Fortune News | Aug 17,2025

Nov 7 , 2024

Consumers will be able to make digital payments to merchants using any participating bank or payment provider, regardless of which entity generated the QR code, beginning in December 1, 2024.

Regulators at the National Bank of Ethiopia (NBE) have mandated the adoption of a standardised digital payment QR code for all payment service providers, unifying the fragmented landscape of proprietary QR codes currently in use. NBE wants to see secure, interoperable, and consistent QR code transactions across the country. Earlier this year, it released the Interoperable QR Code Standard, detailing specifications for QR code generation, placement, and transaction flows. This standard is based on EMVCo specifications, a global technical framework that facilitates worldwide interoperability and acceptance of secure payment transactions. The EMVCo standards incorporated into the new system are designed to protect against fraud, addressing security gaps that might exist in closed-loop systems.

The national payment switch, EthSwitch, will operate the underlying infrastructure needed for QR code interoperability.

Allowing richer transaction data, including details such as merchant name, city, transaction amount, and purpose of the transaction, thr standardised QR codes are upgrades from existing closed-loop systems like TeleBirr, which rely on simple identifiers like merchant numbers and limit the information conveyed in the QR code.

The enhanced data capabilities are expected to improve transparency, facilitate reconciliation, and enable more sophisticated payment use cases.

Fortune News | Aug 17,2025

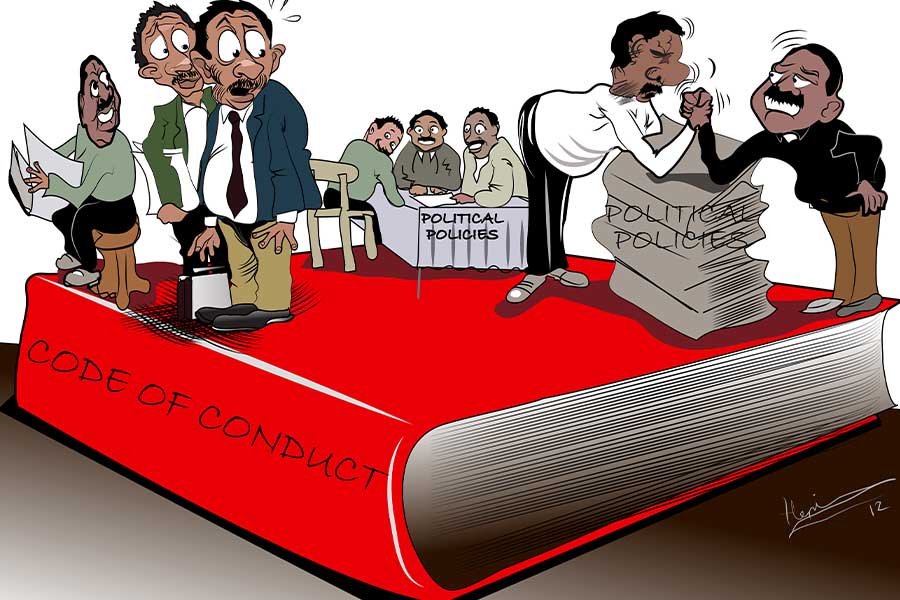

Editorial | Feb 22,2020

In-Picture | Jun 29,2025

Radar |

Viewpoints | Apr 15,2023

Fortune News | Jul 13,2025

Sunday with Eden | Feb 26,2022

Radar | Apr 15,2023

Fortune News | Jul 13,2024

Photo Gallery | 174861 Views | May 06,2019

Photo Gallery | 165080 Views | Apr 26,2019

Photo Gallery | 155342 Views | Oct 06,2021

My Opinion | 136734 Views | Aug 14,2021

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...