Fortune News | Jul 27,2019

Zemen Bank, the 10-year-old private bank, posted a two percent growth rate in the last fiscal year.

The bank reported 271 million Br in profit with a shareholder return of 286 Br, which has dwindled by 26pc.

Stagnation of profit growth and a massive increase in capital led to the decline of earnings per share (EPS), according to Abdulmenan Mohammed, a financial statement analyst.

“Even if the EPS declined, the shareholders still have it in the capital,” said Dereje Zebene, president of the Bank since last year after moving from Awash Bank.

The shareholders of the bank have raised the paid-up capital of Zemen to 1.1 billion Br in the reported time.

The slight profit growth was registered as a result of income increasing from interest and services. Interest on loans, advances and NBE bonds increased by half to reach 712.4 million Br.

The bank's income from fees, commissions and foreign exchange declined by five percent and 41pc recording 320.2 million Br and 97.7 million Br, respectively.

“Zemen needs to pay attention to this area of the business,” Abdulmenan told Fortune.

The central bank's recent regulation that compels banks to surrender nearly one-third of their foreign currency earnings to the national bank at a buying rate has caused the decline of Zemen's forex dealing, according to Dereje.

Zemen's expenses also soared in the last fiscal year. It paid 441.7 million Br for interest on deposits, a 50pc increase from two years ago. The bank’s personnel and other operating expenses also went up by 27pc to 324 million Br.

In the past two years, the growth in administration and operating costs at Zemen was higher than the increase in income.

The central bank's latest increase on the deposit interest rate expanded the bank's expenses, according to Dereje. He also added that the governing bank's regulation that coerces banks to increase their number of branches by 25pc every year as an additional reason for the surge in expenses.

Last year the macroeconomic committee under the Office of the Prime Minister Office raised the minimum interest rate on deposits to seven percent from five.

Abdulmenan argued that the bank needs to focus on costs.

“The management of Zemen should keep an eye on personnel and other operating expenses,” he said.

Abebe Dinku (Prof.), a chairperson of the board, also mentioned the challenges the bank went through in the last financial year.

“The shortage of forex contributed to the economic slowdown and less appetite for credit,” Abebe addressed the shareholders in the annual report of the bank, which has been operating its 26 outlets with 724 employees.

With the main aim of expanding its client base, the bank has lowered the minimum deposit amount it imposed by more than a quarter from 25,000 Br.

“We are working on reaching out more customers,” the president said.

This seems to have borne fruit, as the bank's deposits grew by 28pc and reached 10.2 billion Br. From its total deposits, two thirds of it was collected from corporate clients.

Out of total deposits, the bank disbursed half of it as loans. This made the loan-to-deposit ratio of Zemen to drop and reach 48pc, lower than the industry average that stood at 63pc.

Such a low loan-to-deposit ratio is very disappointing, according to Abdulmenan.

“[The decline in ratio] must have been due to expansion in deposits unaccompanied by parallel growth in loans and advances,” he said.

Dereje attributed the larger amount of NBE bill the bank has purchased and the reserve is the reasons.

Zemen bought 2.4 billion Br worth of NBE bills, a 19pc increase from the previous financial year.

“The loan disbursement analysis needs to consider this factor too,” Dereje said.

The bank has improved the provisions for bad loans, which fell by 58pc to 27.6 million Br.

“We were looking closely after the previous bad loans,” the president said. “We assigned relationship managers to each borrower to follow up and help.”

The bank's non-performing loan ratio in the period reached 3.7pc. The Central Bank set five percent as a ceiling for bad loans in all portfolios.

Bank assets expanded by 27pc to reach 12.4 billion Br. The liquidity level of the bank has increased by 28pc to four billion Birr. When compared against its total assets, the ratio remained the same at 32.6pc.

Zemen has been sitting on huge liquid resources and needs to increase its loans and advances and bring in more income, according to Abdulmenan.

Zemen Bank’s annual shareholder meeting was well-attended.

PUBLISHED ON

Jan 12,2019 [ VOL

19 , NO

976]

Fortune News | Jul 27,2019

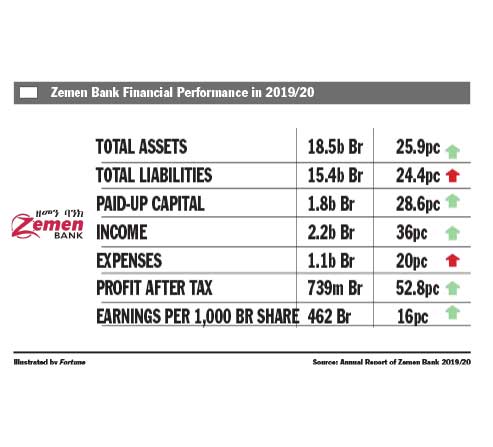

Fortune News | Feb 20,2021

Fortune News | Nov 29,2020

Radar | Apr 06,2019

Viewpoints | Aug 03,2024

Fortune News | Dec 21,2019

Editorial | Feb 09,2019

Fortune News | Apr 19,2025

Sunday with Eden | Dec 21,2019

Commentaries | May 31,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...