Fortune News | Jan 25,2020

Abay Insurance, one of the late entrant insurance firms, recorded a 15pc decline in profit after tax during the 2018/19 fiscal year.

Last fiscal year, the insurance firm netted 56.2 million Br in profit, leading the earnings per share (EPS) to fall by 24.3pc to 7.8 Br. Over the past two years, the EPS of Abay has plummeted by 40pc.

This must be disappointing for the shareholders, according to Abdulmenan Mohammed, a financial analyst with close to two decades of experience.

"The management should come up with a strategy to reverse this trend," said Abdulmenan.

Massive investment to acquire a building, a decline in the savings interest rate and a considerable increase in claim payments are among the reasons for the slow performance of Abay, according to Yohannes Zewdie, the new CEO of Abay Insurance.

In the reporting period, Abay's gross written premium grew by seven percent to 249.3 million Br. Out of the total gross written premium, Abay ceded 64.8 million Br to reinsurers, leading the retention rate to grow slightly by a percentage point to 74pc.

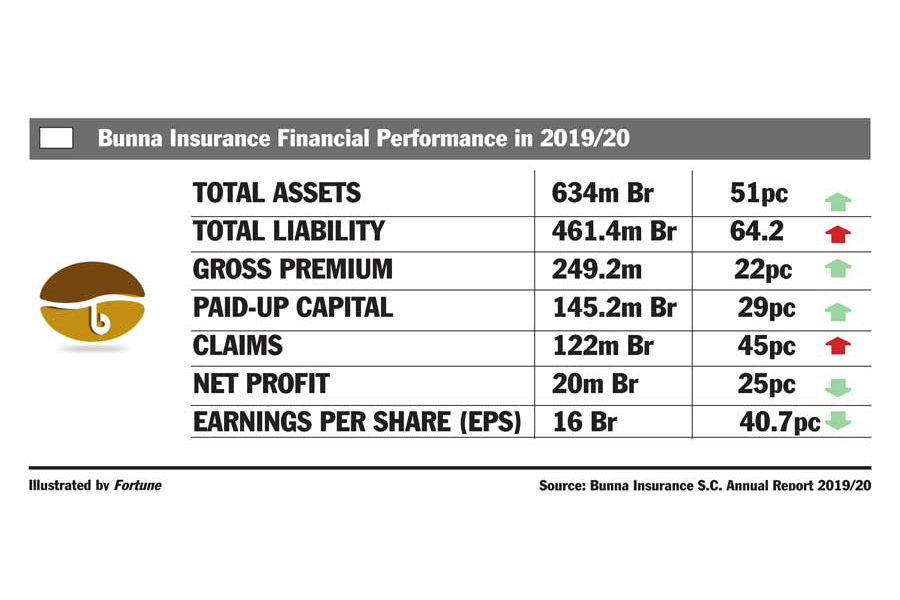

Abay Insurance's Financial Performance for the fiscal year 2018/19.

“The firm should consider increasing the retention rate,” remarked Abdulmenan.

Claims paid and provided for increased by 15pc to 103.2 million Br. The growth in claims undermined the modest increase in gross written premium.

The management of Abay needs to look into its risk management practices, which includes the pricing of customers, according to Abdulmenan.

Though the claims paid in the reported period was within the limit, the rate is driven by a huge increase in the provision for outstanding claims that were under litigation, according to Yohannes.

The increase in motor claims is due to ever-increasing vehicle accidents and the relative maintenance cost hike due to inflation and other factors, according to the CEO.

Abay earned a commission of 22.4 million Br, an increase of five percent. It paid a commission of 10.3 million Br, an increase of 27pc. The company earned five percent commission from re-insurers.

“Abay should review its commission payment policy,” said the expert.

Abay recorded a mixed performance in investment activities. Interest on savings dropped by 29pc to 25.2 million Br due to a massive reduction in time deposits. Time deposits fell by 33pc for the acquisition of fixed assets and increasing liquid resources.

Dividends on shares soared by 243pc to 37.9 million Br.

The income of the company dropped by two percent, while expenses grew by 22pc to 56.8 million Br. Salaries and benefits went up by 18pc to 31.2 million Br, and other operating expenses increased by 27pc to 25.6 million Br.

The increase in salary expenses, a growing number of employees, rent expenses for branch offices as well as the opening of new branches and the expansion of businesses are the causes for the spike in expenses, according to Yohannes.

Total assets held by Abay increased by 24pc to 733.7 million Br. Out of the total assets, 329.2 million Br and 52.3 million Br were held in savings and investments, respectively. These investments account for 60.7pc of total assets, dropping by nine percentage points as a result of improving liquidity.

The analysis shows that the liquidity level at Abay increased considerably. Its cash and bank balances soared by 112pc to 77.8 million Br. The firm's ratio of cash and bank balances to total assets increased to 11pc from 5.8pc. The liquidity level of Abay is above the industry average of eight percent.

"Abay should reduce its liquidity level by investing in income-generating activities," recommended Abdulmenan.

Abay had tight liquidity in the year due to investments in income-generating activities and to minimise expenses by acquiring property as a long-term asset, according to Yohannes.

The paid-up capital of Abay remained the same at 180 million Br. The capital and non-distributable reserves of Abay account for 28.5pc of its total assets.

Shareholders of the company have agreed to raise the paid-up capital of the company by 50 million Br, but this could not be realised due to procedural barriers, according to the CEO.

Still, Abay is already a well-capitalised company, according to the expert.

"It should use its strong capital base to increase its returns to shareholders," recommends Abdulmenan.

PUBLISHED ON

Feb 01,2020 [ VOL

20 , NO

1031]

Fortune News | Jan 25,2020

Fortune News | Dec 26,2020

Radar | Dec 01,2024

Radar | Sep 08,2019

Viewpoints | Apr 20,2019

Fortune News | Nov 29,2020

Editorial | Aug 30,2025

Fortune News | Jul 26,2025

Fortune News | Sep 21,2019

Fortune News | Jan 05,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...