Commentaries | Feb 12,2022

Jun 29 , 2019

By KALAEB GIRMA ( FORTUNE STAFF WRITER )

Girma Wake, proposed chairperson of Ethio Lease Ethiopian Capital Goods Finance S.C.

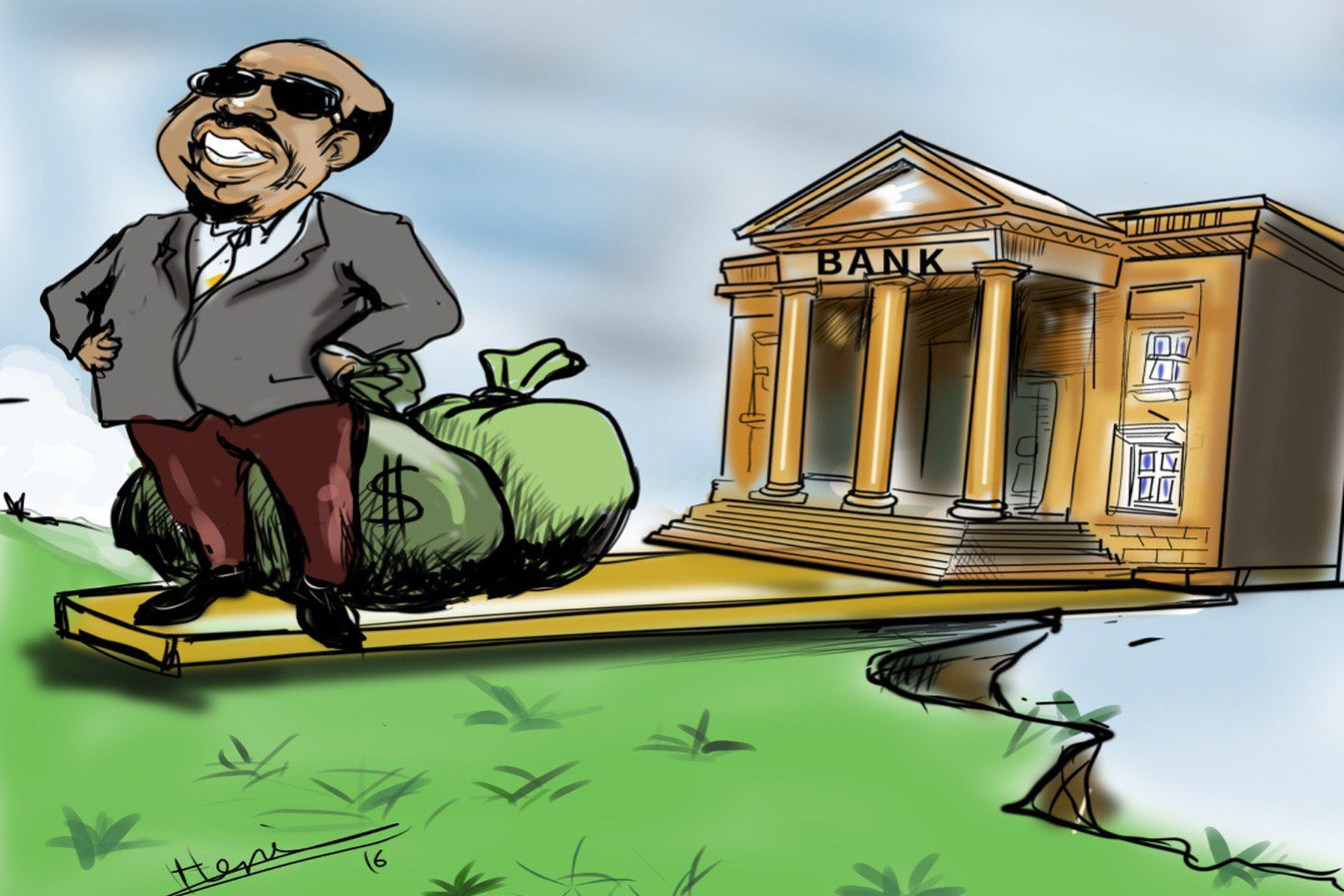

Girma Wake, proposed chairperson of Ethio Lease Ethiopian Capital Goods Finance S.C. Girma Wake, the former CEO of Ethiopian Airlines, along with eight foreign companies and individuals is forming the sixth lease financing company in the country.

Ethio Lease Ethiopian Capital Goods Finance S.C is under formation with 400 million Br in paid up capital by nine shareholders that hail from five countries including the United States, United Kingdom, Saudi Arabia, the Netherlands and Kenya.

Girma, who is also board chairperson of United Insurance and sits on the board of Ethiopian Airlines, is the proposed board chairperson of the company, which has already opened an office on Cape Verde Street.

Girma, 75, had served as the CEO of Ethiopian Airlines from 2004 until his retirement in 2011. He has 50 years of experience in the aviation industry and has also worked as board chairman of RwandAir, and as an advisor to the Rwandan Minister of Transport. Currently, Girma is the adviser to the president of Togo on aviation matters.

Girum Tsegaye, proposed CEO of Ethiopian Capital Goods Finance Business S.C.

The company, which has 400,000 shares with a par value of 1,000 Br, is waiting for the final approval from the National Bank of Ethiopia (NBE) to commence operations.

African Asset Finance Company Holdings BV, a Netherlands registered company, holds the majority of shares in the company, while the remaining eight shareholders have one share each.

Gabriel Nigatu, a senior official at the African Development Bank based in Nairobi, Kenya, is also among the shareholders. African Asset Finance Company Inc, a privately owned US corporation launched in 2017 focusing on equipment leasing and asset-backed lending in Africa, is also among the shareholders.

Girum Tsegaye, who currently works as an advisor for African Asset Finance Company and had served as vice president of operations for United Bank, is the proposed CEO.

Ethio Lease plans to offer its finance leases in combination with a maintenance agreement, insurance as well as operator training, certification and deployment. It also aims to provide lease financing to businesses engaged in manufacturing, food processing, energy, and agriculture.

Ethio Lease will be the first finance company in the country co-owned by non-nationals. Even though the central bank had allowed foreign companies to engage in capital goods financing in Ethiopia since 2014, no company had registered to provide the service.

The company will be joining the five local capital goods finance companies licensed by the National Bank of Ethiopia including Aliya, Oromia, Addis, Debub and Kaza Capital Goods Finance Business. One other company, First Capital Goods, is also under formation.

Recently, the central bank issued a directive allowing foreign companies to access and use their foreign currency to finance the import of capital goods. The regulatory bank has also permitted foreign companies to borrow funds from a foreign source to import the goods but prohibited them from borrowing funds from domestic financial institutions.

The change in perspective of the business environment of the country has made foreign companies and individuals invest in the area, according to Habib Mohammed, a financial expert with a decade and a half of experience in the financial industry.

Habib, who is optimistic that lease financing will increase access to finance, said, "The company should work on its public image through transparency and gain the confidence of the people."

PUBLISHED ON

Jun 29,2019 [ VOL

20 , NO

1000]

Commentaries | Feb 12,2022

Life Matters | Sep 07,2019

Fortune News | Jun 19,2021

My Opinion | Feb 24,2024

My Opinion | Jan 13,2024

Radar | Nov 02,2019

Radar | Nov 11,2023

Fortune News | Oct 24,2020

My Opinion | Feb 27,2021

Fortune News | Apr 06,2019

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 27 , 2024

The Prosperity Party (PP) - Prosperitians - is charting a course through treacherous...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...