollars, that should raise eyebrows in macroeconomic circles. A melange of reasons - swelling domestic demand, burgeoning infrastructure projects, and sectoral gaps - may have driven this spike. The gravity of this trade imbalance is reflected starkly in the capital flows. A receding capital account balance intimates dwindling foreign investments and loans.

In a silver lining to this otherwise overcast horizon, Foreign Direct Investment (FDI) experienced an unexpected surge in 2020-21, hinting at a transient investor confidence - this, in a country where political instability and militarised confrontations, often dominate headlines. Further bolstering the economic buffer is the ever-reliable inflow from remittances, as the Ethiopian diaspora continues to pour funds back home, support kins back home otherwise traumatised by runaway inflation.

However, the precarious nature of the foreign currency reserves remains the elephant in the room. By 2021-22, the reserves were alarmingly scant, covering a mere month’s worth of imports. The subsequent months have not brought better days, placing the country on a tight economic rope, teetering perilously close to a fall. The much-anticipated deal with the IMF and major creditors to salvage the economy remains a distant dream. One of the IMF demands to resume a “generous” bailout package is to see Ethipia’s authorities change the foreign exchange regime to a market-determined system.

Its negotiators would not be wrong to argue that the Birr is significantly undervalued in the official currency market tightly controlled by the central bank. A comparison between the official and parallel foreign exchange markets unveils these disparities. As of January 2022, while the official market saw modest depreciation, the parallel market, according to Steve Hanke of Johns Hopkins University, experienced a staggering 40pc fall. Last week, the official market offered 56.3 Br for a Dollar, less than half the rate the parallel market had.

Yet, hope springs eternal. Post the Pretoria Accord of November 2022, Ethiopia's solitary Eurobond witnessed a commendable rally. Whether this upswing is a testament to rejuvenated confidence or merely a fleeting response to geopolitical shifts remains debatable.

However, navigating this treacherous terrain requires vision and audacity.

A little over a decade ago, under the aegis of the late Meles Zenawi, the federal government embarked on the ambitious Grand Ethiopian Renaissance Dam (GERD) project. Heralded as a beacon of domestic prowess, the dam, with a formidable 5,000Mgwt capacity, promised to amplify Ethiopia’s power generation capacities and a forex revenue of over a billion dollars by this year. This initiative, launched in 2011, ignited a palpable national fervour, with millions pledging support.

While GERD’s goals were laudable, the irony is stark: a country that exports electric power, yet has nearly 65 million of its populace in the dark. This dichotomy extends to the agricultural sphere, too. A recent claim by federal authorities in wheat exports led to domestic disruptions - soaring bread prices, shuttered bakeries, and halted production plants.

The crux lies in Ethiopia’s export policy – seemingly a haphazard assemblage rather than a strategically crafted blueprint. The export of flagship products, such as coffee and sesame, often occurs at a loss, solely to finance the more lucrative import businesses. It is like a country that shoots itself in the foot. A rewarding import margin is allowed to undermine the most crucial export scheme, having multiple benefits to the national economy. The degree to which there is policy tolerance and inaction to redeem this toxic deep in the economy is beyond tragic.

Ethiopia needs an export strategy rooted in long-term foresight - one that transcends quick fixes, transient challenges and political manoeuvrings. A shift from sheer volume to specialisation, focusing on areas with competitive advantage, could be a good place to start.

Yet, as critical as these macroeconomic recalibrations are, they might prove futile without addressing the foundational forex trade regime. For Ethiopia to regain its footing and bolster the confidence of investors and bilateral and multilateral development partners, its leaders must usher in political stability, bridging the divides that currently fracturing the country.

PUBLISHED ON

Sep 23,2023 [ VOL

24 , NO

1221]

Editorial | Jun 14,2025

Viewpoints | Nov 01,2025

Viewpoints | Jul 13,2025

Viewpoints | Jun 04,2022

Editorial | Apr 22,2022

Viewpoints | Dec 29,2018

My Opinion | Aug 21,2021

Commentaries | Aug 06,2022

Editorial | Jul 22,2023

Editorial | Oct 25,2025

Photo Gallery | 180552 Views | May 06,2019

Photo Gallery | 170746 Views | Apr 26,2019

Photo Gallery | 161822 Views | Oct 06,2021

My Opinion | 137293 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...