Fortune News | Sep 21,2019

Survival and overcoming challenges in life very often translate to early mornings and late nights behind the wheel for taxi drivers. While others are fast asleep, drivers like 40-year-old Tsegaye Tesfaye, who owns a meter taxi, are out on the streets of the capital looking for passengers. He operates under Ze-Lucy Meter Taxi S.C., a consortium of 18 taxi associations.

Tsegaye has been working as a taxi driver for the past 15 years and started driving the blue taxi when he was 25. At first he was working the night shift using his friend's blue taxi, a Russian-made Lada, and he saved money through equb, a traditional means of saving in Ethiopia, for two years before he bought his own old blue cab.

"It was a good experience," he said.

However, changing times would force Tsegaye and many others like him to adapt for survival. The transport hailing and booking platform was a disruptive innovation in the country over the past five years.

Uber, the ridesharing pioneer from the United States, was first established in early 2009 and has exploded in popularity over the last decade. Companies worldwide have since looked to emulate the hugely successful service, and Ethiopia is no exception. The introduction of ZayRide, the first app-based taxi-hailing service in the country, boded ill for the signature blue cabs of Addis Abeba.

Indeed, taxi-hailing companies have proliferated since then, and many passengers now opt to use applications on their smartphones to call a cab rather than the old way of flagging down a taxi. Ease of use, standard pricing, better security features, and greater availability has drawn a demand for these companies, and they have steadily expanded their services.

There are currently 22 registered taxi-hailing companies in the city, classified into Electronic Taxi Dispatch service providers (E-Taxi) and Taxi Operation Associations. The first category consists of companies that provide electronic taxi-hailing services but do not own their own vehicles. The second group is comprised of companies that operate using their own fleets. The latter group is also free to utilise electronic systems to connect drivers to passengers.

There are currently 3,000 vehicles registered under 37 associations, according to data from the Addis Abeba Transport Bureau.

ZayRide, an E-Taxi company that was established in 2016 by Habtamu Tadesse, broke the ice for app-based taxi-hailing businesses in the nation. A year after its entry into the market, it became the first platform to launch taxi booking via application instead of text messages or phone calls.

Ride, co-founded by Samrawit Fikru in 2014 as a subsidiary of Hybrid Technology, is the current top dog in the E-Taxi business with over 16,000 vehicles engaged in ferrying passengers for the company.

Ze-Lucy Meter Taxi, an operator with its own fleet of green and yellow cabs, was founded by 18 taxi associations that came together to launch the web-based taxi-hailing platform.

Taxiye is another new addition to the business that was established last year, and many blue Lada taxis are members of the company's fleet, according to Samrawit Molla, marketing manager for the company.

Feres, an E-Taxi company, and Seregela, a taxi operating firm, are also relative newcomers who are currently gaining ground in the industry. Other taxi-hailing companies include Addis Meter, Pick Pick, Hello and Hatch Taxis.

Information technology companies are behind all of these taxi-hailing services, helping them in developing applications based on Global Positioning System (GPS) technology for their platforms and in keeping up with new advances in the field.

Tsegaye joined the evolving business three years ago after selling his old cab and buying a meter taxi.

"When the green and yellow meter taxis first appeared in the city," he said, "I heard that the old Ladas would soon be forced out and began to think of switching sides. It was a hard decision to make."

He now works with three competing app-based taxi-hailing companies: Ze-Lucy Meter Taxi, Ride and Feres, as well providing taxi service to passengers who flag him down on the road.

Pickup requests on his phone, calls from the main call centre, and old customers keep him busy.

Often, taxi drivers work with more than one taxi-hailing company. It is not uncommon for a passenger using one service to hear the driver's phone ring notifying them of a pickup request from another one of the companies during the trip.

Ride does not allow drivers to work with other taxi-hailing companies, according to Abenezer Alemu, a 25-year-old who joined the business when universities shut their doors due to the Novel Coronavirus (COVID-19) pandemic.

"But I don’t care," he said. "I must be working with all of them to survive, because many drivers have joined the market these days, and it is not the same as it was before."

Much the same as drivers having to work for several companies at once to survive in the face of competition, the companies themselves are having to provide different features and services to gain an edge in the market. Offering gifts and raffles to users and minimising the commission rate extracted from the drivers are among the methods being used in marketing strategy schemes.

Seregela Transport Services joined the market earlier this year with a fleet of branded 2020 Suzuki automobiles and only hires women to work as drivers.

In addition to providing the smallest initial price, 35 Br, and 11 Br a kilometre as a marketing strategy, creating social impact in the society is the company's basic objective, according to Eneyat Germew, human capital director for the company.

Seregela operates a fleet equipped with a partition between the customers and the drivers. A 15/15/70 co-ownership system is another method the company uses to compete in the market. A potential driver who wants to work with Seregela can do so by making a 15pc down payment on one of their cars. The company will cover 15pc, and 70pc will be financed through bank credit.

Hello Taxi is offering cars to potential drivers at a 30pc down payment with a five-year financing period conducted through Abyssinia Bank. It also has special discount offers for drivers of old Lada taxis who wish to trade in their cars to work with the company.

Feres, established in February 2020, offers its All-In-One Feres Miles package to users during the first two months of operation. The company gifted 100Km of bonus "Feres miles" to anyone who downloads the application and books three rides with Feres. It also offered a gift of 50Km to those who downloaded the application by recommendation and travelled using Feres. Customers can use their miles as payment for their trips and also have the option of exchanging the bonus miles for mobile card credit.

Feres has not taken any commission from its drivers up until now. This is the company's marketing strategy to ramp up its driver base, and the aim was initially to keep it that way for six months.

But when the time expired, the commission on all trips was covered by sponsorship from E-Birr, a sister company of Feres, according to Shiferaw Tilahun, operational manager at Feres.

E-Birr began working with Feres just a couple of months after the taxi service was founded, and all Feres drivers receive their payments through the mobile banking company.

"E-Birr began covering the platform's commission, because we saw the potential of [Feres] to play a bigger role in cultivating the culture of e-commerce in the country," said Bethlehem Kelbo from E-Birr.

Feres currently works with over 15,000 drivers, according to the company's operational manager.

From a marketing point of view, when the gap between supply and demand begins to close, companies must come up with different marketing strategies, according to Mulugeta Gebremedhin, a lecturer at Addis Abeba University's School of Business & Economics and a board member for the Ethiopian Professional Marketing Association.

"This means until the market matures," he said, "there is always a gap, and marketing is secondary."

The price for these taxi-hailing services in Ethiopia is high compared to similar services in neighbouring countries like Kenya, according to the expert.

"It is difficult to comment on the price of service, because the companies seem to be doing well and demand is still here," he said, adding that the price of vehicles, fuel, and the commission these taxi-hailing companies take from the drivers is correspondingly high as well.

"The competition came after the establishment of a market for the companies, because there is demand," he said, "but after the demand and supply even out, these companies will need to increase their accessibility and quality of service."

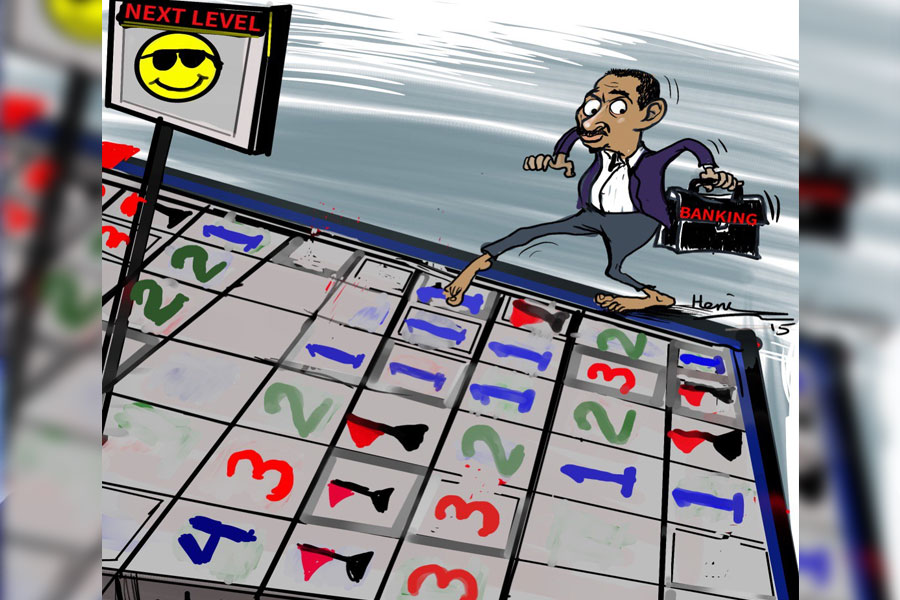

Currently, they are providing the service using vehicles, which are not very luxurious; the next stage might include using more modern vehicles, suggested Mulugeta.

PUBLISHED ON

Nov 14,2020 [ VOL

21 , NO

1072]

Fortune News | Sep 21,2019

Radar | Aug 06,2022

Editorial | May 27,2023

Radar | Jul 02,2022

Commentaries | Apr 17,2021

Radar | Nov 26,2022

Sunday with Eden | Jul 13,2024

Featured | Jan 07,2022

Agenda | Mar 30,2024

Commentaries | Jan 19,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...