Oct 15 , 2024

The National Bank of Ethiopia (NBE) has revised its foreign-exchange policies, imposing a cap on currency trading spreads and compelling commercial banks to separately disclose foreign-exchange fees and commissions. In a statement its officials issued today, they disclosed their intentions to align "banking practices with global standards and enhance transparency in the foreign-exchange market."

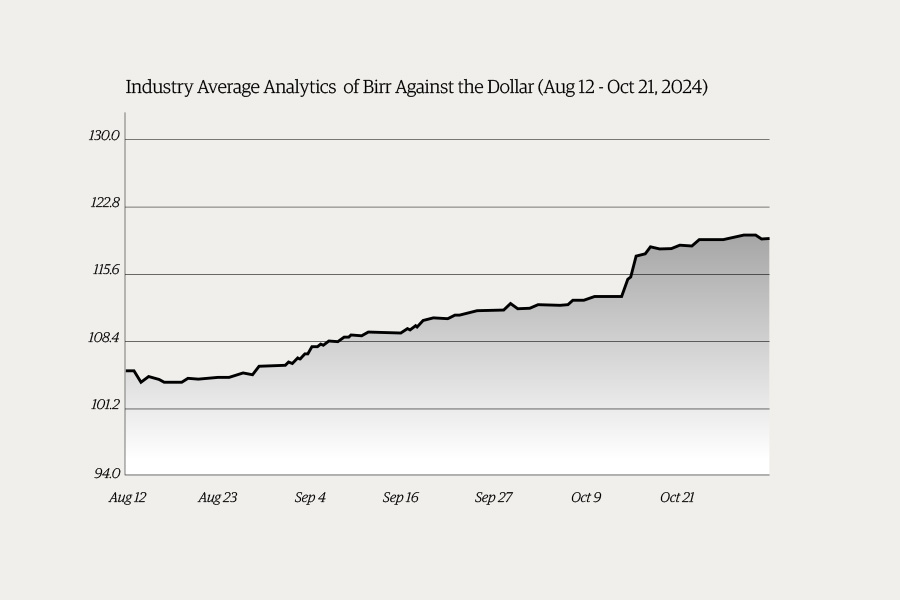

Under the new directive, banks are to identify foreign-exchange trading spreads in their daily posted rates, with the spread not exceeding two percent, from an average of 11.2pc over the past one month.

Previously, the Central Bank, had mandated that all foreign-exchange–related fees and commissions, excluding nominal charges, be included within the trading spread between a bank's buying and selling rates. However, regulators have reconsidered this approach, mandating banks to disclose foreign exchange related fees and commissions separately and report any changes to the Central Bank.

"They are encouraged to adopt international best practices in setting these fees to ensure they remain competitive," said the statement.

The policy changes come during the Central Bank's struggle to stabilise the foreign exchange market in the face of Birr's ongoing devaluation. Measures have included foreign-exchange auctions and the injection of 175 million dollars, particularly targeting at securing fuel imports.

The Central Bank has also issued forex bureau licenses to non-bank operators, further opening up the market and increasing competition.

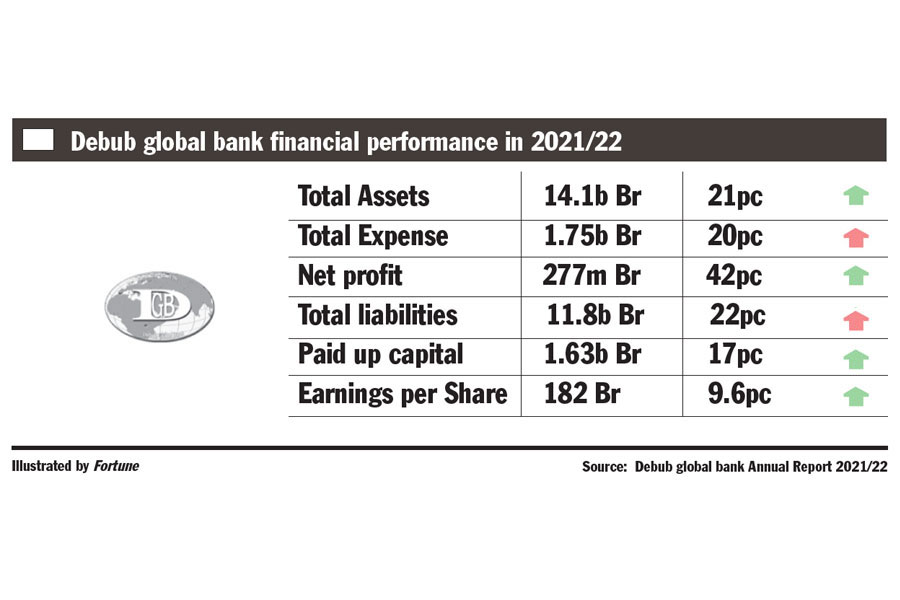

However, industry observors see today's measure in narrowing the spread as constraining commercial banks' profit margins, especially since they are restricted from charging certain commission fees.

With net interest margins under pressure due to credit caps and existing liquidity crunches, banks could face tough times ahead.

Radar | Aug 07,2021

Fortune News | Apr 15,2023

Fortune News | Apr 10,2023

Agenda | Aug 14,2021

News Analysis | Dec 09,2023

Fortune News | Apr 20,2019

Fortune News | May 18,2019

Fortune News | Nov 13,2021

Money Market Watch | Nov 03,2024

Radar | Jul 20,2025

Photo Gallery | 174187 Views | May 06,2019

Photo Gallery | 164412 Views | Apr 26,2019

Photo Gallery | 154553 Views | Oct 06,2021

My Opinion | 136650 Views | Aug 14,2021

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...