My Opinion | 131981 Views | Aug 14,2021

May 30 , 2024

In a compelling address, Akinwumi Adesina (PhD), president of the African Development Bank (AfDB) Group, made a striking point: people do not eat GDP. His argument was anchored on the crucial need to enhance productivity within Africa's economies as a vital component for growth.

Although current growth rate, averaging 3.7pc, is impressive compared to other regions, it is insufficient to drive structural transformation. The President noted the structural constraints on energy and agriculture as vital areas requiring investments.

"We must ensure our growth delivers value to youth and women," Adesina said, pointing to the importance of creating quality jobs to address the migration crisis and capitalizing on youth entrepreneurship. "Investing in young people’s skills and entrepreneurship is crucial."

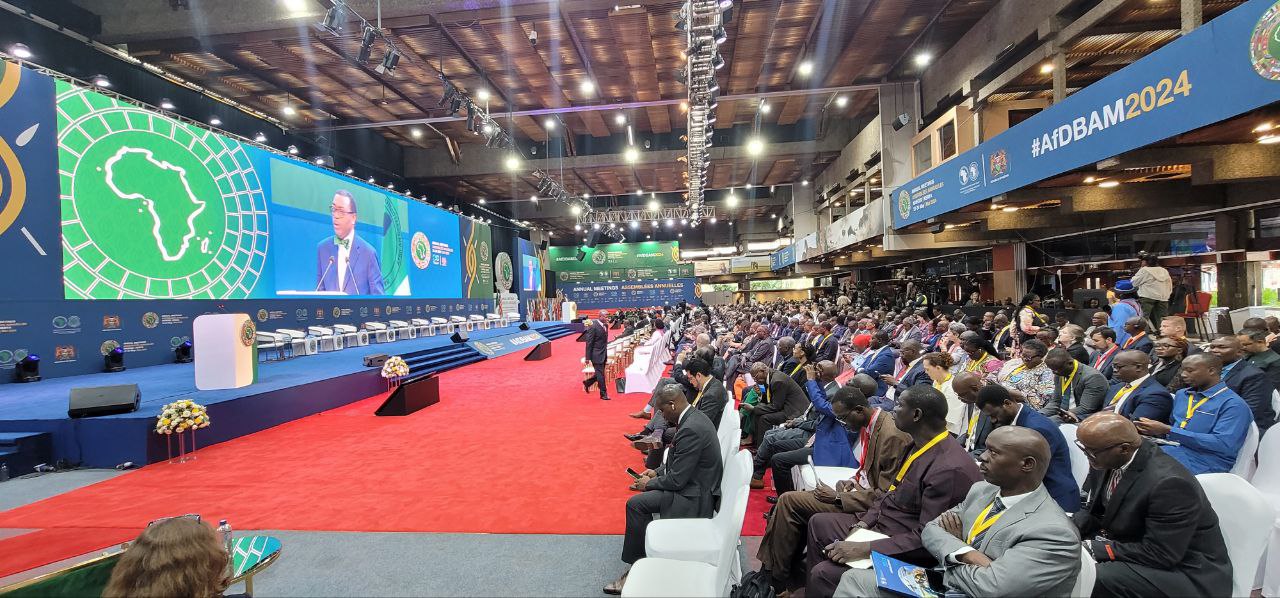

Today, in Nairobi, Kenya, Adesina launched the African Economic Outlook report for 2024, joined by his chief economist, Kevin C. Urama (PhD), who also serves as the vice president for economic governance and knowledge management.

The report discovered that despite a series of overlapping exogenous shocks, including the prolonged impacts of geopolitical tensions, climate change, and internal conflicts, African economies “displayed a remarkable ability to sustain growth,” albeit at a decelerated pace. Africa's average real GDP growth slowed to 3.1pc last year, down by one percentage point from the previous year.

However, projections for 2024-25 are optimistic. Expected growth rates will rise to 4.3pc in 2025, driven by improved global economic conditions and policy implementations across the continent.

Close to 41 countries, including Ethiopia, are anticipated to exhibit higher growth rates this year than last year, and 15 are expected to exceed five percent growth. However, the report finds the pace of structural transformation remains uneven and slow, with traditional sectors such as agriculture still dominating employment despite lower productivity levels than other sectors.

The agricultural sector, employing 42pc of Africa's workforce, remains significantly less productive, demanding targeted policy interventions to enhance productivity and drive sustainable economic development, the report stated. The report authors believe that creating special agro-industrial processing sones and promoting services-led growth are critical avenues to catalyse structural transformation.

The annual flagship publication of the AfDB revealed what Urama termed "the paradox of Africa’s economic development."

Despite having some of the world's fastest-growing economies, the continent struggles with low GDP per capita and persistent poverty.

"Africa needs consistent growth of seven to 10pc annually for about 40 years to break the cycle of poverty," he said.

For Hanan Morsy, deputy executive secretary and chief economist of the Economic Commission for Africa (ECA), Africa remains struggling with low GDP per capita, despite favourable growth rates. Only two countries - Côte d'Ivoire and Senegal - have exceeded the seven percent growth rate threshold.

Inflation and currency depreciation have further undermined economic stability. Consumer price inflation in the continent rose to an average of 17pc this year, up from 14pc last year, driven by domestic factors and the strengthening US Dollar. The impact of debt is no less troubling. Debt service payments consume a large portion of national budgets, diverting funds from critical development projects.

"Debt service payments are rising sharply, taking resources away from structural transformation," Urama noted.

Africa's external financial flows have also declined, with foreign direct investment (FDI) dropping by 44pc in one year.

"We’re seeing a decline in external flows at a time when we need more resources to address climate change and geopolitical tensions," said Urama, who leads a team responsible for the publication of the annual report.

He attributed the paradox of Africa’s high resource potential yet limited access to affordable financing to a high perception of risks.

The President echoed Kenya’s President Willian Ruto, who advocated while opening the annual meetings of the Group the day before, Africa-specific credit rating agencies should provide a “fairer assessment of risk” and unlock more funding. The UNDP estimates “fair ratings” could save Africa 75 billion annually in debt servicing. African countries face 74 billion dollars in debt service payments this year alone. Ethiopia’s annual debt servicing is projected to double next year, from 2.5 billion dollars this year.

Adesina called for an urgent debt resolution of at least 22 countries defaulting or in distress, including Ethiopia, particularly through initiatives like the Common Framework for Debt Treatments, which, while well-intentioned, have been slow to implement.

A day before, Ethiopia’s Finance Minister Ahmed Shedie demanded a speedy process of this mechanism, sitting on an economy that suffers from growing external debt servicing needs and high inflation.

"We need faster progress on the Common Framework," the AfDB President urged. We simply postponed the debt service payments."

The Debt Service Suspension Initiative (DSSI) provided temporary relief but did not address the underlying issues.

Africa is required to mobilise resources to close the annual financing gap of 402 billion dollars by 2030, demanding domestic reforms. However, what has claimed the attention of many, including the leader of the host country, is the reform of multilateral development banks (MDBs) and the rechanneling of the IMF's Special Drawing Rights to these.

Adesina called for reforms of the global financial architecture, particularly on climate finance, an area where Africa is projected to need up to 10 billion dollars annually for climate funds. However, the current system delivers only three percent of what the continent needs.

The debt-to-GDP ratio stands at about 65pc, a heavy burden exacerbated by the end of the era of cheap money and the predominance of short-term commercial debt.

"The structure of the debt itself is problematic," Adesina noted, pointing out that private commercial debt now accounts for 55pc of the total, 10 percentage points higher than the previous year.

"We need export-oriented, industrial manufacturing zones to raise manufacturing’s share of GDP," he argued.

Debt, however, remains a pressing issue, echoing across the conference centre, revibrating rooms to rooms.

For Alexia Latortue, representing the U.S. Treasury, the time has arrived for reforming the global financial architecture to support long-term, concessional capital at scale.

"The global capital markets are tight,” she told a panel called to reflect on the report. “Borrowing costs have increased, which shows the need for concessional financing."

To the delight of the audience, conditioned to think with a barrage of official claims that the global financial architecture created in the aftermath of the Second Worlds War is the culprit for Africa’s financial woes, Latortue’s call for flexibility and speed in financial support, was warmly welcomed.

Victoria Kwakwa, from the World Bank, echoed these sentiments, stating the importance of regional integration and infrastructure development.

"Africa's infrastructure needs are immense, and we must invest in rail, energy, and transportation to support growth," she said. “The role of long-term capital in these investments and governments’ participation is crucial, particularly in sectors like railways where profitability challenges exist.”

Mthuli Ncube (PhD), minister of Finance & Economic Development of Zimbabwe, cautioned against over-reliance on debt, pointing out that high real interest rates could signal economic distress. He advocated for innovative financial instruments and better debt management strategies to finance infrastructure projects sustainably.

"We need to optimize our tax instruments and ensure that the structure of these instruments supports growth," Ncube said.

The call for improved domestic resource mobilisation was loud for a continent with an average tax-to-GDP ratio of 13.6pc. Urama urged ministers to improve efficiency in tax collection and broadening the tax base.

Adesina noted that the African Continental Free Trade Area (AfCFTA) offers a significant aggregate market that can help achieve economies of scale and scope.

"AfCFTA is a game-changer," he said, capitalizing on its potential to transform Africa’s economy by facilitating intra-continental trade and industrialization.

However, Adesina cautioned that for it to be effective, Africa must develop industrial manufacturing zones with consolidated infrastructure. His messages were unambiguous. Africa has immense potential, but realising it requires addressing debt traps, enhancing infrastructure, improving governance, and effectively mobilising both domestic and international resources.

"Africa's future is bright," said Adesina, whose colleagues praised him as the continent’s economic evangelist. "But, we must tackle governance, transparency, and accountability to ensure that our resources benefit the people of this continent."

However, the key to unlocking Africa’s potential lies in improving its human capital through better education, healthcare, and nutrition, according to Njuguna Ndung’u (PhD), Kenya’s cabinet secretary for National Treasury & Economic Planning. Ndung’u linked institutional failures to weaknesses in human capital, arguing that investing in this area could address such shortcomings.

One of the panellists responding to the economic outlook report, Ndung’u, was pleased with the performance of East African economies.

Despite the COVID-19 pandemic's strain on infrastructure, particularly in health and education, East African countries have shown resilience, marked by an average growth rate of 5.7pc, one percentage point above the sub-Saharan Africa average for 2023.

Ndung’u stated that functioning markets need to signal economic growth and distribute resources efficiently, echoing the works of economists like Justin Yifu Lin, who argue that economic transformation depends on capital accumulation and savings.

"In an agricultural economy like Kenya, if markets fail, smallholder farmers producing tea and coffee suffer,” he said. “This impacts their productivity and economic rent."

Ndung’u argued that embracing digital technologies could enhance efficiency across sectors, safeguarding the region's growth trajectory.

"Digital information can create efficiencies in everything we do," he asserted, suggesting that digitalisation is crucial to maintaining the current growth rate and preparing for future challenges.

My Opinion | 131981 Views | Aug 14,2021

My Opinion | 128369 Views | Aug 21,2021

My Opinion | 126307 Views | Sep 10,2021

My Opinion | 123925 Views | Aug 07,2021

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...