Editorial | May 27,2023

Oct 4 , 2025

By Georgia Levenson Keohane

At a recent UN General Assembly, the fault lines of global development were laid bare. Multilateral banks face unprecedented strain, while major donors, from Washington to Brussels, are tightening their foreign aid budgets. For Africa, where 600 million people still live without electricity, the timing could not be more critical. African countries face a 2.8 trillion dollar financing gap to meet climate commitments by 2030.

The postwar global development system has been dramatically altered, a source of conversation and consternation at recent United Nations General Assembly and convenings on climate change. Multilateral development banks are stretched thin, while major donors, such as the United States (US) and the European Union (EU), are slashing their foreign aid budgets.

The resource shortfalls are particularly pronounced when it comes to support for sustainable development and the green transition in emerging markets. African countries alone face a 2.8 trillion dollars financing gap to support their, and our, collective climate goals. Yet, despite the retrenchment, African leaders are writing this next chapter of climate action. Entrepreneurs in Nairobi, fund managers in Lagos, grassroots innovators, public and private institutional investors, and political reformers across the continent are mobilising to build a green economy.

With its abundant natural resources and rapidly growing workforce, Africa has the potential to achieve a clean-energy transition that powers sustainable and inclusive growth. But the loss of traditional development finance makes it more urgent than ever for investors, philanthropists, and other private-sector actors to support the region's green revolution. To this end, we at the Soros Economic Development Fund (SEDF) are doubling down on African-led solutions as engines of sustainable economic growth and broad-based prosperity.

Clean energy is at the heart of these efforts. Today, roughly 600 million people across Africa still lack access to electricity, a major obstacle to propelling resilient economies capable of creating opportunities – jobs and mobility – for the millions of young Africans entering the workforce every year.

Fortunately, we know what works. Scaling proven technologies such as off-grid solar and climate-resilient infrastructure could help catalyse what Africa Climate Ventures' James I. Mwangi calls "climate-positive growth." But the large-scale deployment of these and other renewable energy technologies remains far too slow. For example, while Africa is home to 60pc of the world's solar resources, it accounts for only one percent of installed solar capacity and two percent of global clean-energy investment.

These gaps stem largely from risks, real and perceived, that have discouraged public- and private-sector investors from committing capital to the region. We believe the greatest risk is inaction. Although Africa contributes two to three percent of global carbon dioxide emissions, it is the world's most climate-vulnerable continent. By 2030, as many as 118 million of its poorest people, those living on less than 1.90 dollars per day, could be exposed to drought, floods, and extreme heat.

With Africa's population projected to nearly double to 2.5 billion by 2050, and urbanisation accelerating, energy demand is expected to surge. Without clean power and climate-resilient infrastructure, this demographic boom could become a carbon catastrophe. As we have seen in countries around the world, governments that fail to deliver resilience and shared economic prosperity are vulnerable to instability, migration pressures, and political upheaval, all systemic risks to democracy and an open society.

That is precisely why we invest, not in spite of the risks but because of them. To date, SEDF has committed 55 million dollars to initiatives led primarily by African investors and entrepreneurs, with additional commitments to follow. In some transactions, we take first-loss positions in blended capital stacks, encouraging more commercial partners to come on board.

In every case, we hope that, over time, proof of impact and financial returns will attract a broader set of investors, unlocking more capital for Africa's green growth. With each investment, we seek to strengthen local capital-market infrastructure through innovative and enduring partnerships, like the recently announced Alliance for Green Infrastructure in Africa and Acumen's Hardest-to-reach Initiative. It is essential to get this model right, particularly in light of the growing demand for the continent's critical and rare-earth minerals, and the opportunity to ensure this mineral wealth translates into broad-based prosperity.

In short, we are betting on a future in which African-led, inclusive, and pro-climate growth benefits us all.

PUBLISHED ON

Oct 04,2025 [ VOL

26 , NO

1327]

Editorial | May 27,2023

Commentaries | Oct 12,2024

Radar | Nov 04,2023

Fortune News | May 21,2022

Editorial | May 21,2022

Fortune News | Apr 16,2022

Editorial | May 28,2022

Featured | Jan 07,2024

Commentaries | Dec 09,2023

Sunday with Eden | Sep 17,2022

Photo Gallery | 177102 Views | May 06,2019

Photo Gallery | 167315 Views | Apr 26,2019

Photo Gallery | 157925 Views | Oct 06,2021

My Opinion | 136960 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

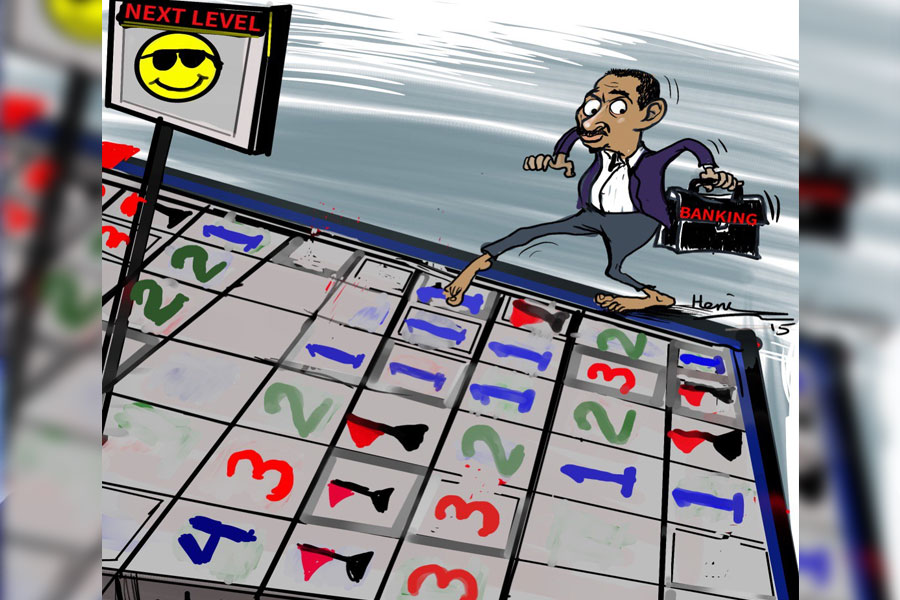

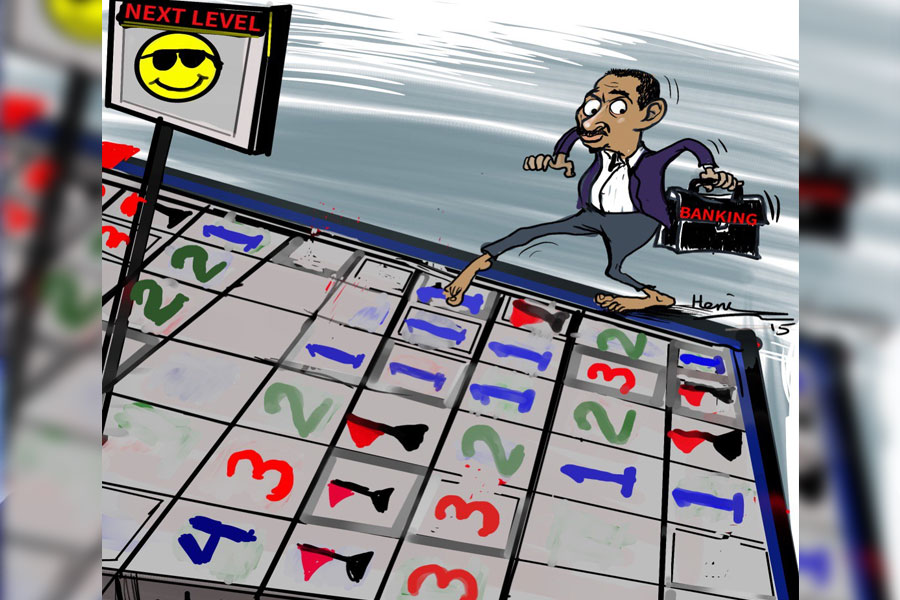

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 26 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...