May 28 , 2025

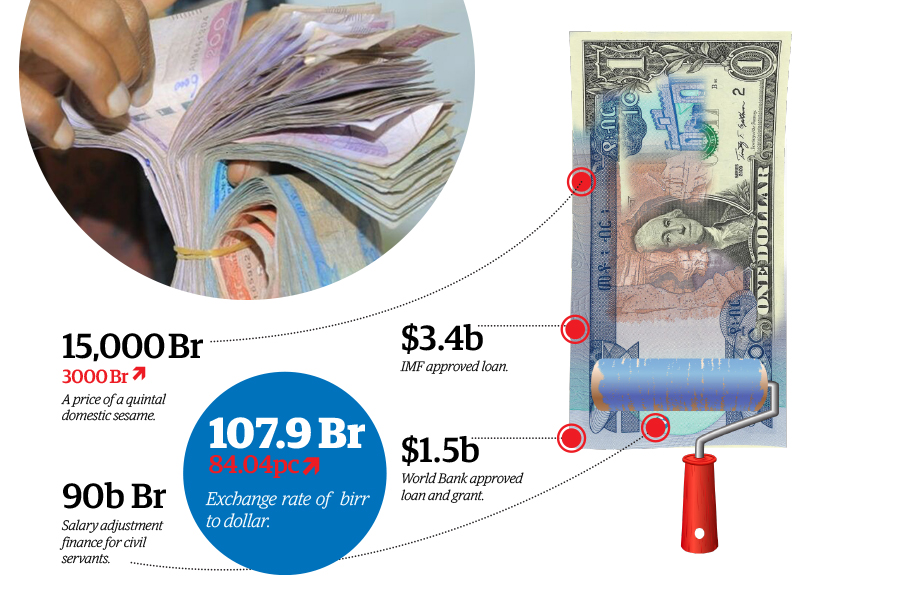

The state-owned Commercial Bank of Ethiopia (CBE) raised its cash exchange rate to 131 Br a dollar for purchases and 133 Br for sales, the steepest single-day move by the country’s largest lender in six months and one market observers say signals a broader depreciation ahead.

The jump came after the National Bank of Ethiopia (NBE) set its

mid-market benchmark at 131/133.62 Br. Compared with the CBE’s postings up until May 24, 2025, when dollars fetched 124.01 Br on the buy side and 126.49 Br on the sell side, today’s quotes represent increases of 5.6pc and 5.1pc, respectively.

The change narrows the spread with the parallel-market rate of about 155 Br, a gap observers say had become untenable.

CBE’s move follows months of relative inertia. Late last week, the Bank inched its buying rate up to 128 Br from 126 Br and set a selling rate of 130.56 Br, offering a 10-Br bonus for each dollar. Private banks had already moved higher, with Awash, Dashen, Abyssinia, Zemen and Wegagen quoting between 131 Br and 132 Br, while Oromia Bank posted the market’s ceiling at 134.44 Br for purchases and 137.13 Br for sales.

During the week ended May 24, the average buying rate across all banks edged up to 131.41 Br from 131.21, and the average selling rate rose to 133.93 Br from 133.86. Observers say today’s adjustment brings CBE into near lockstep with the Central Bank’s midpoint and curtails arbitrage opportunities for dollar sellers on the street.

Fortune News | Aug 04,2024

Radar | Mar 06,2021

Commentaries | Jan 21,2023

Fortune News | May 07,2022

Radar | Jul 11,2021

Fortune News | Feb 24,2024

Commentaries | Sep 23,2023

Featured | Sep 29,2024

Commentaries | Dec 07,2019

My Opinion | 132675 Views | Aug 14,2021

My Opinion | 129127 Views | Aug 21,2021

My Opinion | 126988 Views | Sep 10,2021

My Opinion | 124573 Views | Aug 07,2021

Jul 26 , 2025

Teaching hospitals everywhere juggle three jobs at once: teaching, curing, and discov...

Jul 19 , 2025

Parliament is no stranger to frantic bursts of productivity. Even so, the vote last w...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...